|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Share Hong Kong, China & Hawaii Biz*

Skype - FREE

Voice Over IP Skype - FREE

Voice Over IP  View Hawaii's China Connection

Video Trailer

View Hawaii's China Connection

Video Trailer

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

After

attended a China/Hong Kong Business/Trade Seminar in Hawaii...still unsure what

to do next, contact us, our Officers, Directors and Founding Members are

actively engaged in China/Hong Kong/Asia trade - we can help!

Are you ready to export your product or

service? You will find out in 3 minutes with resources to help you -

enter

to give it a try

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

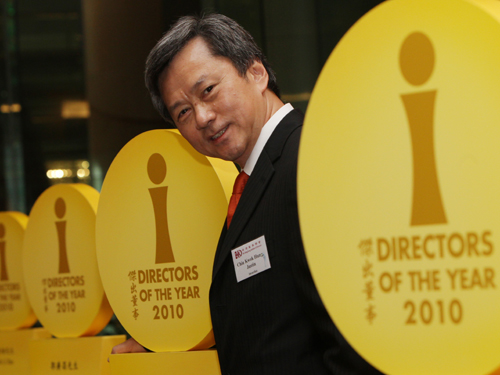

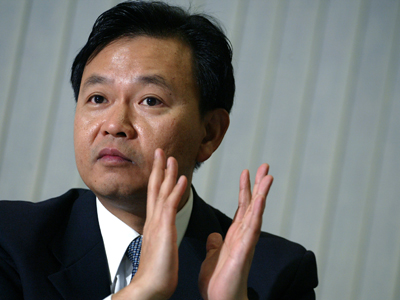

Johnson Choi on Hong Kong

investments with Hawaii filmmakers - Asia in Review host Jay Fidell

in a discussion with Johnson Choi, President of the Hong Kong.China.Hawaii

Chamber of Commerce on his recent (July 2010) trip to Shanghai and Hong Kong and

on Hong Kong investments with Hawaii filmmakers

http://vimeo.com/13994279 or download

video click:

http://www.hkchcc.org/johnsonchoithinktec0710.mp4

Johnson Choi on Hong Kong

investments with Hawaii filmmakers - Asia in Review host Jay Fidell

in a discussion with Johnson Choi, President of the Hong Kong.China.Hawaii

Chamber of Commerce on his recent (July 2010) trip to Shanghai and Hong Kong and

on Hong Kong investments with Hawaii filmmakers

http://vimeo.com/13994279 or download

video click:

http://www.hkchcc.org/johnsonchoithinktec0710.mp4

(approximate $ exchange rates: US$1 = HK$7.8, US$1 = RMB$6.8)

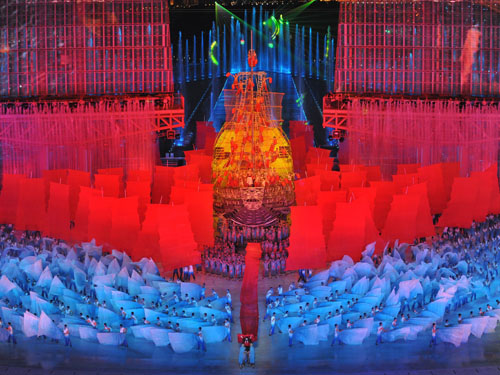

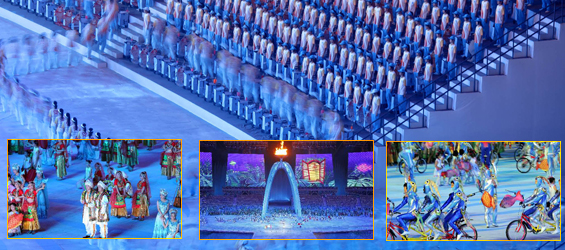

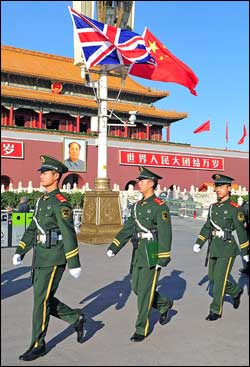

View China 60th

Anniversary Video and Photo online View China 60th

Anniversary Video and Photo online

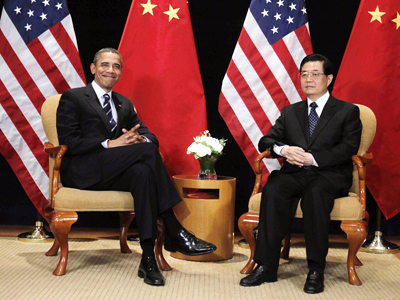

Holidays Greeting from President Obama & Johnson Choi

Holidays Greeting from President Obama & Johnson Choi

http://www.youtube.com/watch?v=pNk4Z4lUV-k

http://www.youtube.com/watch?v=pNk4Z4lUV-k

http://www.facebook.com/video/video.php?v=219896871983&ref=mf

http://www.facebook.com/video/video.php?v=219896871983&ref=mf

View Our Conference call with President Barack Obama on Nov 3

2010 4:30pm EST

http://www.youtube.com/watch?v=slMhUhS3wJg

View Our Conference call with President Barack Obama on Nov 3

2010 4:30pm EST

http://www.youtube.com/watch?v=slMhUhS3wJg

Wine-Biz

- Hong Kong

Wine-Biz

- Hong Kong

Brand Hong Kong

Video

Brand Hong Kong

Video

Mainland and Hong

Kong Closer Economic Partnership Arrangement (CEPA)

http://www.tid.gov.hk/english/cepa/index.html

Mainland and Hong

Kong Closer Economic Partnership Arrangement (CEPA)

http://www.tid.gov.hk/english/cepa/index.html

About APEC

http://www.apec.org/apec/about_apec.html

About APEC

http://www.apec.org/apec/about_apec.html

APEC 2011 November

2011 Honolulu Hawaii USA

Presentation: Inside APEC

http://www.hkchcc.org/insideapechkchccpresentation080810.ppt

(Microsoft Power Point 16 Meg File Size)

http://www.apec2011usa.org/

http://www.apec2011usa.org/

AmCham

Shanghai launches latest Viewpoint - U.S. Export Competitiveness in China

- on the 2010 Washington, D.C. Doorknock - Please download report in PDF format:

http://www.hkchcc.org/viewpointusexport.pdf AmCham

Shanghai launches latest Viewpoint - U.S. Export Competitiveness in China

- on the 2010 Washington, D.C. Doorknock - Please download report in PDF format:

http://www.hkchcc.org/viewpointusexport.pdf

HK is doubling the Professors' pay to US$25,806/month - looking for

1,000 professor

http://www.hkchcc.org/job_opportunities.htm

HK is doubling the Professors' pay to US$25,806/month - looking for

1,000 professor

http://www.hkchcc.org/job_opportunities.htm

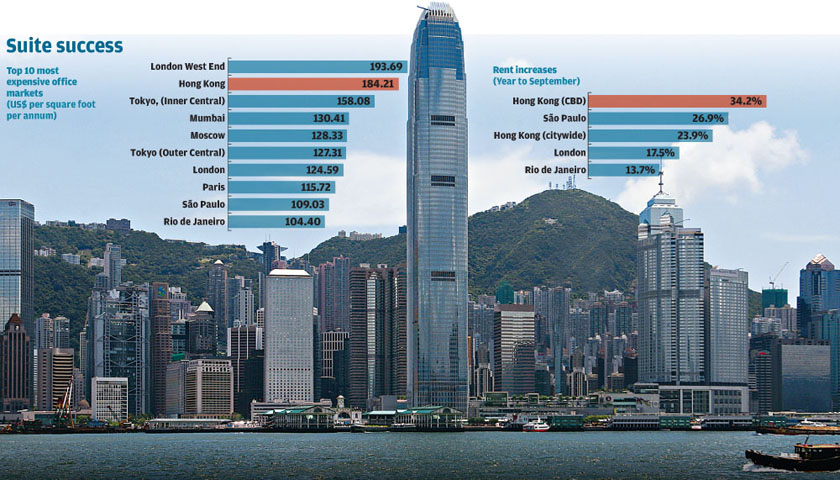

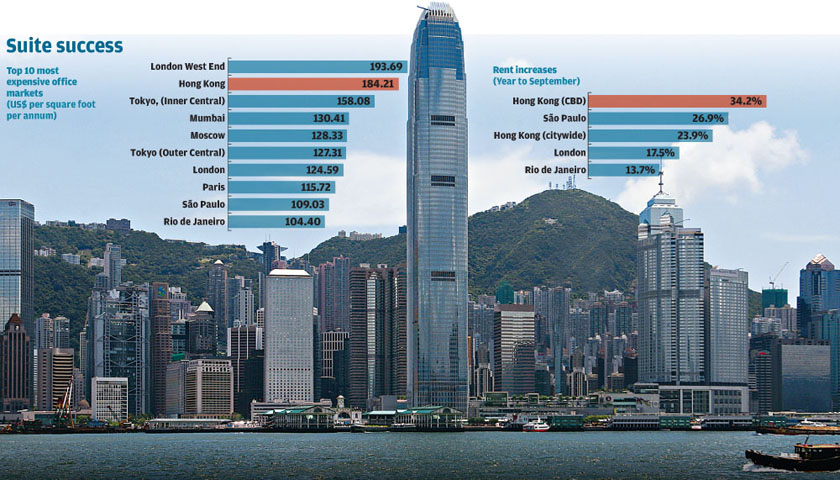

December 1, 2010

Hong Kong*:

Financial Secretary John Tsang Chun-wah said on Monday Hong Kong’ economy was

enjoying steady growth - but warned of higher inflation in future. Speaking to

the Legislative Council Panel on Financial Affairs, Tsang said Hong Kong’s

economy had benefited from strong economic growth in the mainland and other

parts of Asia. The economy had been buoyant in the first half of the year. “Real

gross domestic product [GDP] grew by 7.1 per cent in the first and third

quarters of the year compared with the same periods a year earlier,” Tsang said.

“Given the strong growth so far, [and] even allowing for some possible

deceleration in the fourth quarter, economic growth this year should exceed the

forecast of 5 to 6 per cent predicted earlier this year. “[Therefore] I have

raised the full-year GDP growth forecast to 6.5 per cent,” he said. But the

financial secretary warned that Hong Kong would also face higher inflation next

year. “The second round of quantitative easing by the Federal Reserve in the US

has lowered the [value of the] US dollar and further driven up the prices of

food, energy and other commodities,” he noted. Tsang said fears of higher

inflation had become a major concern for Asian economies and that he will

closely monitor inflation, especially its impact on those on low incomes. Tsang

said Asian countries were also concerned about the increasing risk of asset

bubbles and volatility in financial and currency markets following the

qualitative easing. He also reiterated that the government was determined to

curb excessive speculation in Hong Kong’s residential property market. Hong Kong*:

Financial Secretary John Tsang Chun-wah said on Monday Hong Kong’ economy was

enjoying steady growth - but warned of higher inflation in future. Speaking to

the Legislative Council Panel on Financial Affairs, Tsang said Hong Kong’s

economy had benefited from strong economic growth in the mainland and other

parts of Asia. The economy had been buoyant in the first half of the year. “Real

gross domestic product [GDP] grew by 7.1 per cent in the first and third

quarters of the year compared with the same periods a year earlier,” Tsang said.

“Given the strong growth so far, [and] even allowing for some possible

deceleration in the fourth quarter, economic growth this year should exceed the

forecast of 5 to 6 per cent predicted earlier this year. “[Therefore] I have

raised the full-year GDP growth forecast to 6.5 per cent,” he said. But the

financial secretary warned that Hong Kong would also face higher inflation next

year. “The second round of quantitative easing by the Federal Reserve in the US

has lowered the [value of the] US dollar and further driven up the prices of

food, energy and other commodities,” he noted. Tsang said fears of higher

inflation had become a major concern for Asian economies and that he will

closely monitor inflation, especially its impact on those on low incomes. Tsang

said Asian countries were also concerned about the increasing risk of asset

bubbles and volatility in financial and currency markets following the

qualitative easing. He also reiterated that the government was determined to

curb excessive speculation in Hong Kong’s residential property market.

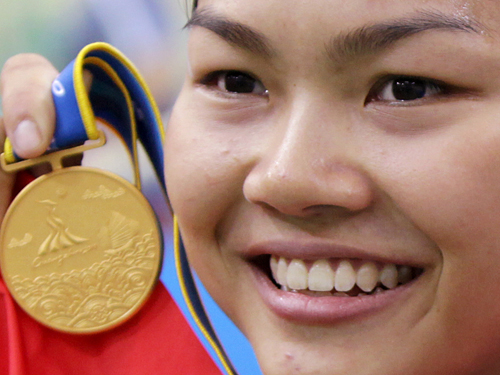

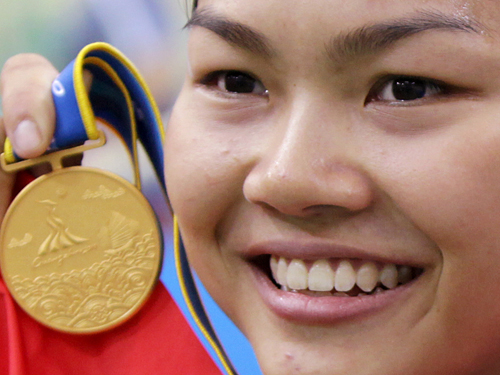

Gold medalist urges support for Asian

Games bid - Asian Games 2010 cycling gold medalist Wong Kam-po speaks at the

Legislative Council’s Home Affairs Panel meeting on Wednesday where he urged

lawmakers to support the city's bid to host the 2023 Asian Games. Gold medalist urges support for Asian

Games bid - Asian Games 2010 cycling gold medalist Wong Kam-po speaks at the

Legislative Council’s Home Affairs Panel meeting on Wednesday where he urged

lawmakers to support the city's bid to host the 2023 Asian Games.

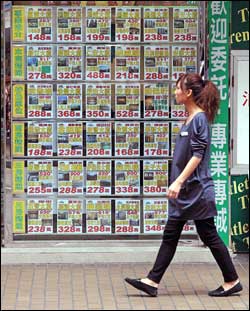

Lack of projects darkens

outlook - Only 700 new homes were sold in the first 25 days of this month, a 60

percent decrease from the 1,651 deals in October. "Deals for new homes will fail

to reach 800 for the month," said Jeffrey Ng Chong-yip of Hong Kong Property,

who also expects fewer than 1,000 deals in each of the coming months. As for the

past seven days, the impact of new stamp duties of up to 15 percent on homes

purchased and sold within six months could be felt in transactions for new

homes, which declined for the second straight week. Fewer buyers also showed

interest in checking out open houses at the weekend. "Fewer than 10 new homes

were sold through us on Saturday and Sunday, compared to a usual range of 20 to

30," said Patrick Chow Moon-kit, head of research of Ricacorp Properties. Of

these, four were at Festival City II in Tai Wai. Chow said new home sales will

dip further as no new projects are scheduled to be launched next month. The

value of transactions this month declined only 12 percent to HK$13.5 billion so

far. An average of HK$19.4 million was booked for each transaction, more than

double the HK$9.3 million in October. "Many of those new homes sold in November

were worth more than HK$10 million," added Ng. Meanwhile, most buyers stayed

away at the weekend. "Most buyers are expecting a further cut in home prices,

while a few sellers are willing to give discounts," said Midland Reality sales

director Gary Yeung Wing-kin. There were only 1,550 groups visiting 15 major

estates of preowned homes at the weekend, the largest weekly fall since 2008 at

26.7 percent. It also marked the fourth straight weekly decline. Sentiment in

the secondary market is also declining, with transactions down by half from a

week ago, said Chow. About 20 percent of homeowners have pulled out of the

market, with many switching to letting instead. Deals in the coming month will

continue to come under pressure, especially for units with prices ranging from

HK$5 million to HK$10 million. "With the impact from the new cooling measures,

fewer than 1,000 pre- owned homes will change hands in December," said Ng. Lack of projects darkens

outlook - Only 700 new homes were sold in the first 25 days of this month, a 60

percent decrease from the 1,651 deals in October. "Deals for new homes will fail

to reach 800 for the month," said Jeffrey Ng Chong-yip of Hong Kong Property,

who also expects fewer than 1,000 deals in each of the coming months. As for the

past seven days, the impact of new stamp duties of up to 15 percent on homes

purchased and sold within six months could be felt in transactions for new

homes, which declined for the second straight week. Fewer buyers also showed

interest in checking out open houses at the weekend. "Fewer than 10 new homes

were sold through us on Saturday and Sunday, compared to a usual range of 20 to

30," said Patrick Chow Moon-kit, head of research of Ricacorp Properties. Of

these, four were at Festival City II in Tai Wai. Chow said new home sales will

dip further as no new projects are scheduled to be launched next month. The

value of transactions this month declined only 12 percent to HK$13.5 billion so

far. An average of HK$19.4 million was booked for each transaction, more than

double the HK$9.3 million in October. "Many of those new homes sold in November

were worth more than HK$10 million," added Ng. Meanwhile, most buyers stayed

away at the weekend. "Most buyers are expecting a further cut in home prices,

while a few sellers are willing to give discounts," said Midland Reality sales

director Gary Yeung Wing-kin. There were only 1,550 groups visiting 15 major

estates of preowned homes at the weekend, the largest weekly fall since 2008 at

26.7 percent. It also marked the fourth straight weekly decline. Sentiment in

the secondary market is also declining, with transactions down by half from a

week ago, said Chow. About 20 percent of homeowners have pulled out of the

market, with many switching to letting instead. Deals in the coming month will

continue to come under pressure, especially for units with prices ranging from

HK$5 million to HK$10 million. "With the impact from the new cooling measures,

fewer than 1,000 pre- owned homes will change hands in December," said Ng.

HK IPOs roll on, US$2.8b deals

launched - Asian initial public offerings had a strong start to the week, with

two deals worth US$2.8 billion priced in Hong Kong on Monday, as issuers make a

last minute push to raise funds before markets close for year-end holidays in

about two weeks. Asian issuers have largely shrugged off the Korean tensions and

Ireland’s debt crisis, emboldened by continued strong fund inflows into the

region. Chongqing Rural Commercial Bank, which will trade under the listing code

3618, set a price range of HK$4.50-6.00 per share for its Hong Kong IPO, aiming

to raise up to HK$12 billion (US$1.5 billion), according to a term sheet seen by

Reuters. Huaneng Renewables Corporation priced its’ Hong Kong IPO at

HK$2.98-3.98 per share to raise up to US$1.3 billion, according to its term

sheet seen by Reuters. Asia has dominated the world IPO market this year,

accounting for 62 per cent of the US$241.2 billion raised through globally,

according to Thomson Reuters data. Hong Kong’s stock exchange has been an IPO

hot bed, raising about US$48 billion so far this year. Chongqing Rural

Commercial Bank planned to issue 2 billion shares, the term sheet said. Morgan

Stanley and Nomura Holdings are handling the sale. Huaneng Renewables plans to

issue 2.486 billion shares, the term sheet said. Morgan Stanley is the sole

global coordinator.

Flexible hours are being pushed so

working parents have more time with their kids - a call that follows a survey

showing about a third of Hong Kong's people spend only an hour a day with

families. Yet more than half of the 1,930 respondents to the survey by the Hong

Kong Young Women's Christian Association are generally satisfied with their

personal lives, and almost all gave a "pass" mark to their family relationships.

The respondents - most of them in two-parent, two-children "nuclear families" -

were interviewed from July to October and asked to grade personal and family

life satisfaction on a scale of one to seven, with three a "pass" level. The

study found 32.8 percent spend less than seven hours a week at dinner, talking

or in leisure activities with the family. They rated their personal and family

lives at 4.32 and 2.9 respectively. Those who spend more than 21 hours a week

involved in family activities recorded personal and family satisfaction at 5.48

and 3.52 respectively. "Mutual understanding and mutual respect can be

cultivated through daily communication, which are the keys to a harmonious

family," said YWCA social work supervisor Emily Lee Man-shan. Shared

responsibilities go a long way to making a happy family, Lee added. So the

government should introduce more family-friendly policies such as flexible

working hours to achieve a balance between work and the family. A couple with a

baby under three years of age should be able to get some extra leave and

subsidies, Lee said. Despite perceived needs, 53 percent of all respondents are

generally satisfied with life, with an average 4.94 points, while 93.2 percent

grade family life at 3.2 - just above the "pass" level. Those aged 19 to 39 are

less happy both in personal and family lives, possibly because of emotional,

employment, and marriage problems. Ms Ho, with a 10-year-old son and an

eight-year-old daughter, said she felt strain when the latter was diagnosed with

dyslexia two years ago. But her husband, a civil engineer, shares chores. They

take turns to pick up the children from school, and their son helps tutor his

sister. "We sit down and reach major decisions together," she said. "My

daughter's studies have improved and we are more united than before." Flexible hours are being pushed so

working parents have more time with their kids - a call that follows a survey

showing about a third of Hong Kong's people spend only an hour a day with

families. Yet more than half of the 1,930 respondents to the survey by the Hong

Kong Young Women's Christian Association are generally satisfied with their

personal lives, and almost all gave a "pass" mark to their family relationships.

The respondents - most of them in two-parent, two-children "nuclear families" -

were interviewed from July to October and asked to grade personal and family

life satisfaction on a scale of one to seven, with three a "pass" level. The

study found 32.8 percent spend less than seven hours a week at dinner, talking

or in leisure activities with the family. They rated their personal and family

lives at 4.32 and 2.9 respectively. Those who spend more than 21 hours a week

involved in family activities recorded personal and family satisfaction at 5.48

and 3.52 respectively. "Mutual understanding and mutual respect can be

cultivated through daily communication, which are the keys to a harmonious

family," said YWCA social work supervisor Emily Lee Man-shan. Shared

responsibilities go a long way to making a happy family, Lee added. So the

government should introduce more family-friendly policies such as flexible

working hours to achieve a balance between work and the family. A couple with a

baby under three years of age should be able to get some extra leave and

subsidies, Lee said. Despite perceived needs, 53 percent of all respondents are

generally satisfied with life, with an average 4.94 points, while 93.2 percent

grade family life at 3.2 - just above the "pass" level. Those aged 19 to 39 are

less happy both in personal and family lives, possibly because of emotional,

employment, and marriage problems. Ms Ho, with a 10-year-old son and an

eight-year-old daughter, said she felt strain when the latter was diagnosed with

dyslexia two years ago. But her husband, a civil engineer, shares chores. They

take turns to pick up the children from school, and their son helps tutor his

sister. "We sit down and reach major decisions together," she said. "My

daughter's studies have improved and we are more united than before."

More Bank of China (Hong Kong)

branches will be authorized to collect subscription monies and process

applications for the Bank of China (3988) H-share rights issue. Processing

counters at seven more branches will open today, in addition to the 20 that are

currently collecting applications, BOCHK corporate banking and financial

institutions deputy general manager Chan Man said. "We may add eight to 35

branches to handle rights issue applications when needed," he said. The

inquiries and form submission take 15 to 20 minutes on average. BOCHK got

145,000 applications for the rights issue, of which 89,000 are provisional

allotment letters and 56,000 excess application forms, as of Saturday. Most

mistakes in the application forms related to the payee name, as the payee

accounts for provisional allotment letters and excess application forms are

different. To help make filling in forms easier, the branches offer seals of the

account names to shareholders. In the 10 days between November 17 and 27, the

deal's registrar Computershare Hong Kong Investor Services received over 20,000

inquiries about the rights issue, the registrar's managing director Pamela Chung

Kong-hung said. About 70 percent of BOC shareholders are expected to take up the

rights, and half of them have already submitted applications, Chan said. The

subscription closes on Friday. The rights issue of Industrial and Commercial

Bank of China (1398) kicks off tomorrow.

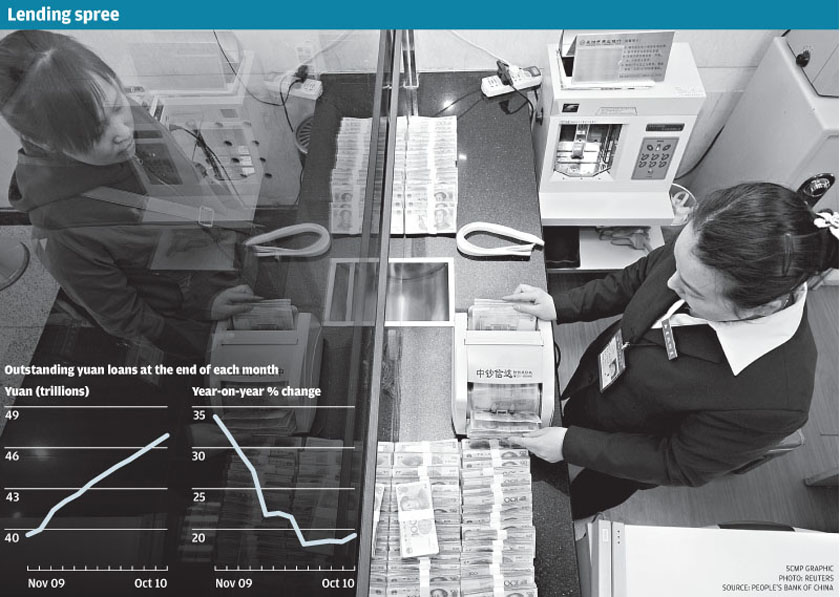

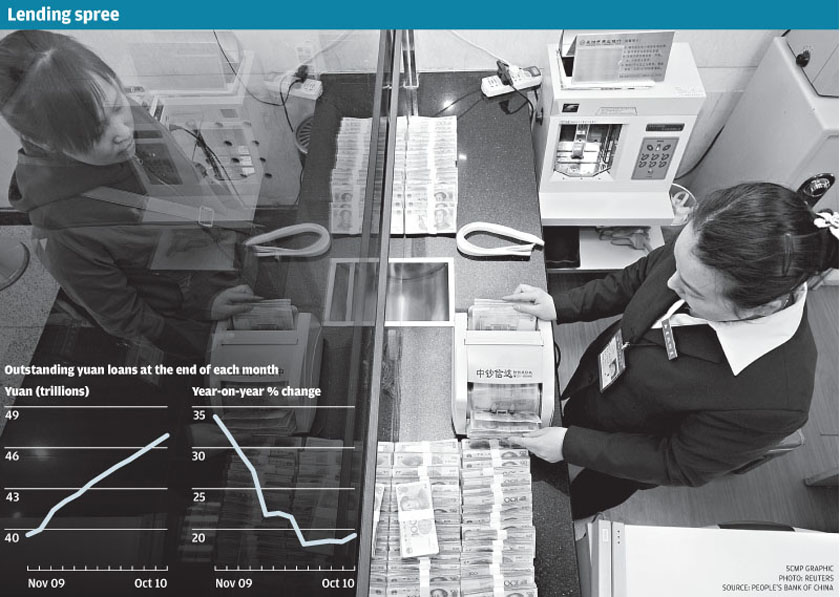

China*:

A set of data published by the People's Bank of China shows capital inflows

jumped in October, reinforcing the government’s rationale for a slew of monetary

tightening steps.

China*:

A set of data published by the People's Bank of China shows capital inflows

jumped in October, reinforcing the government’s rationale for a slew of monetary

tightening steps.

Seoul considers Beijing's call for talks - China's Vice Foreign Minister Wu

Dawei called for emergency talks on Sunday to diffuse tensions on the Korean

Peninsula. South Korean and US forces pressed on with massive military drills on

Monday as regional powers considered a call by China for emergency talks

following North Korea's attack on a southern island. China’s proposed emergency

consultations come amid global pressure on Beijing to take a more aggressive

role in the stand-off between the rival Koreas and try to rein in ally Pyongyang

using its leverage as its largest source of aid. Washington and Tokyo were

non-committal, saying they would consult with Seoul, which was sceptical of the

proposal to sit down with North Korea around a table, effectively rewarding the

North for bad behavior. The reclusive North was previously offered massive aid

in return for disarmament pledges that went unmet. “The six-party talks cannot

substitute for action by North Korea to comply with its obligations,” a State

Department spokesman said, referring to disarmament talks which North Korea

abandoned two years ago. “We have called on China to urge the DPRK (North Korea)

to restrain its provocations and responsibly act in the interests of peace and

stability.” The call for two Koreas, the United States, Japan, and Russia to

meet at a forum hosted by China must be reviewed “very cautiously” in view of

North Korea’s provocations, Seoul said. Both Beijing and Pyongyang have been

pressing regional powers to return to talks in some form or other for the past

few months in a move analysts say is aimed at extracting concessions. China,

which agreed with South Korea that the situation was “worrisome,” suggested the

emergency talks for December. It did not say whether Pyongyang had agreed to

join. South Korean President Lee Myung-bak was scheduled to address the country

to speak about the country’s response to the North’s shelling on Tuesday of its

western island of Yeonpyeong. Four people were killed in the attack. The island

lies 3 kilometres (2 miles) from the disputed sea border. Yang Moo-jin, of the

University of North Korean Studies, said the possibility of immediate additional

provocations by the North was low, citing the massive drills by the South and US

forces and the start of Chinese diplomacy to defuse tension. The nuclear-powered

USS George Washington, which has 75 warplanes and a crew of more than 6,000, is

taking part in around-the-clock drills in waters west of the Korean Peninsula

but well south of the sea border disputed by the North. North Korea kept up the

tension at the weekend by reportedly moving missiles to frontline areas and

warning of retaliation if its territory is violated. South Korea’s financial

authorities expect jitters to remain in the markets for some time but without

long-lasting effects but were braced for possible volatile swings in capital

flows. The South Korean won posted the largest weekly drop in over five months

on Friday and was expected to stay weak, analysts and dealers said. The few

remaining residents of Yeonpyeong about 80 kilometres (50 miles) from the

mainland South had to evacuate to air raid shelters temporarily on Sunday when

the military issued a warning for a possible renewed artillery attack by the

North. But in Seoul, life carried on normally for the city’s more than 10

million residents, with downtown shopping districts jammed with people despite

the freezing temperatures, and cafes decked with Christmas decorations doing

brisk business. “I am worried, but not that worried that I need to stay at

home,” said Eunhye Kim, an usher showing people from a packed theatre. “They

don’t really want to make war ... there’s no gain for either side.”

Seoul considers Beijing's call for talks - China's Vice Foreign Minister Wu

Dawei called for emergency talks on Sunday to diffuse tensions on the Korean

Peninsula. South Korean and US forces pressed on with massive military drills on

Monday as regional powers considered a call by China for emergency talks

following North Korea's attack on a southern island. China’s proposed emergency

consultations come amid global pressure on Beijing to take a more aggressive

role in the stand-off between the rival Koreas and try to rein in ally Pyongyang

using its leverage as its largest source of aid. Washington and Tokyo were

non-committal, saying they would consult with Seoul, which was sceptical of the

proposal to sit down with North Korea around a table, effectively rewarding the

North for bad behavior. The reclusive North was previously offered massive aid

in return for disarmament pledges that went unmet. “The six-party talks cannot

substitute for action by North Korea to comply with its obligations,” a State

Department spokesman said, referring to disarmament talks which North Korea

abandoned two years ago. “We have called on China to urge the DPRK (North Korea)

to restrain its provocations and responsibly act in the interests of peace and

stability.” The call for two Koreas, the United States, Japan, and Russia to

meet at a forum hosted by China must be reviewed “very cautiously” in view of

North Korea’s provocations, Seoul said. Both Beijing and Pyongyang have been

pressing regional powers to return to talks in some form or other for the past

few months in a move analysts say is aimed at extracting concessions. China,

which agreed with South Korea that the situation was “worrisome,” suggested the

emergency talks for December. It did not say whether Pyongyang had agreed to

join. South Korean President Lee Myung-bak was scheduled to address the country

to speak about the country’s response to the North’s shelling on Tuesday of its

western island of Yeonpyeong. Four people were killed in the attack. The island

lies 3 kilometres (2 miles) from the disputed sea border. Yang Moo-jin, of the

University of North Korean Studies, said the possibility of immediate additional

provocations by the North was low, citing the massive drills by the South and US

forces and the start of Chinese diplomacy to defuse tension. The nuclear-powered

USS George Washington, which has 75 warplanes and a crew of more than 6,000, is

taking part in around-the-clock drills in waters west of the Korean Peninsula

but well south of the sea border disputed by the North. North Korea kept up the

tension at the weekend by reportedly moving missiles to frontline areas and

warning of retaliation if its territory is violated. South Korea’s financial

authorities expect jitters to remain in the markets for some time but without

long-lasting effects but were braced for possible volatile swings in capital

flows. The South Korean won posted the largest weekly drop in over five months

on Friday and was expected to stay weak, analysts and dealers said. The few

remaining residents of Yeonpyeong about 80 kilometres (50 miles) from the

mainland South had to evacuate to air raid shelters temporarily on Sunday when

the military issued a warning for a possible renewed artillery attack by the

North. But in Seoul, life carried on normally for the city’s more than 10

million residents, with downtown shopping districts jammed with people despite

the freezing temperatures, and cafes decked with Christmas decorations doing

brisk business. “I am worried, but not that worried that I need to stay at

home,” said Eunhye Kim, an usher showing people from a packed theatre. “They

don’t really want to make war ... there’s no gain for either side.”

Golden decoration of rabbit at a shop in

Suzhou City of east China's Jiangsu Province. According to the Chinese

traditional lunar calendar, it is still two months to go to embrace the Year of

Rabbit, however, business operators in China have been busily engaged in

promoting rabbit-related products in a hope to boost sales. Golden decoration of rabbit at a shop in

Suzhou City of east China's Jiangsu Province. According to the Chinese

traditional lunar calendar, it is still two months to go to embrace the Year of

Rabbit, however, business operators in China have been busily engaged in

promoting rabbit-related products in a hope to boost sales.

Singapore's pro-trade agency

International Enterprise (IE) Singapore on Monday opened its 10th Overseas

Center (OC) in China's Hubei province. Based in Hubei's capital city Wuhan, the

new OC will focus efforts on Central China, in particular Hubei, Hunan and

Jiangxi provinces. The center will bring IE Singapore and Singapore Economic

Development Board under one roof to facilitate trade and investment activities.

It will assist Singapore-based companies to explore business collaborations and

opportunities with the Chinese enterprises, help increase in-market knowledge of

these companies as well as to build networks with the local governments and

businesses. It will assist Chinese companies to explore international operations

from Singapore, and help increase the companies' familiarity of the

international marketplace. "The establishment of the Singapore Center in Wuhan

is timely," said Sam Tan, Singapore's Senior Parliamentary Secretary for Trade &

Industry, and Information, Communications & the Arts, "Singapore- based

companies have the relevant expertise and experience to share and contribute to

the developing needs of Central China in various industries," he added. In 2009,

there were a cumulative number of 287 Singapore projects in Hubei with

cumulative actual investments reaching 770 million U.S. dollars. Singapore's

actual foreign direct investments into Hubei amounted to 138 million U.S.

dollars. IE Singapore currently has Overseas Centers located in China's Beijing,

Chengdu, Chongqing, Dalian, Guangzhou, Hong Kong, Qingdao, Shanghai and Xi'an.

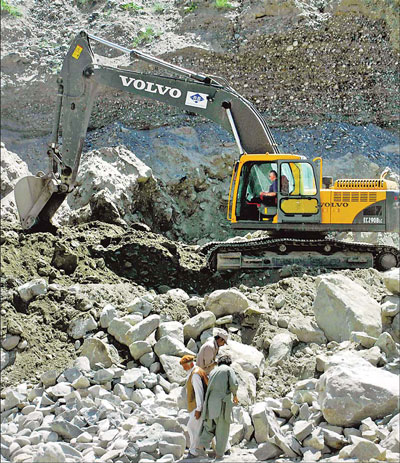

China's 840KM

Shijiazhuang-Wuhan high speed rail work begins to be completed end of 2011 -

Workers lay down tracks for the Shijiazhuang-Wuhan high speed rail in Xuchang,

Central China’s Henan province, Nov 29, 2010. Construction work on the Xuchang

section of the 840 km railway began on Monday. The whole line will be finished

at the end of 2011, connecting two capital cities - Shijiazhuang of North

China’s Hebei province and Wuhan of Central China’s Hubei province. It is

designed to reach a speed of 350 kilometers per hour, cutting the running time

between Xuchang and its neighboring city Zhengzhou, more than 80 kilometers in

distance, to a few minutes. China's 840KM

Shijiazhuang-Wuhan high speed rail work begins to be completed end of 2011 -

Workers lay down tracks for the Shijiazhuang-Wuhan high speed rail in Xuchang,

Central China’s Henan province, Nov 29, 2010. Construction work on the Xuchang

section of the 840 km railway began on Monday. The whole line will be finished

at the end of 2011, connecting two capital cities - Shijiazhuang of North

China’s Hebei province and Wuhan of Central China’s Hubei province. It is

designed to reach a speed of 350 kilometers per hour, cutting the running time

between Xuchang and its neighboring city Zhengzhou, more than 80 kilometers in

distance, to a few minutes.

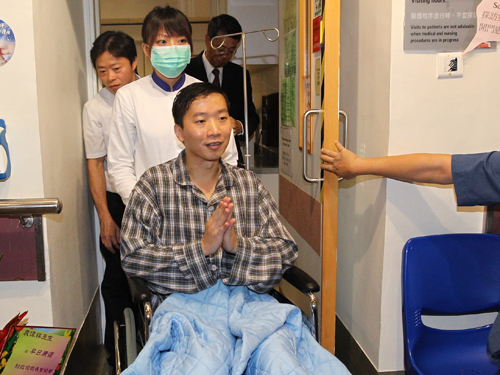

Super Girl death during surgery probed - China authorities have launched a probe

into the death of an aspiring pop singer during plastic surgery - an incident

that has sparked concerns about the dangers of going under the knife. Wang Bei,

24, a former contestant on Super Girl - China's smash-hit answer to American

Idol - died on November 15 during "facial bone-grinding surgery" in Wuhan. "The

Ministry of Health has tasked the Hubei health department to investigate and

verify the situation ... and to announce results of the probe to the public

without delay," an official said. Wang, whose good looks made her a popular

contestant on Super Girl, died in an "anesthetic accident" as she was having

surgery, Xinhua News Agency reported earlier. Her "jaw suddenly started bleeding

during the procedure, blocking her windpipe and causing her to suffocate."

Wang's mother was having the same procedure at the clinic when her daughter

died. News of her death and commentaries about it plastic surgery have been

followed avidly across China, where three million people go under the knife each

year, according to figures published by state media. Surging demand has led to

untrained doctors operating, "which is risky and irresponsible," said Zhang

Huabin, a professor of plastic surgery at Guangdong Medical College. The health

ministry has also ordered increased supervision in the industry.

Super Girl death during surgery probed - China authorities have launched a probe

into the death of an aspiring pop singer during plastic surgery - an incident

that has sparked concerns about the dangers of going under the knife. Wang Bei,

24, a former contestant on Super Girl - China's smash-hit answer to American

Idol - died on November 15 during "facial bone-grinding surgery" in Wuhan. "The

Ministry of Health has tasked the Hubei health department to investigate and

verify the situation ... and to announce results of the probe to the public

without delay," an official said. Wang, whose good looks made her a popular

contestant on Super Girl, died in an "anesthetic accident" as she was having

surgery, Xinhua News Agency reported earlier. Her "jaw suddenly started bleeding

during the procedure, blocking her windpipe and causing her to suffocate."

Wang's mother was having the same procedure at the clinic when her daughter

died. News of her death and commentaries about it plastic surgery have been

followed avidly across China, where three million people go under the knife each

year, according to figures published by state media. Surging demand has led to

untrained doctors operating, "which is risky and irresponsible," said Zhang

Huabin, a professor of plastic surgery at Guangdong Medical College. The health

ministry has also ordered increased supervision in the industry.

November 30, 2010

Hong Kong*:

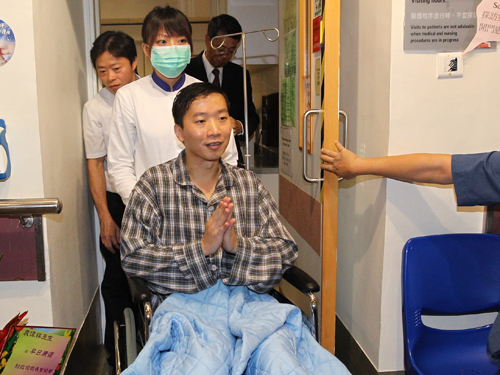

Szeto Wah was last night re-elected chairman of the Hong Kong Alliance in

Support of Patriotic Democratic Movements in China for the 21st time. But unlike

past elections, he did not attend the annual meeting - he is in hospital

fighting late-stage lung cancer, which has spread to his bones. Szeto's absence

was inevitable, colleagues said, because chemotherapy and medication have

weakened his immunity, increasing the risk of infection. In a statement released

after his re-election, the veteran activist said: "I have no regret for all the

work I have done for the alliance." The political group was founded to promote

democracy and rehabilitation of the victims of the Tiananmen military crackdown

in June 1989. But it was branded subversive by Beijing. Alliance member and

Democratic Party chairman Albert Ho Chun-yan revealed the extent of Szeto's

deteriorating health. "Cancer cells have invaded his bones, he is suffering

great pain every day," he said. Szeto's condition has been fluctuating amid

frequent treatment, Ho said, but as the alliance's chairmanship post was largely

ceremonial, it imposed little burden on him. Other core members of the group

have taken on his responsibilities. "He is exerting great effort to fight such a

serious illness. But he still insists on working for the alliance," Ho said.

Szeto's diagnosis of stage-four lung cancer was confirmed about a year ago.

After last night's election, unionist lawmaker Lee Cheuk-yan and activist

Richard Tsoi Yiu-cheong remain vice-chairmen. Three key standing committee

members did not seek re-election. They were Andrew Cheng Kar-foo, Andrew To

Kwan-hang and "Long Hair" Leung Kwok-hung. Cheng, a former democrat, broke from

the Democratic Party after it endorsed the government's political reform. Leung

and To, both of the League of Social Democrats, said on previous occasions that

the alliance had gone soft on Beijing. Leung caused bitterness among alliance

supporters when he said Szeto backed the government's reform package because

"cancer had gone into his brain". Hong Kong*:

Szeto Wah was last night re-elected chairman of the Hong Kong Alliance in

Support of Patriotic Democratic Movements in China for the 21st time. But unlike

past elections, he did not attend the annual meeting - he is in hospital

fighting late-stage lung cancer, which has spread to his bones. Szeto's absence

was inevitable, colleagues said, because chemotherapy and medication have

weakened his immunity, increasing the risk of infection. In a statement released

after his re-election, the veteran activist said: "I have no regret for all the

work I have done for the alliance." The political group was founded to promote

democracy and rehabilitation of the victims of the Tiananmen military crackdown

in June 1989. But it was branded subversive by Beijing. Alliance member and

Democratic Party chairman Albert Ho Chun-yan revealed the extent of Szeto's

deteriorating health. "Cancer cells have invaded his bones, he is suffering

great pain every day," he said. Szeto's condition has been fluctuating amid

frequent treatment, Ho said, but as the alliance's chairmanship post was largely

ceremonial, it imposed little burden on him. Other core members of the group

have taken on his responsibilities. "He is exerting great effort to fight such a

serious illness. But he still insists on working for the alliance," Ho said.

Szeto's diagnosis of stage-four lung cancer was confirmed about a year ago.

After last night's election, unionist lawmaker Lee Cheuk-yan and activist

Richard Tsoi Yiu-cheong remain vice-chairmen. Three key standing committee

members did not seek re-election. They were Andrew Cheng Kar-foo, Andrew To

Kwan-hang and "Long Hair" Leung Kwok-hung. Cheng, a former democrat, broke from

the Democratic Party after it endorsed the government's political reform. Leung

and To, both of the League of Social Democrats, said on previous occasions that

the alliance had gone soft on Beijing. Leung caused bitterness among alliance

supporters when he said Szeto backed the government's reform package because

"cancer had gone into his brain".

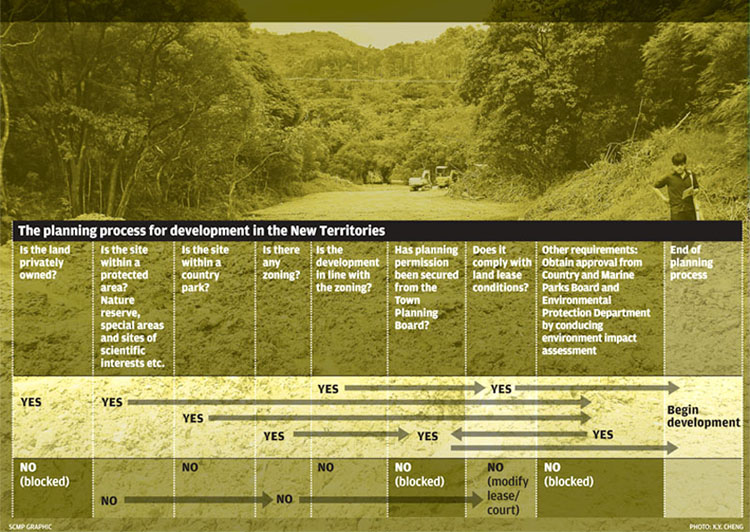

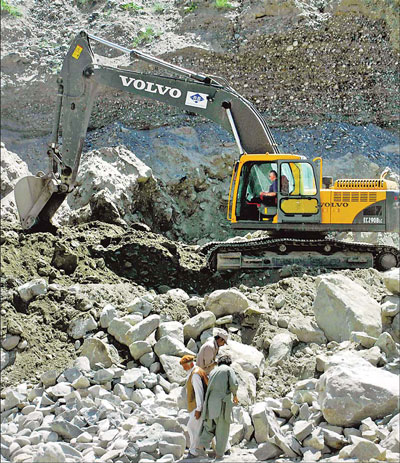

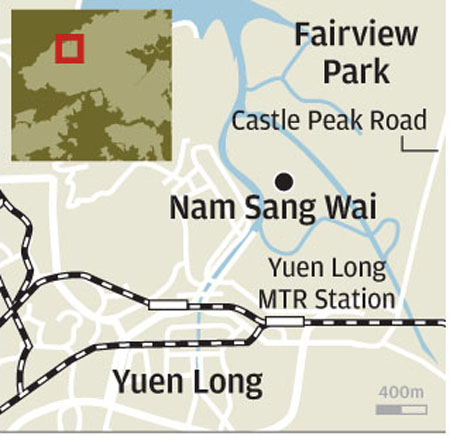

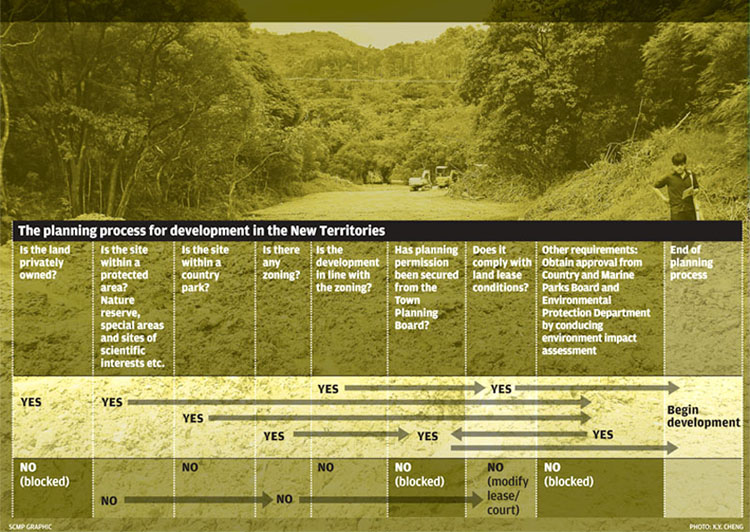

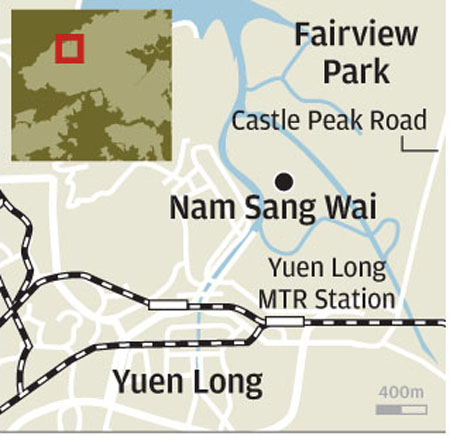

Kuk chief's land to take waste from rail

project - A massive area in Lung Kwu Tan, the ancestral home of Heung Yee Kuk

chief Lau Wong-fat, was cleared and leveled for future dumping of waste soil

from construction of the Hong Kong-Guangzhou high-speed rail line. The

85,000-square metre site in Lung Tsai, south of Lung Kwu Tan village in Tuen Mun,

looks like barren land with trees chopped down and the site bulldozed. But in

months, it is likely to be heaped with piles of soil. The site, partly owned by

Lau, an executive councillor and chairman of the kuk, which represents

indigenous inhabitants, was rented by village chief Lau Wai-ping two months ago.

"There is no planning [control] on this site and this makes it possible to

receive the earth from the ongoing cross-border express rail construction," Lau

Wai-ping said. "This is good for everybody, as these materials are clean and

they can be reused in other construction projects. Keeping them here is better

and much cheaper than moving them to a landfill or the mainland." Lau disclosed

his plan when asked about the clearance at a site which green activists say was

a butterfly hot spot. Over the past decade, the site has degenerated due to

gradual man-made destruction such as dumping and tree-cutting. Lau did not say

how he could get the soil from the HK$60 billion rail project contractors and

how much he would earn from the earth storage. Under the construction waste

charging law in Hong Kong, it costs HK$125 to dump a ton of such waste in a

landfill. According to the environmental impact assessment report for the rail

link, at least 9 million cubic metres of unwanted construction waste generated

from building 26 kilometres of tunnels will require disposal. Some of it might

be used for construction of an artificial island for the proposed Hong Kong-Zhuhai-Macau

bridge, cement plants and an ongoing reclamation project in Taishan in the

western Pearl River Delta. Lau said waste would be stored at the Lung Tsai site

for about two years and then handed back to Lau Wong-fat, who he understood had

always wanted to develop it for housing. The area could have 100 villas but Lau

Wong-fat declined to comment. The village chief also recently commissioned

workers to remove more vegetation on the site, which used to house a golf

driving range and a kart course. Trying to diffuse his fellow villagers' worries

about possible environmental nuisance from the storage operation, which is just

50 metres from the nearest village houses, Lau Wai-ping pledged that any

material would not be stacked too high and surface run-offs would be properly

controlled. But the land clearance has sparked concern from green activists who

have monitored changes at the site, known for rare butterfly sightings - such as

the Redlace Wing - over the past decade. Dr Cheng Luk-ki, the research head of

Green Power, said the site had been damaged at different stages over the past

decade. Photographs taken by the group since 1997 show how it was turned from a

once-green field into concrete and then a dumping site. Cheng suspected that

damage was deliberately done to pre-empt any attempt by the government to impose

a zoning control. "By trashing the site before any future zoning is imposed, all

existing uses on the site can be kept and therefore allow more room for the

landowner to develop in the future," he said. Cheng said there were well known

examples of damage being inflicted on ecologically sensitive sites before a

zoning plan came into force. He cited Sham Chung, one of the largest freshwater

wetlands in Hong Kong. The group wrote to the Lands Department, Environmental

Protection Department, Planning Department and the Drainage Services Department

to inquire if the work at Lung Tsai was authorised, and if they had received any

development proposal. The Planning Department said since the site has no zoning

cover, any land-use change had to be scrutinised by the Lands Department. It

also refused to disclose if a zoning plan was being drawn up for the site, as it

said this was sensitive information. Lands officials did not reply to inquiries

made on Friday. The Environmental Protection Department said it found no illegal

dumping activities at the site or breaches of environmental ordinances in an

inspection on Friday. "We will maintain liaison with the department concerned

and continue to monitor the situation," a spokesman said. Kuk chief's land to take waste from rail

project - A massive area in Lung Kwu Tan, the ancestral home of Heung Yee Kuk

chief Lau Wong-fat, was cleared and leveled for future dumping of waste soil

from construction of the Hong Kong-Guangzhou high-speed rail line. The

85,000-square metre site in Lung Tsai, south of Lung Kwu Tan village in Tuen Mun,

looks like barren land with trees chopped down and the site bulldozed. But in

months, it is likely to be heaped with piles of soil. The site, partly owned by

Lau, an executive councillor and chairman of the kuk, which represents

indigenous inhabitants, was rented by village chief Lau Wai-ping two months ago.

"There is no planning [control] on this site and this makes it possible to

receive the earth from the ongoing cross-border express rail construction," Lau

Wai-ping said. "This is good for everybody, as these materials are clean and

they can be reused in other construction projects. Keeping them here is better

and much cheaper than moving them to a landfill or the mainland." Lau disclosed

his plan when asked about the clearance at a site which green activists say was

a butterfly hot spot. Over the past decade, the site has degenerated due to

gradual man-made destruction such as dumping and tree-cutting. Lau did not say

how he could get the soil from the HK$60 billion rail project contractors and

how much he would earn from the earth storage. Under the construction waste

charging law in Hong Kong, it costs HK$125 to dump a ton of such waste in a

landfill. According to the environmental impact assessment report for the rail

link, at least 9 million cubic metres of unwanted construction waste generated

from building 26 kilometres of tunnels will require disposal. Some of it might

be used for construction of an artificial island for the proposed Hong Kong-Zhuhai-Macau

bridge, cement plants and an ongoing reclamation project in Taishan in the

western Pearl River Delta. Lau said waste would be stored at the Lung Tsai site

for about two years and then handed back to Lau Wong-fat, who he understood had

always wanted to develop it for housing. The area could have 100 villas but Lau

Wong-fat declined to comment. The village chief also recently commissioned

workers to remove more vegetation on the site, which used to house a golf

driving range and a kart course. Trying to diffuse his fellow villagers' worries

about possible environmental nuisance from the storage operation, which is just

50 metres from the nearest village houses, Lau Wai-ping pledged that any

material would not be stacked too high and surface run-offs would be properly

controlled. But the land clearance has sparked concern from green activists who

have monitored changes at the site, known for rare butterfly sightings - such as

the Redlace Wing - over the past decade. Dr Cheng Luk-ki, the research head of

Green Power, said the site had been damaged at different stages over the past

decade. Photographs taken by the group since 1997 show how it was turned from a

once-green field into concrete and then a dumping site. Cheng suspected that

damage was deliberately done to pre-empt any attempt by the government to impose

a zoning control. "By trashing the site before any future zoning is imposed, all

existing uses on the site can be kept and therefore allow more room for the

landowner to develop in the future," he said. Cheng said there were well known

examples of damage being inflicted on ecologically sensitive sites before a

zoning plan came into force. He cited Sham Chung, one of the largest freshwater

wetlands in Hong Kong. The group wrote to the Lands Department, Environmental

Protection Department, Planning Department and the Drainage Services Department

to inquire if the work at Lung Tsai was authorised, and if they had received any

development proposal. The Planning Department said since the site has no zoning

cover, any land-use change had to be scrutinised by the Lands Department. It

also refused to disclose if a zoning plan was being drawn up for the site, as it

said this was sensitive information. Lands officials did not reply to inquiries

made on Friday. The Environmental Protection Department said it found no illegal

dumping activities at the site or breaches of environmental ordinances in an

inspection on Friday. "We will maintain liaison with the department concerned

and continue to monitor the situation," a spokesman said.

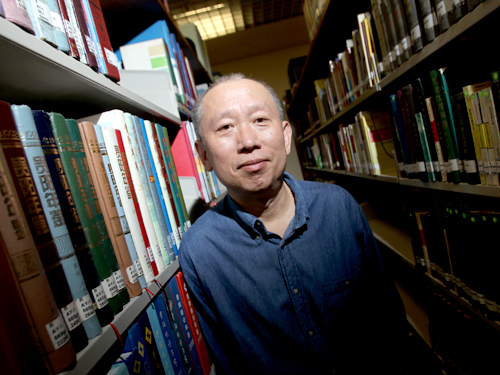

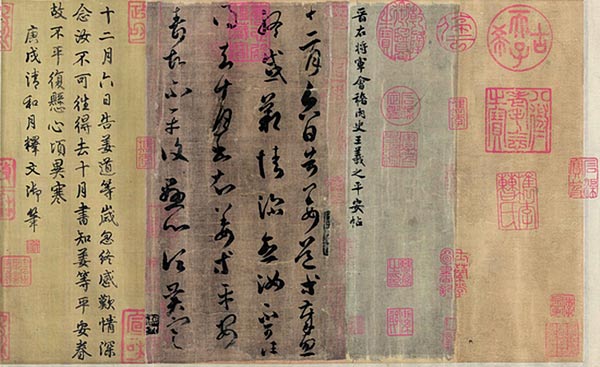

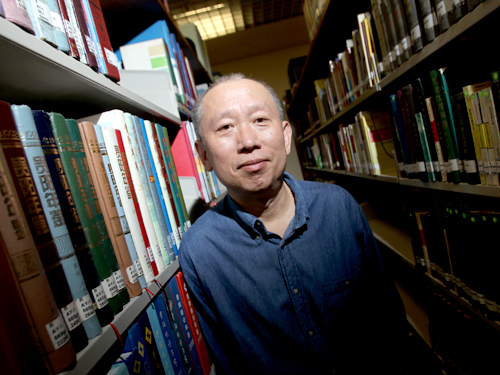

HK blooms as back door for books likely

to ruffle mainland feathers - Wang Shaoguang says many books about the Cultural

Revolution were published in Hong Kong. When Shen Zhihua wrote a book in the

1990s about Mao and Stalin's connection to the Korean war, based on declassified

files from Russia, the mainland's censors blocked his attempts to have it

published. But come Hong Kong's handover in 1997, the history professor at

Shanghai's East China Normal University hit upon the idea of taking advantage of

the "one country, two systems" policy and had the book published in Hong Kong in

1998. Freedom of publication in the city allowed it to become a back door for

the publication of books on sensitive topics of modern Chinese history that were

banned on the mainland. Demand for them rose especially after 2003, when Beijing

allowed individual travel to Hong Kong. Since then, more than 46 million

mainlanders have visited Hong Kong without joining tour groups. Customers from

the mainland zero in on books depicting details of power struggles within the

Communist Party and party bosses' private lives - big sellers for small

bookshops and news-stands around the city. But mainlanders also seek out

intellectual titles based on serious academic research. Chinese University

Press, one of Hong Kong's major publishers specialising in books on modern

Chinese history and politics, has brought out 30 books in this area since the

handover, 28 of them in Chinese. It published fewer than 10 titles before 1997.

How Did the Sun Rise Over Yan'an? - a critical account of the ideological mass

movement initiated by the Communist Party in 1942 - has sold nearly 20,000

copies and been reprinted nine times since its publication in 2000. "The book is

one of the most popular titles we published in recent years. Its sales volume is

really impressive, as it is not easy to sell 2,000 copies of a serious title in

Hong Kong," Angelina Wong Lai-fun, the business manager of Chinese University

Press, said. Even the hefty series The History of the People's Republic of China

- distributed by Chinese University Press - has fared reasonably well. Seven of

the 10 volumes planned have hit bookshelves since 2008. Buyers have snatched up

more than 1,000 copies of each one. Cosmos Books, which published Shen's book on

the Korean war, has produced nearly 80 books on contemporary Chinese history and

politics since 1998. Much of the vitality of this industry can be attributed to

readers from the mainland anxious to read what they cannot back home.

"Individual travellers from the mainland have emerged as the major buyers of

those books," Wong said. "One of their major activities during their visits to

Hong Kong is shopping at bookshops." Shen, a frequent traveller to Hong Kong for

academic exchanges, estimated that mainlanders account for 70 per cent of buyers

of intellectual books on modern Chinese history - although a large proportion of

the books, like his own, are in traditional Chinese script only, not the

simplified script used on the mainland. Terri Chan Kim-man, deputy general

manager of Cosmos Books, said mainlanders bought many of her company's books on

modern Chinese history, which sell in the range of several hundred to nearly

20,000 copies. Shen said Hong Kong's advantage in publishing works on

contemporary Chinese history was aided by a trend in Taiwan in the past decade

of "desinification", which aims at severing the cultural kinship between the

mainland and the island. He is one of the academics who spearheaded the

publication of The History of the People's Republic of China, which was funded

by Chinese University's Research Centre for Contemporary Chinese Culture. The

aim, he said, was to publish a series of books on the country's post-1949

history that would be objective and grounded in evidence-based academic

research. "When I discussed the idea with Chinese University academics, we

immediately came up with the idea of publishing them in Hong Kong. Where else

can we do the project except in Hong Kong?" Shen said. Professor Chen Fong-ching,

an honorary senior research fellow of Chinese University's Institute of Chinese

Studies, who backed the publishing project, said the series could break even

although the number of target readers was rather small. Wang Shaoguang ,

director of the Universities Service Centre for China Studies at the university,

said the mainland had imposed restrictions since the 1980s on books relating to

the Cultural Revolution. "That's why many books about the Cultural Revolution

were published in Hong Kong," he said. Shen's book Mao Zedong, Joseph Stalin and

the Korean War was eventually published on the mainland in 2003. HK blooms as back door for books likely

to ruffle mainland feathers - Wang Shaoguang says many books about the Cultural

Revolution were published in Hong Kong. When Shen Zhihua wrote a book in the

1990s about Mao and Stalin's connection to the Korean war, based on declassified

files from Russia, the mainland's censors blocked his attempts to have it

published. But come Hong Kong's handover in 1997, the history professor at

Shanghai's East China Normal University hit upon the idea of taking advantage of

the "one country, two systems" policy and had the book published in Hong Kong in

1998. Freedom of publication in the city allowed it to become a back door for

the publication of books on sensitive topics of modern Chinese history that were

banned on the mainland. Demand for them rose especially after 2003, when Beijing

allowed individual travel to Hong Kong. Since then, more than 46 million

mainlanders have visited Hong Kong without joining tour groups. Customers from

the mainland zero in on books depicting details of power struggles within the

Communist Party and party bosses' private lives - big sellers for small

bookshops and news-stands around the city. But mainlanders also seek out

intellectual titles based on serious academic research. Chinese University

Press, one of Hong Kong's major publishers specialising in books on modern

Chinese history and politics, has brought out 30 books in this area since the

handover, 28 of them in Chinese. It published fewer than 10 titles before 1997.

How Did the Sun Rise Over Yan'an? - a critical account of the ideological mass

movement initiated by the Communist Party in 1942 - has sold nearly 20,000

copies and been reprinted nine times since its publication in 2000. "The book is

one of the most popular titles we published in recent years. Its sales volume is

really impressive, as it is not easy to sell 2,000 copies of a serious title in

Hong Kong," Angelina Wong Lai-fun, the business manager of Chinese University

Press, said. Even the hefty series The History of the People's Republic of China

- distributed by Chinese University Press - has fared reasonably well. Seven of

the 10 volumes planned have hit bookshelves since 2008. Buyers have snatched up

more than 1,000 copies of each one. Cosmos Books, which published Shen's book on

the Korean war, has produced nearly 80 books on contemporary Chinese history and

politics since 1998. Much of the vitality of this industry can be attributed to

readers from the mainland anxious to read what they cannot back home.

"Individual travellers from the mainland have emerged as the major buyers of

those books," Wong said. "One of their major activities during their visits to

Hong Kong is shopping at bookshops." Shen, a frequent traveller to Hong Kong for

academic exchanges, estimated that mainlanders account for 70 per cent of buyers

of intellectual books on modern Chinese history - although a large proportion of

the books, like his own, are in traditional Chinese script only, not the

simplified script used on the mainland. Terri Chan Kim-man, deputy general

manager of Cosmos Books, said mainlanders bought many of her company's books on

modern Chinese history, which sell in the range of several hundred to nearly

20,000 copies. Shen said Hong Kong's advantage in publishing works on

contemporary Chinese history was aided by a trend in Taiwan in the past decade

of "desinification", which aims at severing the cultural kinship between the

mainland and the island. He is one of the academics who spearheaded the

publication of The History of the People's Republic of China, which was funded

by Chinese University's Research Centre for Contemporary Chinese Culture. The

aim, he said, was to publish a series of books on the country's post-1949

history that would be objective and grounded in evidence-based academic

research. "When I discussed the idea with Chinese University academics, we

immediately came up with the idea of publishing them in Hong Kong. Where else

can we do the project except in Hong Kong?" Shen said. Professor Chen Fong-ching,

an honorary senior research fellow of Chinese University's Institute of Chinese

Studies, who backed the publishing project, said the series could break even

although the number of target readers was rather small. Wang Shaoguang ,

director of the Universities Service Centre for China Studies at the university,

said the mainland had imposed restrictions since the 1980s on books relating to

the Cultural Revolution. "That's why many books about the Cultural Revolution

were published in Hong Kong," he said. Shen's book Mao Zedong, Joseph Stalin and

the Korean War was eventually published on the mainland in 2003.

Liberals to back Tien despite rift -

The Liberal Party will continue to support Michael Tien Puk-sun despite his

break with the organisation almost two weeks ago, party elders said yesterday.

China*:

Two Chinese fishery patrol boats were spotted yesterday off islands at the

centre of a bitter dispute between Beijing and Tokyo, Japan's coast guard said.

The two vessels began cruising in waters close to the island chain - known as

the Senkaku Islands in Japan and the Diaoyu Islands in China - at about 7:40am,

a coastguard spokeswoman said. "They are still navigating off the Senkaku

Islands, and our patrol ships and airplanes are warning them by radio not to

enter Japanese territorial waters," she said. It was the second time in eight

days that Chinese patrol vessels sailed around the disputed waters. The previous

Sunday, two Chinese fishery patrol vessels - including a new one that Beijing

says is its fastest and most sophisticated to date and is equipped with a

helicopter - were spotted near the disputed islets. That day, the spokeswoman

said, Japanese patrol ships repeatedly warned the two vessels not to enter

Japan's territorial waters, but the ships, which were identified as Yuzheng 310

and Yuzheng 201, repeated responses such as "we are conducting a justifiable

mission". "The two vessels came as close as 23 kilometres to the islands," the

spokeswoman said. She said the ships had not entered what Japan considers its

waters. It was not immediately clear how close they were this time. Both Tokyo

and Beijing claim the potentially resource-rich islands, along with their

surrounding waters. However, Japan has traditionally had more of a presence in

the area and administers the islands. A tense territorial row broke out in

September after Japan arrested a Chinese trawler captain following a collision

in the area between his boat and Japanese coastguard ships. He was eventually

freed, but the dispute brought ties between the two neighbours to their lowest

point in years. The arrest sparked serious protests from China, which cut or

dramatically reduced political, cultural and economic exchanges with Japan. The

two countries have since worked to get their relationship back on an even keel.

After the incident, Beijing sent fishery patrol boats to the disputed waters

several times, the last time on November 20, before withdrawing them the

following day.

China*:

Two Chinese fishery patrol boats were spotted yesterday off islands at the

centre of a bitter dispute between Beijing and Tokyo, Japan's coast guard said.

The two vessels began cruising in waters close to the island chain - known as

the Senkaku Islands in Japan and the Diaoyu Islands in China - at about 7:40am,

a coastguard spokeswoman said. "They are still navigating off the Senkaku

Islands, and our patrol ships and airplanes are warning them by radio not to

enter Japanese territorial waters," she said. It was the second time in eight

days that Chinese patrol vessels sailed around the disputed waters. The previous

Sunday, two Chinese fishery patrol vessels - including a new one that Beijing

says is its fastest and most sophisticated to date and is equipped with a

helicopter - were spotted near the disputed islets. That day, the spokeswoman

said, Japanese patrol ships repeatedly warned the two vessels not to enter

Japan's territorial waters, but the ships, which were identified as Yuzheng 310

and Yuzheng 201, repeated responses such as "we are conducting a justifiable

mission". "The two vessels came as close as 23 kilometres to the islands," the

spokeswoman said. She said the ships had not entered what Japan considers its

waters. It was not immediately clear how close they were this time. Both Tokyo

and Beijing claim the potentially resource-rich islands, along with their

surrounding waters. However, Japan has traditionally had more of a presence in

the area and administers the islands. A tense territorial row broke out in

September after Japan arrested a Chinese trawler captain following a collision

in the area between his boat and Japanese coastguard ships. He was eventually

freed, but the dispute brought ties between the two neighbours to their lowest

point in years. The arrest sparked serious protests from China, which cut or

dramatically reduced political, cultural and economic exchanges with Japan. The

two countries have since worked to get their relationship back on an even keel.

After the incident, Beijing sent fishery patrol boats to the disputed waters

several times, the last time on November 20, before withdrawing them the

following day.

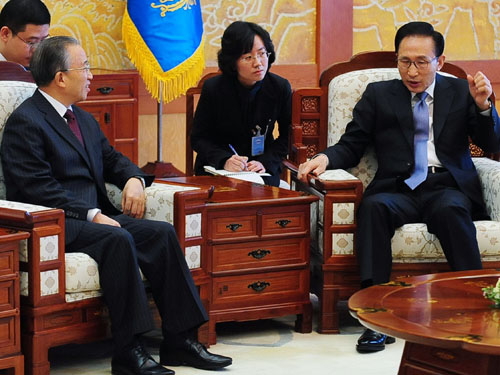

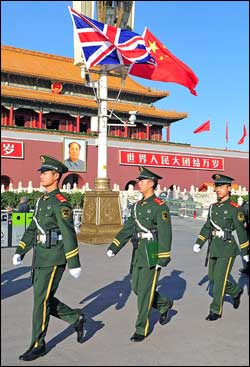

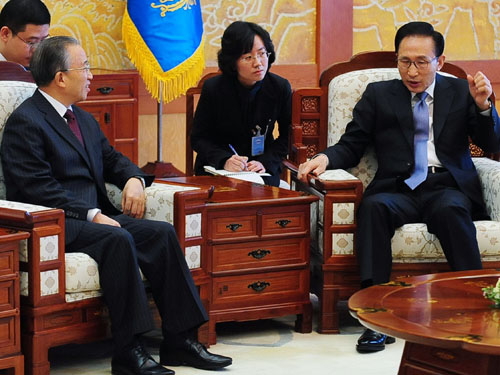

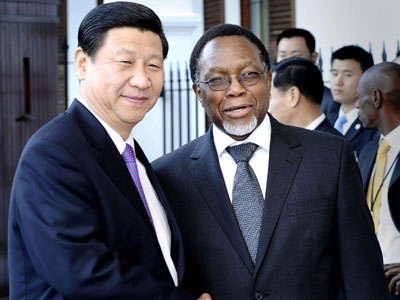

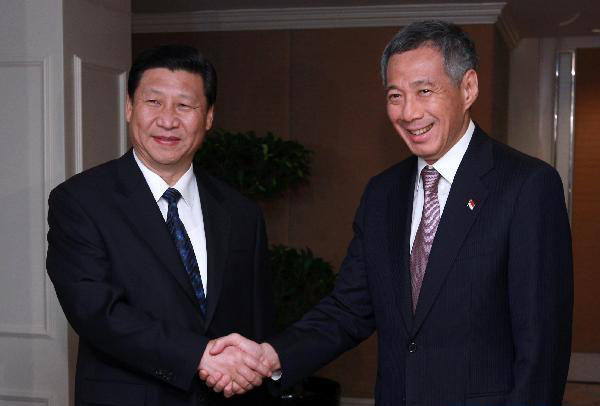

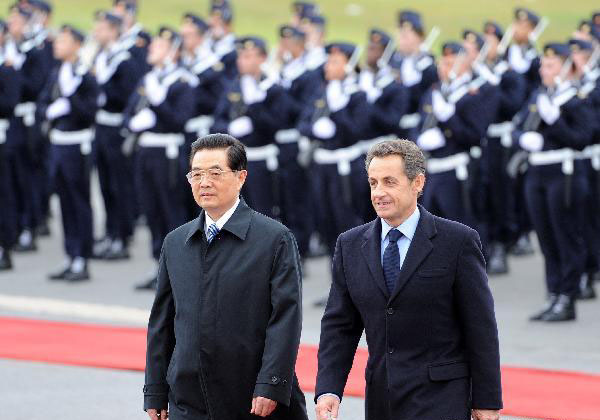

Beijing

makes offer to host emergency talks - State Councillor Dai Bingguo (left) with

South Korean President Lee Myung-bak during talks in Seoul yesterday. China

seeks six-nation meeting on Korean crisis - China offered to host emergency

talks between the six nations involved in the stalled nuclear disarmament

negotiations over North Korea - Beijing's first concrete move in the crisis

sparked by the North's fatal bombardment of a frontline island held by the South

last week. The proposal was announced by Wu Dawei , China's top North Korea

envoy, in a hastily-arranged briefing yesterday afternoon. It came a few hours

after the nuclear-powered USS George Washington sailed into the Yellow Sea to

take part in a US-South Korean naval drill opposed by Beijing. "The Chinese

side, after careful study, proposes to have emergency consultations among the

heads of delegations to the six-party talks in early December in Beijing to

exchange views on major issues of concern to the parties," Wu said. He

emphasized that the consultations did not amount to a formal restart of the

stalled six-party negotiations, which aim to end North Korea's nuclear programs,

but "we do hope they will create conditions for their relaunch". The proposal

met with a cautious reaction from countries involved in the talks - the two

Koreas, Japan, the US, China and Russia. South Korea's Foreign Ministry said

Seoul would "very carefully" consider China's suggestion of talks. Japan was

likewise. "We want to respond cautiously, while co-operating closely with South

Korea and the United States," Kyodo quoted Deputy Chief Cabinet Secretary

Tetsuro Fukuyama as saying. Beijing

makes offer to host emergency talks - State Councillor Dai Bingguo (left) with

South Korean President Lee Myung-bak during talks in Seoul yesterday. China

seeks six-nation meeting on Korean crisis - China offered to host emergency

talks between the six nations involved in the stalled nuclear disarmament

negotiations over North Korea - Beijing's first concrete move in the crisis

sparked by the North's fatal bombardment of a frontline island held by the South

last week. The proposal was announced by Wu Dawei , China's top North Korea

envoy, in a hastily-arranged briefing yesterday afternoon. It came a few hours

after the nuclear-powered USS George Washington sailed into the Yellow Sea to

take part in a US-South Korean naval drill opposed by Beijing. "The Chinese

side, after careful study, proposes to have emergency consultations among the

heads of delegations to the six-party talks in early December in Beijing to

exchange views on major issues of concern to the parties," Wu said. He

emphasized that the consultations did not amount to a formal restart of the

stalled six-party negotiations, which aim to end North Korea's nuclear programs,

but "we do hope they will create conditions for their relaunch". The proposal

met with a cautious reaction from countries involved in the talks - the two

Koreas, Japan, the US, China and Russia. South Korea's Foreign Ministry said

Seoul would "very carefully" consider China's suggestion of talks. Japan was

likewise. "We want to respond cautiously, while co-operating closely with South

Korea and the United States," Kyodo quoted Deputy Chief Cabinet Secretary

Tetsuro Fukuyama as saying.

An official

signboard reading "Environment-friendly architecture, environment-friendly

future" at a subway station in the capital. It appears Beijing may have softened

its stance on the issue of verification of developing countries' emissions

reductions. Climate talks a stepping stone to new deal - Delegates meet for UN's

Cancun conference without much hope of progress on big issues. As delegates from

nearly 200 countries gather today in Cancun, Mexico, for the year's biggest UN

conference tackling global warming, international climate negotiations appear to

be at one of the lowest points in their 20-year history. The discord and

widespread pessimism that have shrouded the climate talks over the past year

continue to hover over the Caribbean beach resort, with a new, legally binding

pact on carbon emission cuts - something negotiators have been working towards

for the past five years - remaining far out of sight. An official

signboard reading "Environment-friendly architecture, environment-friendly

future" at a subway station in the capital. It appears Beijing may have softened

its stance on the issue of verification of developing countries' emissions

reductions. Climate talks a stepping stone to new deal - Delegates meet for UN's

Cancun conference without much hope of progress on big issues. As delegates from

nearly 200 countries gather today in Cancun, Mexico, for the year's biggest UN

conference tackling global warming, international climate negotiations appear to

be at one of the lowest points in their 20-year history. The discord and

widespread pessimism that have shrouded the climate talks over the past year

continue to hover over the Caribbean beach resort, with a new, legally binding

pact on carbon emission cuts - something negotiators have been working towards

for the past five years - remaining far out of sight.

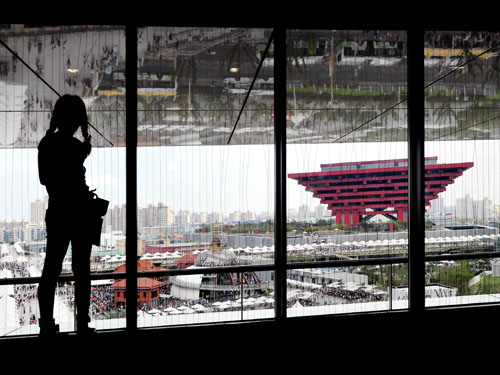

CR Cement embarks on

expansion course - Lending curbs not stopping mainland company from doubling

production capacity - The river cargo terminal which is used by China Resources

Cement to transport its product. Calls to curb the massive loan growth on the

mainland are not stopping China Resources (SEHK: 0291) Cement Holdings from

building what will become possibly the world's biggest cement plant and doubling

production capacity. "By 2012, we will have the world's biggest cement plant in

Fengkai," said the company's strategic development director, Max Yu Zhongliang.

The state-owned firm's plant in Fengkai, Guangdong, started operation last year.

Its annual production capacity is four million tonnes, which would double to

eight million tonnes in January, Yu said. By 2012, the plant would have an

annual production capacity of 12 million tonnes of cement, 9.3 million tonnes of

clinker and 4 million tonnes of concrete, he said. Currently, the largest cement

plants in the world have annual production capacity of 10 million tonnes, and

there are four plants, all on the mainland. Three are owned by Anhui Conch

Cement (SEHK: 0914). The fourth, in Pingnan, Guangxi, is owned by China

Resources. The total investment in the Fengkai plant is 5.5 billion yuan (HK$6.4

billion), with 1.4 billion yuan yet to be invested, Yu said. "We have no problem

obtaining bank financing," he said. People's Bank of China adviser Xia Bin has

called for a slowing of the nation's loan growth to reduce the excessive

liquidity fuelling inflation. New loans totalled 9.5 trillion yuan last year,

which would fall to 7.5 trillion yuan this year and 6.5 trillion yuan next year,

Yu said. "There will still be loan growth, but slower growth." From June to

2012, China Resources would almost double its annual production capacity from

36.7 million tonnes of cement to 70 million tonnes, 20.2 million tons of

concrete to 42 million tonnes and 25.2 million tonnes of clinker to 55 million

tonnes, Yu said. "In future, mergers and acquisitions are definitely the way to

expand our production capacity. In three to five years, revenue from acquired

plants will equal revenue from plants built by us," he said. He said it would be

impossible to build new plants following the government move to curb

overcapacity in September last year, he said. The cost of acquiring one tonne of

annual cement production capacity was 400 to 450 yuan, he said. This year, China

would have 200 million tonnes of new cement production capacity while 110

million tonnes of obsolete capacity would be eliminated, giving a net addition

of 900 million tonnes, Yu said. Next year, there would be 150 million tonnes of

new capacity while 150 million tonnes of obsolete capacity would be removed.

More than half of China Resources' output is for the booming domestic

infrastructure sector. "The pace of infrastructure construction in China will

triple in the coming decade," Yu said. In the railways sector, 1,800 kilometres

of tracks were built in the past five years. This will rise to 4,000 kilometres

of high-speed and 4,000 kilometres of ordinary tracks each year in the next five

years, Yu said. One kilometre of high-speed railway would need 20,000 tonnes of

cement, said Hu Song, a business director of China Resources (Holdings), the

state-owned parent of China Resources Cement. The Fengkai plant boasts another

world record - the world's longest conveyor belt at 39.8 kilometres. It carries

gravel from a quarry to the plant. The two billion yuan belt would be lengthened

to 48 kilometres in the first quarter of next year, Yu said. He said it cost 25

yuan per tonne for trucks to transport gravel, but the conveyor belt would cost

only eight yuan per tonne, which would drop to five yuan when it was lengthened.

The Fengkai plant is next to the Xijiang or Western River. China Resources

invested 1.2 billion yuan in a cargo terminal to transport cement from the plant

by river. It was seven times cheaper to transport cement by river compared to

trucks, Hu said. Next year, the river terminal would start shipping fine stones,

or aggregate as it is known in the industry, to Hong Kong as a raw material for

construction projects, Yu said. CR Cement embarks on

expansion course - Lending curbs not stopping mainland company from doubling

production capacity - The river cargo terminal which is used by China Resources

Cement to transport its product. Calls to curb the massive loan growth on the

mainland are not stopping China Resources (SEHK: 0291) Cement Holdings from

building what will become possibly the world's biggest cement plant and doubling

production capacity. "By 2012, we will have the world's biggest cement plant in

Fengkai," said the company's strategic development director, Max Yu Zhongliang.

The state-owned firm's plant in Fengkai, Guangdong, started operation last year.

Its annual production capacity is four million tonnes, which would double to

eight million tonnes in January, Yu said. By 2012, the plant would have an

annual production capacity of 12 million tonnes of cement, 9.3 million tonnes of

clinker and 4 million tonnes of concrete, he said. Currently, the largest cement

plants in the world have annual production capacity of 10 million tonnes, and

there are four plants, all on the mainland. Three are owned by Anhui Conch

Cement (SEHK: 0914). The fourth, in Pingnan, Guangxi, is owned by China

Resources. The total investment in the Fengkai plant is 5.5 billion yuan (HK$6.4

billion), with 1.4 billion yuan yet to be invested, Yu said. "We have no problem

obtaining bank financing," he said. People's Bank of China adviser Xia Bin has

called for a slowing of the nation's loan growth to reduce the excessive

liquidity fuelling inflation. New loans totalled 9.5 trillion yuan last year,

which would fall to 7.5 trillion yuan this year and 6.5 trillion yuan next year,

Yu said. "There will still be loan growth, but slower growth." From June to

2012, China Resources would almost double its annual production capacity from

36.7 million tonnes of cement to 70 million tonnes, 20.2 million tons of

concrete to 42 million tonnes and 25.2 million tonnes of clinker to 55 million

tonnes, Yu said. "In future, mergers and acquisitions are definitely the way to

expand our production capacity. In three to five years, revenue from acquired

plants will equal revenue from plants built by us," he said. He said it would be

impossible to build new plants following the government move to curb

overcapacity in September last year, he said. The cost of acquiring one tonne of

annual cement production capacity was 400 to 450 yuan, he said. This year, China

would have 200 million tonnes of new cement production capacity while 110

million tonnes of obsolete capacity would be eliminated, giving a net addition

of 900 million tonnes, Yu said. Next year, there would be 150 million tonnes of

new capacity while 150 million tonnes of obsolete capacity would be removed.

More than half of China Resources' output is for the booming domestic

infrastructure sector. "The pace of infrastructure construction in China will

triple in the coming decade," Yu said. In the railways sector, 1,800 kilometres

of tracks were built in the past five years. This will rise to 4,000 kilometres

of high-speed and 4,000 kilometres of ordinary tracks each year in the next five

years, Yu said. One kilometre of high-speed railway would need 20,000 tonnes of

cement, said Hu Song, a business director of China Resources (Holdings), the

state-owned parent of China Resources Cement. The Fengkai plant boasts another

world record - the world's longest conveyor belt at 39.8 kilometres. It carries