|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Share Hong Kong, China & Hawaii Biz*

Skype - FREE

Voice Over IP Skype - FREE

Voice Over IP  View Hawaii's China Connection

Video Trailer

View Hawaii's China Connection

Video Trailer

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

After

attended a China/Hong Kong Business/Trade Seminar in Hawaii...still unsure what

to do next, contact us, our Officers, Directors and Founding Members are

actively engaged in China/Hong Kong/Asia trade - we can help!

Are you ready to export your product or

service? You will find out in 3 minutes with resources to help you -

enter

to give it a try

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

(approximate $ exchange rates: US$1 = HK$7.8, US$1 = RMB$6.8)

View China 60th

Anniversary Video and Photo online View China 60th

Anniversary Video and Photo online

Holidays Greeting from President Obama & Johnson Choi

Holidays Greeting from President Obama & Johnson Choi

http://www.youtube.com/watch?v=pNk4Z4lUV-k

http://www.youtube.com/watch?v=pNk4Z4lUV-k

http://www.facebook.com/video/video.php?v=219896871983&ref=mf

http://www.facebook.com/video/video.php?v=219896871983&ref=mf

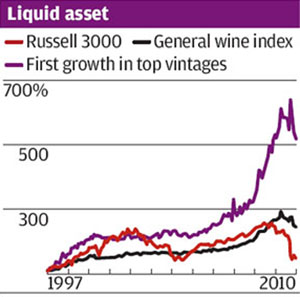

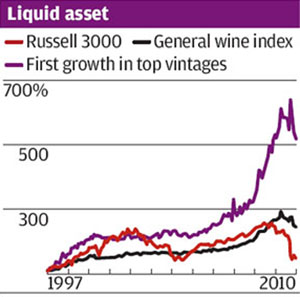

Wine-Biz

- Hong Kong

Wine-Biz

- Hong Kong

Brand Hong Kong

Video

Brand Hong Kong

Video

May 1, 2010

Hong Kong*:

Tsang Yok-sing is prepared to resign as Legco president and vote for the

government's constitutional reform proposal if its passage depends on his vote. Hong Kong*:

Tsang Yok-sing is prepared to resign as Legco president and vote for the

government's constitutional reform proposal if its passage depends on his vote.

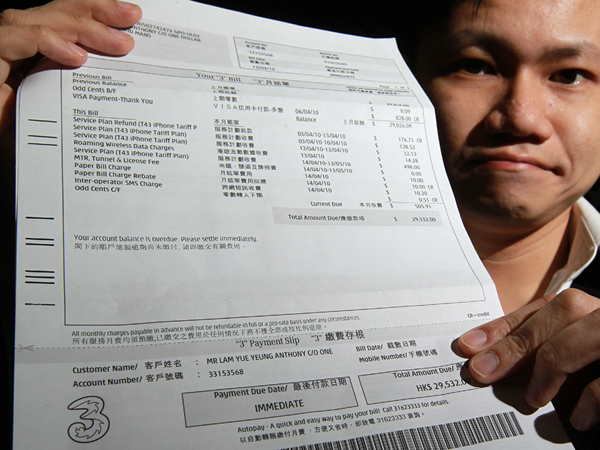

HSBC and Hang Seng Bank have pledged

to install keypad covers for all their ATMs by the end of next month after a

dozen customers lost money in a scam.

A Sheung Wan school that was barred

from running a Primary One class has teamed up with a special needs charity in a

HK$3.7 million fund-raising drive to run the class privately.

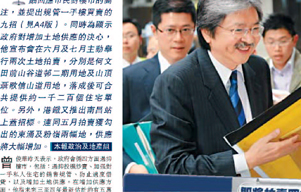

Former Hong Kong Monetary Authority chief

executive Joseph Yam Chi-kwong, once the world's highest paid central banker,

has a new job in academia. Yam has been appointed a distinguished research

fellow at The Chinese University of Hong Kong's newly formed Institute of Global

Economics and Finance. The part-time role means Yam will take part in research,

share his experience and insights with top bankers and brokers, conduct classes

for Chinese University students and deliver lectures. It is not known how much

he will be paid. Before retiring as HKMA chief executive at the start of

October, Yam was the world's highest paid central banker, receiving HK$11.9

million in 2008 compared to US Federal Reserve chairman Ben Bernanke's

US$191,300. Yam was Hong Kong's first central banker and occupied the post from

the authority's establishment in 1993. The People's Bank of China in December

recruited him to be an executive vice-president of an advisory body to the

central bank. It is not known whether the bank pays Yam for the work. The

Institute of Global Economics and Finance has been set up to contribute concepts

and policy ideas on opening up China's financial system. It will also launch

educational programs related to global finance and banking issues, such as the

internationalization of the yuan. Besides Yam, the institute has enlisted top

professionals and academics including Nobel Prize-winning economists James

Mirrlees and Robert Mundell. At a university event to announce his appointment

yesterday, Yam slipped easily back into central banker mode, offering his views

on the outlook for the yuan. "It will be impossible for the yuan to keep on

rising forever," he said. "Mainland officials have also said the yuan has not

been undervalued." Yam reiterated his view that the yuan could become the third

major international currency, after the US dollar and euro. He also believed

Beijing's tightening of credit and other measures to cool down the property

market would have a positive economic impact. Former Hong Kong Monetary Authority chief

executive Joseph Yam Chi-kwong, once the world's highest paid central banker,

has a new job in academia. Yam has been appointed a distinguished research

fellow at The Chinese University of Hong Kong's newly formed Institute of Global

Economics and Finance. The part-time role means Yam will take part in research,

share his experience and insights with top bankers and brokers, conduct classes

for Chinese University students and deliver lectures. It is not known how much

he will be paid. Before retiring as HKMA chief executive at the start of

October, Yam was the world's highest paid central banker, receiving HK$11.9

million in 2008 compared to US Federal Reserve chairman Ben Bernanke's

US$191,300. Yam was Hong Kong's first central banker and occupied the post from

the authority's establishment in 1993. The People's Bank of China in December

recruited him to be an executive vice-president of an advisory body to the

central bank. It is not known whether the bank pays Yam for the work. The

Institute of Global Economics and Finance has been set up to contribute concepts

and policy ideas on opening up China's financial system. It will also launch

educational programs related to global finance and banking issues, such as the

internationalization of the yuan. Besides Yam, the institute has enlisted top

professionals and academics including Nobel Prize-winning economists James

Mirrlees and Robert Mundell. At a university event to announce his appointment

yesterday, Yam slipped easily back into central banker mode, offering his views

on the outlook for the yuan. "It will be impossible for the yuan to keep on

rising forever," he said. "Mainland officials have also said the yuan has not

been undervalued." Yam reiterated his view that the yuan could become the third

major international currency, after the US dollar and euro. He also believed

Beijing's tightening of credit and other measures to cool down the property

market would have a positive economic impact.

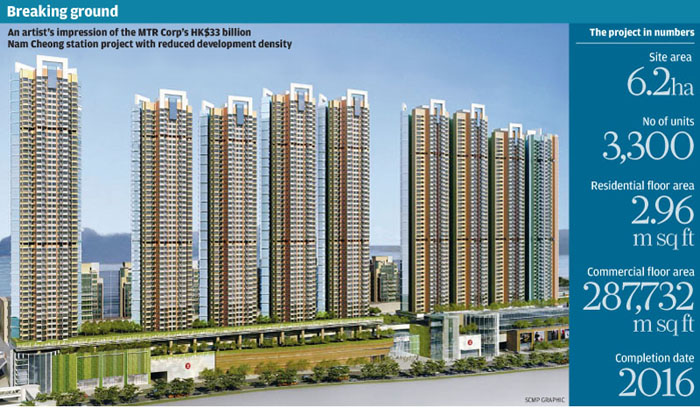

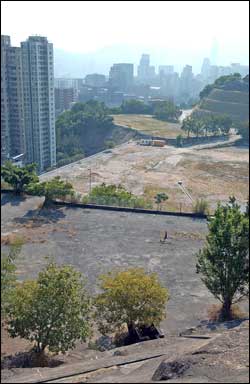

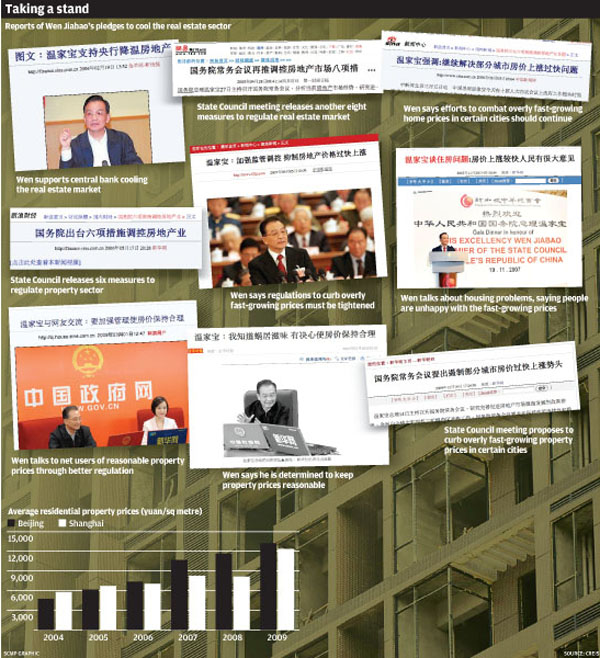

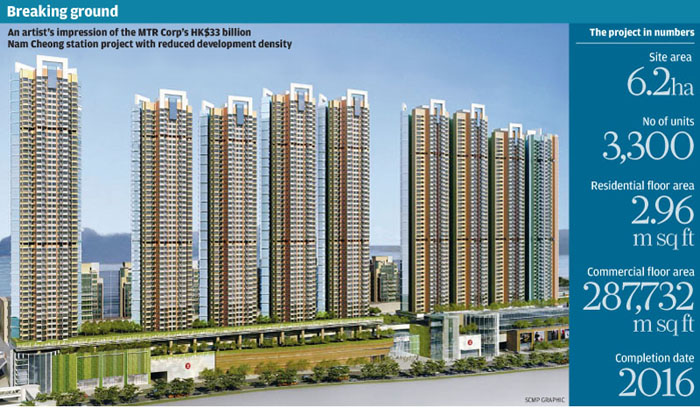

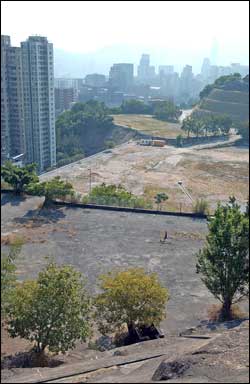

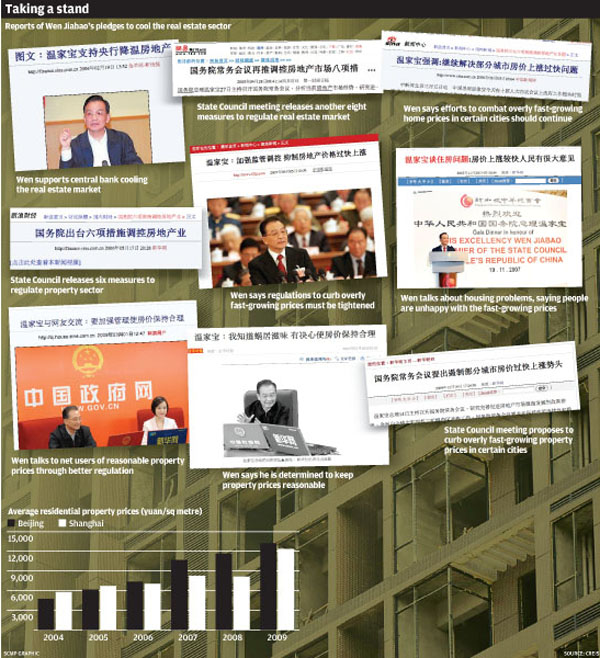

The MTR Corp's HK$33 billion Nam

Cheong Station project has attracted interest from 12 developers - four more

than when it was first launched five years ago. In 2005, when the KCRC was

managing the project in Sham Shui Po, eight developers expressed an interest

before the residential development was shelved due to concerns of green groups

that the 20 high-rise towers would cause a wall effect. The railway operator has

since modified the design and lowered the density of the development on top of

Nam Cheong Station, close to the Fu Cheong and Nam Cheong public housing

estates. The 6.2-hectare site will now house nine seven- to nine-storey low-rise

blocks and nine 42- to 46-storey high-rise residential towers, plus a

287,732-square-foot shopping centre. The project will provide 3,300 flats with a

total residential floor area of 2.96 million square feet and is due for

completion in 2016. All the major developers, such as Cheung Kong (Holdings) (SEHK:

0001), Sun Hung Kai Properties (SEHK: 0016), Sino Land, Kerry Properties (SEHK:

0683), Henderson Land (SEHK: 0012) and Nam Fung Development were among the 12 to

express interest yesterday. MTR is currently negotiating the land premium with

the government and will put the project up for tender in the near future, a

spokesman said. Even though there has been a better response this time it does

not mean the developers are more optimistic about the property market's outlook,

according to analysts. Alnwick Chan Chi-hing, executive director at Knight

Frank, said only a few of the developers could afford the large investment cost

and he expects only four of them to eventually join the tendering process. "But

it does present an opportunity for the developers to get the inside information

on land premiums if they submit expressions of interest. It can also show the

MTR that you are still a market player," Chan said. According to the transaction

data of Centaline Property Agency, prices at the seven-year-old Metro Harbor

View in the area range between HK$4,964 and HK$5,137 per square foot. A further

indication on the state of the property market will be available over the next

three months when the Lands Department sells four development sites in Fanling,

Tung Chung, Ho Man Tin and The Peak. The two residential sites at Mount

Nicholson Road on The Peak and Fat Kwong Street in Ho Man Tin are expected to be

major targets as they offer an opportunity for luxury residential projects. Chan

said Nam Cheong Station was still competitive, being a mass residential project

on top of an MTR station, although he did not believe the developers would be

submitting aggressive offers for it or any of the other sites due to the

uncertain market outlook. "The latest housing policies show the government is

paying special attention to the property market. The government may release new

measures to curb the growth in property prices." he said. The MTR Corp's HK$33 billion Nam

Cheong Station project has attracted interest from 12 developers - four more

than when it was first launched five years ago. In 2005, when the KCRC was

managing the project in Sham Shui Po, eight developers expressed an interest

before the residential development was shelved due to concerns of green groups

that the 20 high-rise towers would cause a wall effect. The railway operator has

since modified the design and lowered the density of the development on top of

Nam Cheong Station, close to the Fu Cheong and Nam Cheong public housing

estates. The 6.2-hectare site will now house nine seven- to nine-storey low-rise

blocks and nine 42- to 46-storey high-rise residential towers, plus a

287,732-square-foot shopping centre. The project will provide 3,300 flats with a

total residential floor area of 2.96 million square feet and is due for

completion in 2016. All the major developers, such as Cheung Kong (Holdings) (SEHK:

0001), Sun Hung Kai Properties (SEHK: 0016), Sino Land, Kerry Properties (SEHK:

0683), Henderson Land (SEHK: 0012) and Nam Fung Development were among the 12 to

express interest yesterday. MTR is currently negotiating the land premium with

the government and will put the project up for tender in the near future, a

spokesman said. Even though there has been a better response this time it does

not mean the developers are more optimistic about the property market's outlook,

according to analysts. Alnwick Chan Chi-hing, executive director at Knight

Frank, said only a few of the developers could afford the large investment cost

and he expects only four of them to eventually join the tendering process. "But

it does present an opportunity for the developers to get the inside information

on land premiums if they submit expressions of interest. It can also show the

MTR that you are still a market player," Chan said. According to the transaction

data of Centaline Property Agency, prices at the seven-year-old Metro Harbor

View in the area range between HK$4,964 and HK$5,137 per square foot. A further

indication on the state of the property market will be available over the next

three months when the Lands Department sells four development sites in Fanling,

Tung Chung, Ho Man Tin and The Peak. The two residential sites at Mount

Nicholson Road on The Peak and Fat Kwong Street in Ho Man Tin are expected to be

major targets as they offer an opportunity for luxury residential projects. Chan

said Nam Cheong Station was still competitive, being a mass residential project

on top of an MTR station, although he did not believe the developers would be

submitting aggressive offers for it or any of the other sites due to the

uncertain market outlook. "The latest housing policies show the government is

paying special attention to the property market. The government may release new

measures to curb the growth in property prices." he said.

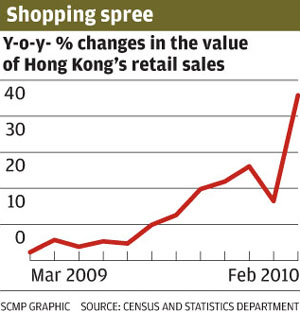

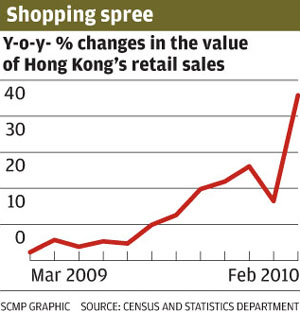

Customs has stepped up its blitz on

counterfeit goods ahead of the May Day Golden Week. Over the past fortnight,

officers have seized 4,500 pirated items worth about HK$1 million and unearthed

five "storage warehouses" in Yau Tsim Mong. Nine men and seven women aged 24 to

49 have been arrested. Most are shop owners. The fake goods include mobile

phones, cosmetics, luxury watches, brand-name bags and - ahead of the FIFA World

Cup in South Africa - football strips. Intellectual Property Investigation

Bureau divisional commander Koon Hon-chuen said it will strengthen surveillance

in tourist shopping areas. There were 167 cases in the first quarter this year,

the same as in 2009. A total of 1,014 cases were recorded for the whole year.

Meanwhile, traffic at Kowloon West's Olympic City during the May Day Golden Week

is expected to increase 15 percent to 157,000 people and bring in HK$7.26

million in sales. Sino Group is predicting overall growth of 13 percent for

Olympic City, Golden Coast Piazza and Island Resort Mall. with 262,000 visitors.

To attract more high-spending mainlanders, Olympic City is offering a one-night

stay and buffet breakfast for two. It is also hosting a South African Festival

from today until May 9. The 10-day Golden Week lasts from May Day until Mother's

Day on May 8. Spokespersons for major shopping malls including Times Square and

Elements said mainlanders are becoming a force to be reckoned with. Times Square

has increased its cross-border bus service to 30 a day to pick up tourists from

Shenzhen, Foshan and Guangzhou. Elements expects mainland shoppers to contribute

40 percent to its overall turnover. The Hong Kong Tourism Board reported tourist

spending rose 3.2 percent to surpass HK$160 billion last year. Chairman James

Tien Pei- chun said average spending of transit visitors also went up 20

percent. Customs has stepped up its blitz on

counterfeit goods ahead of the May Day Golden Week. Over the past fortnight,

officers have seized 4,500 pirated items worth about HK$1 million and unearthed

five "storage warehouses" in Yau Tsim Mong. Nine men and seven women aged 24 to

49 have been arrested. Most are shop owners. The fake goods include mobile

phones, cosmetics, luxury watches, brand-name bags and - ahead of the FIFA World

Cup in South Africa - football strips. Intellectual Property Investigation

Bureau divisional commander Koon Hon-chuen said it will strengthen surveillance

in tourist shopping areas. There were 167 cases in the first quarter this year,

the same as in 2009. A total of 1,014 cases were recorded for the whole year.

Meanwhile, traffic at Kowloon West's Olympic City during the May Day Golden Week

is expected to increase 15 percent to 157,000 people and bring in HK$7.26

million in sales. Sino Group is predicting overall growth of 13 percent for

Olympic City, Golden Coast Piazza and Island Resort Mall. with 262,000 visitors.

To attract more high-spending mainlanders, Olympic City is offering a one-night

stay and buffet breakfast for two. It is also hosting a South African Festival

from today until May 9. The 10-day Golden Week lasts from May Day until Mother's

Day on May 8. Spokespersons for major shopping malls including Times Square and

Elements said mainlanders are becoming a force to be reckoned with. Times Square

has increased its cross-border bus service to 30 a day to pick up tourists from

Shenzhen, Foshan and Guangzhou. Elements expects mainland shoppers to contribute

40 percent to its overall turnover. The Hong Kong Tourism Board reported tourist

spending rose 3.2 percent to surpass HK$160 billion last year. Chairman James

Tien Pei- chun said average spending of transit visitors also went up 20

percent.

China*:

Insurers rush to launch yuan-denominated policies - Expectations of an

appreciating yuan has spread to the insurance sector as policyholders seek out

yuan-denominated policies.

China*:

Insurers rush to launch yuan-denominated policies - Expectations of an

appreciating yuan has spread to the insurance sector as policyholders seek out

yuan-denominated policies.

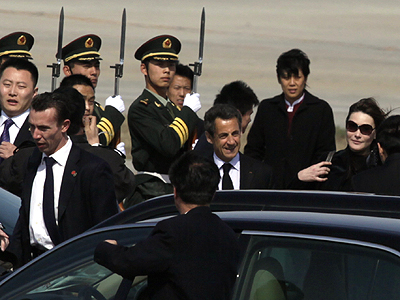

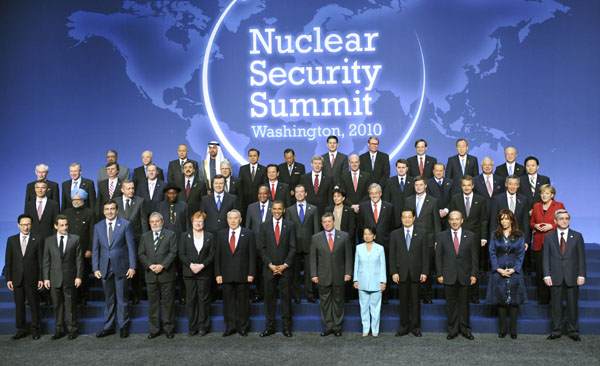

French President

Nicolas Sarkozy and his wife, Carla Bruni-Sarkozy, arrive at the Great Hall of

the People. Wen pledges that China will play a bigger part in global issues -

China yesterday pledged to take a greater role in global issues as it vowed to

work with the European Union on nuclear non-proliferation, energy security and

climate change. In wide-ranging talks between Premier Wen Jiabao and European

Commission President Jose Manuel Barroso, the two sides also agreed to fight

protectionism and tear down trade barriers. "China will undertake greater

international responsibilities," Wen said in a joint media appearance with

Barroso after their talks. "This is not only to meet international expectations

but also serves China's interests." The two sides also agreed to set up a

climate change hotline between top environmental officials of the EU and China

to help both sides co-ordinate their positions in global greenhouse gas

negotiations, Barroso said. On the Iranian nuclear issue - a key concern of the

EU and United States - Wen did not say whether Beijing would support new

sanctions against Tehran. He said only that China was committed to the global

nuclear non-proliferation regime and upholding peace in the Middle East. Wen

said: "China will remain in touch with the relevant parties and will play a

positive and constructive role for the early and proper settlement of the

Iranian nuclear issue." Western nations are calling for a fresh round of UN

sanctions but Beijing - a veto-wielding permanent member of the UN Security

Council - has so far resisted such a move. "China and the European Union have

far more consensus than differences," Wen said. "We both stand for world

multi-polarity and diversity and we both believe that major decisions in world

affairs should be taken in an open, democratic and transparent manner." Barroso

and his delegation will leave Beijing today to attend the opening of the World

Expo in Shanghai. French President Nicolas Sarkozy and his wife, Carla

Bruni-Sarkozy - who will also attend the expo - yesterday walked the Great Wall

and wandered the imperial Ming Tombs on a sightseeing stop during their visit to

China. Sarkozy's trip is being billed as a return to healthy diplomatic

relations between the countries after spats over Tibet. The French leader is

also pressing Beijing to support further sanctions on Iran over its nuclear

program. Hours before Sarkozy's planned meeting with NPC chairman Wu Bangguo ,

the French first couple visited the tombs and a section of the Great Wall

usually closed to the public, French officials said. The tombs, on Beijing's

outskirts, were chosen by 13 of the 16 Ming dynasty emperors, who ruled between

1368 and 1644, as their last resting place. Sarkozy will travel to Shanghai

today, where he will attend the opening ceremony for the expo and visit France's

stand at the fair. On Wednesday, the couple went to Xian to visit the terracotta

warriors. French President

Nicolas Sarkozy and his wife, Carla Bruni-Sarkozy, arrive at the Great Hall of

the People. Wen pledges that China will play a bigger part in global issues -

China yesterday pledged to take a greater role in global issues as it vowed to

work with the European Union on nuclear non-proliferation, energy security and

climate change. In wide-ranging talks between Premier Wen Jiabao and European

Commission President Jose Manuel Barroso, the two sides also agreed to fight

protectionism and tear down trade barriers. "China will undertake greater

international responsibilities," Wen said in a joint media appearance with

Barroso after their talks. "This is not only to meet international expectations

but also serves China's interests." The two sides also agreed to set up a

climate change hotline between top environmental officials of the EU and China

to help both sides co-ordinate their positions in global greenhouse gas

negotiations, Barroso said. On the Iranian nuclear issue - a key concern of the

EU and United States - Wen did not say whether Beijing would support new

sanctions against Tehran. He said only that China was committed to the global

nuclear non-proliferation regime and upholding peace in the Middle East. Wen

said: "China will remain in touch with the relevant parties and will play a

positive and constructive role for the early and proper settlement of the

Iranian nuclear issue." Western nations are calling for a fresh round of UN

sanctions but Beijing - a veto-wielding permanent member of the UN Security

Council - has so far resisted such a move. "China and the European Union have

far more consensus than differences," Wen said. "We both stand for world

multi-polarity and diversity and we both believe that major decisions in world

affairs should be taken in an open, democratic and transparent manner." Barroso

and his delegation will leave Beijing today to attend the opening of the World

Expo in Shanghai. French President Nicolas Sarkozy and his wife, Carla

Bruni-Sarkozy - who will also attend the expo - yesterday walked the Great Wall

and wandered the imperial Ming Tombs on a sightseeing stop during their visit to

China. Sarkozy's trip is being billed as a return to healthy diplomatic

relations between the countries after spats over Tibet. The French leader is

also pressing Beijing to support further sanctions on Iran over its nuclear

program. Hours before Sarkozy's planned meeting with NPC chairman Wu Bangguo ,

the French first couple visited the tombs and a section of the Great Wall

usually closed to the public, French officials said. The tombs, on Beijing's

outskirts, were chosen by 13 of the 16 Ming dynasty emperors, who ruled between

1368 and 1644, as their last resting place. Sarkozy will travel to Shanghai

today, where he will attend the opening ceremony for the expo and visit France's

stand at the fair. On Wednesday, the couple went to Xian to visit the terracotta

warriors.

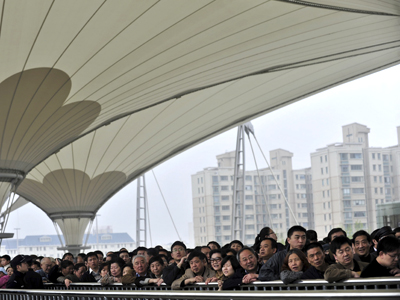

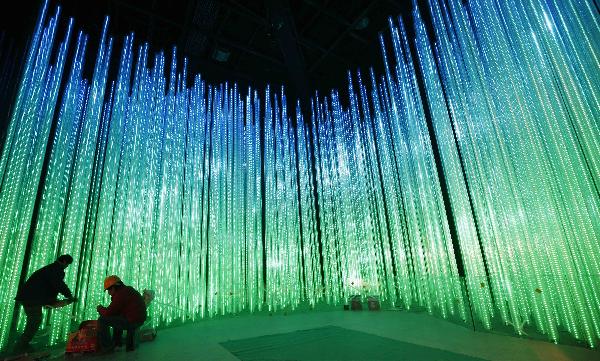

More

than seven years ago, after Shanghai won the right to host the 2010 World Expo,

thousands of people whooped it up on the city's streets. People from all walks

of life believed the big show would help Shanghai catch up with Beijing, which

was splashing out roughly US$40 billion on the 2008 Olympics. The municipal

government mobilised enormous resources to ensure that expo-related projects

were completed on time, allowing the city to show its best face to the world.

Real estate firm Jones Lang LaSalle says Shanghai has spent US$95 billion on

expo-related infrastructure, with analysts describing the scale and pace of

development over the past two years as something never seen before - anywhere.

Now the Shanghai government and people are hoping it all pays off. Xinhua has

reported that the international fair could create as many as 250,000 jobs in the

city and increase Shanghai's gross domestic product growth by 5 percentage

points. If the expo attracts the 70 million visitors that have been forecast,

income from ticket sales and food and beverage sales could top 10 billion yuan

(HK$11.4 billion). The hospitality sector will be one of the top beneficiaries

of the six-month event, which looks like being a windfall for the city's 310

star-rated hotels and 6,000 or so inns, which have 334,000 rooms and 557,000

beds. Cheng Meihong , a deputy director of the Shanghai Tourism Administration,

told a press conference this month that hotel prices were expected to rise

slightly during the expo, as thousands of travellers from other parts of the

country and abroad flocked to Shanghai. But economists say that while the expo

may boost the retail and hospitality sectors in the short term, it will be

difficult for Shanghai to sustain rapid growth after the event. "After all, the

economy doesn't necessarily hinge on the event," Morgan Stanley analyst Allen

Gui said. "Taking a long view, the outlook is still unclear because it's too

early to assess whether the massive infrastructure investments are redundant or

properly needed." When the expo opens tomorrow, Shanghai's Metro system will

have 420 kilometres of track in operation - nearly double last year's total.

That breakneck pace of subway expansion has seen "decentralised" office blocks

sprout up outside the central business district. At the end of last year,

Shanghai had 415,000 square metres of decentralised Grade A office space, Jones

Lang LaSalle said. It predicted the figure would jump to 1.8 million square

metres by the end of 2013. More corporate tenants are leaving the city centre to

take advantage of cheaper rents in the suburbs. Shanghai, one of the mainland's

two main economic locomotives, failed to dodge the bullet when the global

financial crisis struck two years ago. Shrinking external demand knocked the

steam out of Shanghai's economic growth and robust retail sales, which grew 13.6

per cent last year, were not enough to offset the export slowdown. The city's

GDP grew 8.2 per last year, 1.7 percentage points less than in 2008, and the

second consecutive year of single-digit growth. Shanghai had posted double-digit

growth in the previous 16 years - from 1992 to 2007 - as exports from the

Yangtze River Delta boomed and foreign capital flooded in. To add to the blushes

of the city's leaders, including Mayor Han Zheng , Shanghai's GDP growth last

year was also among the lowest recorded by any of the provincial-level regions.

"Shanghai would have to draw a lesson from the slowdown in the past two years,"

Zhang Youwen , the chief world economy researcher at the Shanghai Academy of

Social Sciences, said. "It will be difficult to gauge how much the expo can help

the local economy in the long term." The city took a hammering from the global

financial crisis, lagging behind mainland rivals whose economies kept growing

rapidly, fuelled by Beijing's 4 trillion yuan stimulus package. Shanghai has

been striving to shift its economic focus from manufacturing to services,

seeking to become a big-name metropolis on a par with New York, London and

Paris. Beijing drew up an ambitious blueprint for the city last year,

encouraging Shanghai to transform itself into a global financial and shipping

centre. However, in the absence of substantive liberalization policies,

economists have seen the plan as nothing more than an empty promise. Without

full convertibility of the yuan, they said, Shanghai's dream of becoming an

international financial hub centre would remain illusory. An official with the

Pudong Financial Services Office said district government and city government

officials were preparing to host several events during the expo where they would

lobby for accelerated market deregulation and seek to attract more overseas

investors. Some other governments around the country have also sniffed out

opportunities during the expo, hoping to promote investment and trade when

influential government officials and businesspeople visit the big show. "We

can't afford to miss the big party because it provides a good chance to get to

know the big shots," said Guo Yi , a deputy director of the economic research

department in Jining , Shandong . "It will be a platform to promote Jining's

trade and draw investment to the city." More

than seven years ago, after Shanghai won the right to host the 2010 World Expo,

thousands of people whooped it up on the city's streets. People from all walks

of life believed the big show would help Shanghai catch up with Beijing, which

was splashing out roughly US$40 billion on the 2008 Olympics. The municipal

government mobilised enormous resources to ensure that expo-related projects

were completed on time, allowing the city to show its best face to the world.

Real estate firm Jones Lang LaSalle says Shanghai has spent US$95 billion on

expo-related infrastructure, with analysts describing the scale and pace of

development over the past two years as something never seen before - anywhere.

Now the Shanghai government and people are hoping it all pays off. Xinhua has

reported that the international fair could create as many as 250,000 jobs in the

city and increase Shanghai's gross domestic product growth by 5 percentage

points. If the expo attracts the 70 million visitors that have been forecast,

income from ticket sales and food and beverage sales could top 10 billion yuan

(HK$11.4 billion). The hospitality sector will be one of the top beneficiaries

of the six-month event, which looks like being a windfall for the city's 310

star-rated hotels and 6,000 or so inns, which have 334,000 rooms and 557,000

beds. Cheng Meihong , a deputy director of the Shanghai Tourism Administration,

told a press conference this month that hotel prices were expected to rise

slightly during the expo, as thousands of travellers from other parts of the

country and abroad flocked to Shanghai. But economists say that while the expo

may boost the retail and hospitality sectors in the short term, it will be

difficult for Shanghai to sustain rapid growth after the event. "After all, the

economy doesn't necessarily hinge on the event," Morgan Stanley analyst Allen

Gui said. "Taking a long view, the outlook is still unclear because it's too

early to assess whether the massive infrastructure investments are redundant or

properly needed." When the expo opens tomorrow, Shanghai's Metro system will

have 420 kilometres of track in operation - nearly double last year's total.

That breakneck pace of subway expansion has seen "decentralised" office blocks

sprout up outside the central business district. At the end of last year,

Shanghai had 415,000 square metres of decentralised Grade A office space, Jones

Lang LaSalle said. It predicted the figure would jump to 1.8 million square

metres by the end of 2013. More corporate tenants are leaving the city centre to

take advantage of cheaper rents in the suburbs. Shanghai, one of the mainland's

two main economic locomotives, failed to dodge the bullet when the global

financial crisis struck two years ago. Shrinking external demand knocked the

steam out of Shanghai's economic growth and robust retail sales, which grew 13.6

per cent last year, were not enough to offset the export slowdown. The city's

GDP grew 8.2 per last year, 1.7 percentage points less than in 2008, and the

second consecutive year of single-digit growth. Shanghai had posted double-digit

growth in the previous 16 years - from 1992 to 2007 - as exports from the

Yangtze River Delta boomed and foreign capital flooded in. To add to the blushes

of the city's leaders, including Mayor Han Zheng , Shanghai's GDP growth last

year was also among the lowest recorded by any of the provincial-level regions.

"Shanghai would have to draw a lesson from the slowdown in the past two years,"

Zhang Youwen , the chief world economy researcher at the Shanghai Academy of

Social Sciences, said. "It will be difficult to gauge how much the expo can help

the local economy in the long term." The city took a hammering from the global

financial crisis, lagging behind mainland rivals whose economies kept growing

rapidly, fuelled by Beijing's 4 trillion yuan stimulus package. Shanghai has

been striving to shift its economic focus from manufacturing to services,

seeking to become a big-name metropolis on a par with New York, London and

Paris. Beijing drew up an ambitious blueprint for the city last year,

encouraging Shanghai to transform itself into a global financial and shipping

centre. However, in the absence of substantive liberalization policies,

economists have seen the plan as nothing more than an empty promise. Without

full convertibility of the yuan, they said, Shanghai's dream of becoming an

international financial hub centre would remain illusory. An official with the

Pudong Financial Services Office said district government and city government

officials were preparing to host several events during the expo where they would

lobby for accelerated market deregulation and seek to attract more overseas

investors. Some other governments around the country have also sniffed out

opportunities during the expo, hoping to promote investment and trade when

influential government officials and businesspeople visit the big show. "We

can't afford to miss the big party because it provides a good chance to get to

know the big shots," said Guo Yi , a deputy director of the economic research

department in Jining , Shandong . "It will be a platform to promote Jining's

trade and draw investment to the city."

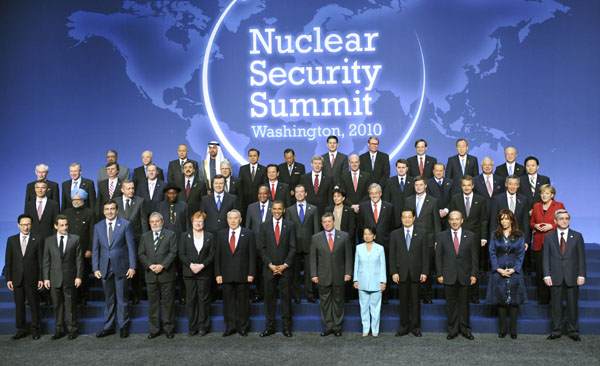

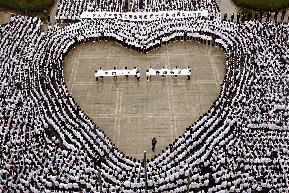

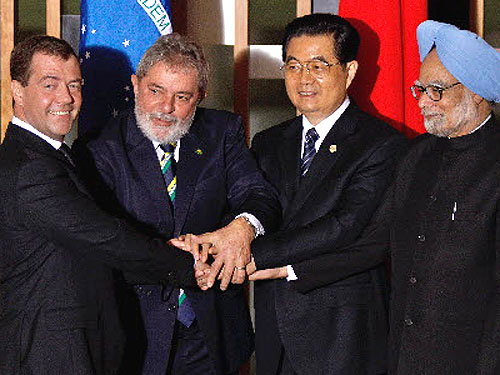

Leaders from 20 countries are due to

gather in Shanghai today as the city prepares to raise the curtain on the

biggest and most expensive World Expo in history.

To outdo each other in impressing

visitors to the World Expo in Shanghai, participating countries are putting on

display their national treasures, many of which had never been taken abroad. The

Little Mermaid statue from Denmark, Impressionist paintings and a Rodin

sculpture from France, paintings by the Italian Renaissance master Caravaggio

and other national treasures are part of the countries' bids to showcase their

best. Entertainment will also be a major part of some pavilions' offerings.

Among the 20,000-strong performances will be big names such as Orchestra del

Teatro alla Scala from Italy, Russian singer Vitas and jazz pianist Herbie

Hancock from the United States. Representatives of these pavilions see the

higher profiles as a way to promote their countries' culture, as well as boost

their tourism and economy. This is the first time, for example, The Little

Mermaid has left Copenhagen since it was dedicated in 1913. Even during the

six-day "soft opening" of the expo, thousands of visitors swarmed to the Denmark

pavilion to view the lady from Hans Christian Andersen's fairy tale, which is

well known in China. Wang Jing , the pavilion's deputy director, said it was an

honour to share the statue with tourists from all around the world. "Denmark has

never valued an expo to such an extent. [Moving the statue] was meant as a

cultural exchange, and in the meantime, it can be helpful to business and trade

between [Denmark] and China," she said. The France pavilion will exhibit six

paintings by Impressionist masters, such as Paul Cezanne and Vincent van Gogh,

and a sculpture by Pierre Auguste Rodin, all borrowed from the Musee d'Orsay in

Paris. Italy is showing two paintings by Michelangelo Merisi da Caravaggio,

Basket of Fruit and Boy With a Basket of Fruit. The Czech Republic removed two

bronze Plaquettes of Good Fortune from Charles Bridge in Prague and installed

them at the expo, and Nepal is displaying Buddhist relics. Luxembourg is also

competing for Chinese people's attention by exhibiting the Gelle Fra (Golden

Lady in English) statue, a national monument. Completed in 1923, the statue had

never been out of the country. Professor Xu Mingqi , of the Shanghai Academy of

Social Sciences, said the expo was a good opportunity for mainland people to

learn about other countries, since most of them have never gone abroad.

While Google's mainland business has

suffered from a quixotic stand against Beijing's internet censors, Baidu is

reaping a mighty windfall from it.

If Beijing does not speed up

approvals for hydropower projects it may not meet its clean-energy goals for

2020, the China Electricity Council says.

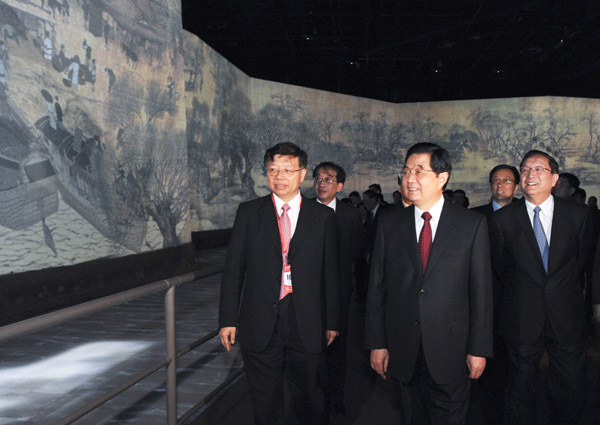

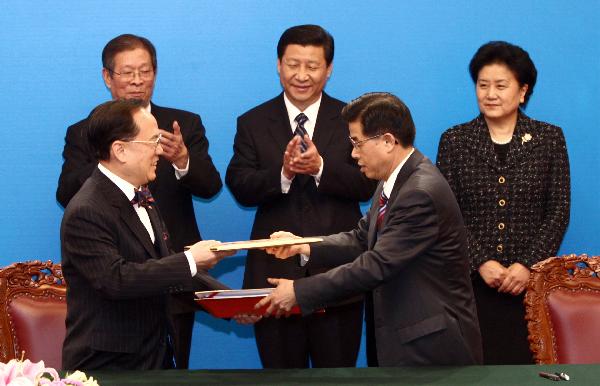

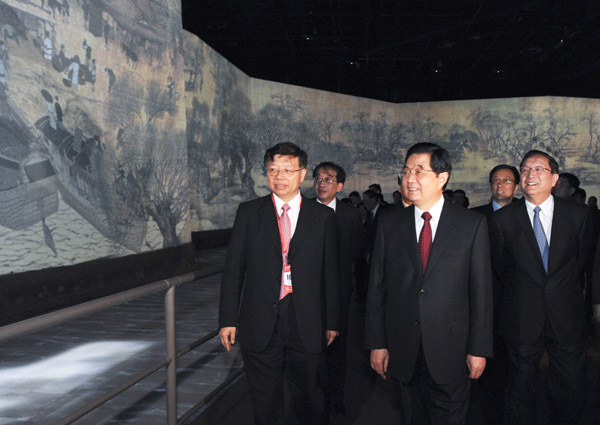

President Hu visits

Shanghai World Expo Park. President Hu visits

Shanghai World Expo Park.

Chinese President Hu

Jintao (C) visits China Pavilion at the Shanghai World Expo Park in Shanghai,

east China, April 29, 2010. Hu Jintao paid a visit to the Shanghai World Expo

Park Thursday, two days ahead of the opening of the global event. Chinese President Hu

Jintao (C) visits China Pavilion at the Shanghai World Expo Park in Shanghai,

east China, April 29, 2010. Hu Jintao paid a visit to the Shanghai World Expo

Park Thursday, two days ahead of the opening of the global event.

Chinese President Hu

Jintao use sign language to express greetings to a volunteer at Life Sunshine

Pavilion in the expo site in Shanghai, east China, April 29, 2010. Chinese

President Hu Jintao paid a visit to the Shanghai World Expo Park Thursday, two

days ahead of the opening of the global event. Chinese President Hu

Jintao use sign language to express greetings to a volunteer at Life Sunshine

Pavilion in the expo site in Shanghai, east China, April 29, 2010. Chinese

President Hu Jintao paid a visit to the Shanghai World Expo Park Thursday, two

days ahead of the opening of the global event.

Enjoy sleepless city of Shanghai. Enjoy sleepless city of Shanghai.

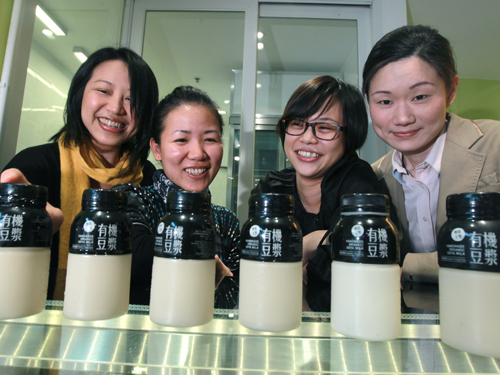

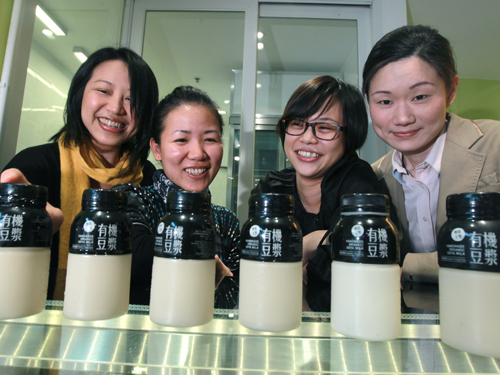

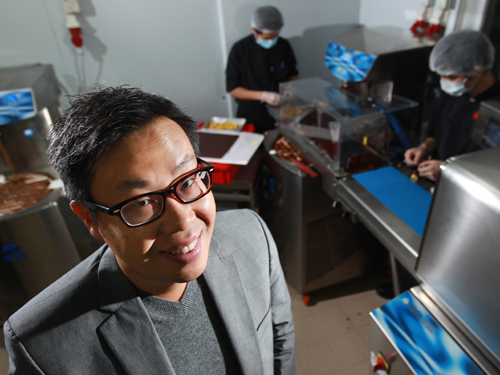

As Western investments into mainland

companies go, Goldman Sachs, Morgan Stanley and UK private equity firm Actis

Capital's decision to plough US$73 million into yoghurt drink maker Hunan

Taizinai may qualify as one of the worst. On April 12 the company, which

operates across China but is legally based in the Cayman Islands, was wound up

by a court in the balmy British territory, owing creditors 2.7 billion yuan

(HK$3.1 billion). But back in January 2007, the company and its founder, Li

Tuchun, were the stuff of private equity managers' dreams. Li was a self-made,

energetic entrepreneur who left a state-owned enterprise in Shenzhen in 1990,

aged 30, with 300 yuan in savings. He built Taizinai, which produces probiotic

drinks similar to Japan's Yakult, into a supermarket brand that tapped into the

vast potential of China's nascent consumer goods sector. But by August 2008,

Taizinai was insolvent, according to a confidential report by accountants

Deloitte. After he won the foreign investment, Li massively overexpanded his

business, the accountants said. Deloitte also said it suspected Li of inflating

sales and assets and making payments out of the company that "drained cash". The

report was not an audit, but a draft discussion paper that the accountants

prepared for the private equity investors after addressing detailed questions to

Taizinai's management, including Li. As Western investments into mainland

companies go, Goldman Sachs, Morgan Stanley and UK private equity firm Actis

Capital's decision to plough US$73 million into yoghurt drink maker Hunan

Taizinai may qualify as one of the worst. On April 12 the company, which

operates across China but is legally based in the Cayman Islands, was wound up

by a court in the balmy British territory, owing creditors 2.7 billion yuan

(HK$3.1 billion). But back in January 2007, the company and its founder, Li

Tuchun, were the stuff of private equity managers' dreams. Li was a self-made,

energetic entrepreneur who left a state-owned enterprise in Shenzhen in 1990,

aged 30, with 300 yuan in savings. He built Taizinai, which produces probiotic

drinks similar to Japan's Yakult, into a supermarket brand that tapped into the

vast potential of China's nascent consumer goods sector. But by August 2008,

Taizinai was insolvent, according to a confidential report by accountants

Deloitte. After he won the foreign investment, Li massively overexpanded his

business, the accountants said. Deloitte also said it suspected Li of inflating

sales and assets and making payments out of the company that "drained cash". The

report was not an audit, but a draft discussion paper that the accountants

prepared for the private equity investors after addressing detailed questions to

Taizinai's management, including Li.

April 30, 2010

Hong Kong*:

The Hongkong and Shanghai Banking Corporation Asia-Pacific chief executive Peter

Wong Tung-shun said on Wednesday the bank would conduct a review of its ATM

services. Hong Kong*:

The Hongkong and Shanghai Banking Corporation Asia-Pacific chief executive Peter

Wong Tung-shun said on Wednesday the bank would conduct a review of its ATM

services.

Greece was pushed to the brink of a

financial abyss and started dragging another eurozone country – Portugal – down

with it, fuelling fears of a continent-wide debt meltdown.

Anti-drug push `driving down

narcotic crime' - Drug offences involving teenagers slid 40 percent in the first

quarter of the year, amid a decline in overall crime, according to the security

chief.

After days of intense speculation, the

future of outgoing Swire Pacific (0019) heavyweight Philip Chen Nan-lok is now

clear. He will join Hang Lung Group (0010) and subsidiary Hang Lung Properties

(0101) as managing director of both firms. And he will get HK$21 million a year

for his services. Chen - the first Chinese to head Cathay Pacific (0293) -

announced on April 19 that he will step down as chairman of John Swire & Sons

(China), deputy chairman of Cathay Pacific and all other Swire posts on July 1.

He said the decision was prompted by his "desire to pursue other interests." The

shock announcement triggered media speculation that Chen will join PCCW (0008) -

which issued an immediate denial - or Hysan Development (0014). Hang Lung

chairman Ronnie Chan Chi-chung said he looks forward to working closely with

Chen, and that their appointment talks began "a few months ago." "Chen is a

well-rounded person, with experience in all aspects and also has a good

personality," Chan said. "I think he is a management professional who is hard to

come by," he told The Standard. Chan said though Chen lacks property experience,

the departing Swire executive will prove to be a good leader for Hang Lung's

property experts. "I believe the group will have bright prospects with Chen as

managing director," he said. Chen will succeed Nelson Yuen Wai-leung on July 15.

That is the day Yuen retires after 32 years of service with the group to become

a board adviser. He has been managing director for the past 17 years. Chan noted

Chen's pay will be "exactly the same" as Yuen's was because he will have similar

responsibilities. According to Hang Lung's statement to the bourse, Chen is,

apart from the HK$21 million a year, entitled to a bonus of HK$5.2 million at

the end of June next year. In addition, Chen will be granted the option to apply

for 10 million Hang Lung Properties shares and receive a director's fee from

Hang Lung Group. His total remuneration from the Swire Group in 2008 and 2009

was HK$15.1 million and HK$14.2 million, respectively. Hang Lung Group closed

down 3.3 percent at HK$39 and Hang Lung Properties ended 2.7 percent down at

HK$29.20 before Chen's appointment was announced. After days of intense speculation, the

future of outgoing Swire Pacific (0019) heavyweight Philip Chen Nan-lok is now

clear. He will join Hang Lung Group (0010) and subsidiary Hang Lung Properties

(0101) as managing director of both firms. And he will get HK$21 million a year

for his services. Chen - the first Chinese to head Cathay Pacific (0293) -

announced on April 19 that he will step down as chairman of John Swire & Sons

(China), deputy chairman of Cathay Pacific and all other Swire posts on July 1.

He said the decision was prompted by his "desire to pursue other interests." The

shock announcement triggered media speculation that Chen will join PCCW (0008) -

which issued an immediate denial - or Hysan Development (0014). Hang Lung

chairman Ronnie Chan Chi-chung said he looks forward to working closely with

Chen, and that their appointment talks began "a few months ago." "Chen is a

well-rounded person, with experience in all aspects and also has a good

personality," Chan said. "I think he is a management professional who is hard to

come by," he told The Standard. Chan said though Chen lacks property experience,

the departing Swire executive will prove to be a good leader for Hang Lung's

property experts. "I believe the group will have bright prospects with Chen as

managing director," he said. Chen will succeed Nelson Yuen Wai-leung on July 15.

That is the day Yuen retires after 32 years of service with the group to become

a board adviser. He has been managing director for the past 17 years. Chan noted

Chen's pay will be "exactly the same" as Yuen's was because he will have similar

responsibilities. According to Hang Lung's statement to the bourse, Chen is,

apart from the HK$21 million a year, entitled to a bonus of HK$5.2 million at

the end of June next year. In addition, Chen will be granted the option to apply

for 10 million Hang Lung Properties shares and receive a director's fee from

Hang Lung Group. His total remuneration from the Swire Group in 2008 and 2009

was HK$15.1 million and HK$14.2 million, respectively. Hang Lung Group closed

down 3.3 percent at HK$39 and Hang Lung Properties ended 2.7 percent down at

HK$29.20 before Chen's appointment was announced.

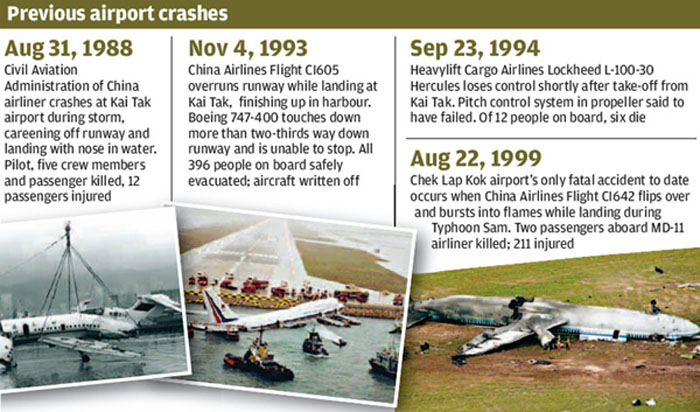

Cathay Pacific Airways (SEHK: 0293)

said on Wednesday its operations had returned to normal after its flights to

Europe were disrupted for a week after ash from an erupting Icelandic volcano

covered a huge part of the European continent. Cathay Pacific’s chief executive

Tony Tyler said although the airline’s business had been affected, it was too

early to decide whether it would adjust its fares like other airlines. “The

closure of the European airspace has some impacts on our revenues, but I am

pleased to say we are recovering very quickly. “It’s too early to calculate the

total financial impact, we will probably make a statement about it later,” Tyler

said. Cathay Pacific Airways (SEHK: 0293)

said on Wednesday its operations had returned to normal after its flights to

Europe were disrupted for a week after ash from an erupting Icelandic volcano

covered a huge part of the European continent. Cathay Pacific’s chief executive

Tony Tyler said although the airline’s business had been affected, it was too

early to decide whether it would adjust its fares like other airlines. “The

closure of the European airspace has some impacts on our revenues, but I am

pleased to say we are recovering very quickly. “It’s too early to calculate the

total financial impact, we will probably make a statement about it later,” Tyler

said.

Unionists say they have the figures

to back up their demand for minimum hourly pay of no less than HK$33, which they

say is vital to halt a widening gap between rich and poor.

'Referendum' push has failed, top adviser

says - Think-tank polls say most oppose poll campaign. The campaign to make next

month's Legco by-elections a "de facto referendum" on democratisation is a

failure, the government's chief adviser declared yesterday. Professor Lau

Siu-kai, the head of the Central Policy Unit, said its surveys had consistently

shown that more than half the people opposed the campaign. Five lawmakers from

the League of Social Democrats and the Civic Party resigned from their seats to

trigger the polls, hoping to offer voters the chance to show they wanted

"genuine" democracy. Campaign organisers rejected Lau's claim. Lau said the unit

had conducted more than three public opinion polls in recent months - he could

not recall how many exactly, nor over what time period they had been done. Each

had a sample size of about 1,000. In each survey, more than half the respondents

said they opposed the movement for a "de facto referendum" and thought it had

failed. Citing the findings and those of others, Lau said people did not think

the campaign would put pressure on Beijing to compromise on electoral reform,

and felt it lacked large-scale support. League chairman Andrew To Kwan-hang

dismissed Lau's conclusion. "Uncle Kai already maxed out his credit limit when

he wrongly predicted the turnout of the march on July 1, 2003." Lau reportedly

predicted only about 30,000 would join the protest, which saw an estimated

500,000 people take to the streets. Meanwhile, a minister had a message for

pan-democrats unhappy with the government's proposal for electoral reform in

2012: take it or leave it, and don't expect any second helpings. Since the

government had already "racked its brains" in preparing the proposal - which

pan-democrats look likely to veto - there would be no room to come up with one

more democratic, constitutional affairs chief Stephen Lam Sui-lung said. Under

questioning from Democrat Cheung Man-kwong, Lam said if Legco voted down the

proposals there would not be enough time before 2012 to restart the five-step

process Beijing has set down for drawing up electoral reforms. But Cheung said

after the meeting that the government would have no option but to come up with a

new proposal if its refusal to make concessions meant the current one was

vetoed. The government is proposing to create 10 new Legco seats. But five of

them would be functional constituency seats voted on by 405 district councillors.

The membership of the Election Committee that picks the chief executive would

rise by half, to 1,200. Pan-democrats have rejected these proposals on the

grounds they are too conservative and lack a road map to universal suffrage. 'Referendum' push has failed, top adviser

says - Think-tank polls say most oppose poll campaign. The campaign to make next

month's Legco by-elections a "de facto referendum" on democratisation is a

failure, the government's chief adviser declared yesterday. Professor Lau

Siu-kai, the head of the Central Policy Unit, said its surveys had consistently

shown that more than half the people opposed the campaign. Five lawmakers from

the League of Social Democrats and the Civic Party resigned from their seats to

trigger the polls, hoping to offer voters the chance to show they wanted

"genuine" democracy. Campaign organisers rejected Lau's claim. Lau said the unit

had conducted more than three public opinion polls in recent months - he could

not recall how many exactly, nor over what time period they had been done. Each

had a sample size of about 1,000. In each survey, more than half the respondents

said they opposed the movement for a "de facto referendum" and thought it had

failed. Citing the findings and those of others, Lau said people did not think

the campaign would put pressure on Beijing to compromise on electoral reform,

and felt it lacked large-scale support. League chairman Andrew To Kwan-hang

dismissed Lau's conclusion. "Uncle Kai already maxed out his credit limit when

he wrongly predicted the turnout of the march on July 1, 2003." Lau reportedly

predicted only about 30,000 would join the protest, which saw an estimated

500,000 people take to the streets. Meanwhile, a minister had a message for

pan-democrats unhappy with the government's proposal for electoral reform in

2012: take it or leave it, and don't expect any second helpings. Since the

government had already "racked its brains" in preparing the proposal - which

pan-democrats look likely to veto - there would be no room to come up with one

more democratic, constitutional affairs chief Stephen Lam Sui-lung said. Under

questioning from Democrat Cheung Man-kwong, Lam said if Legco voted down the

proposals there would not be enough time before 2012 to restart the five-step

process Beijing has set down for drawing up electoral reforms. But Cheung said

after the meeting that the government would have no option but to come up with a

new proposal if its refusal to make concessions meant the current one was

vetoed. The government is proposing to create 10 new Legco seats. But five of

them would be functional constituency seats voted on by 405 district councillors.

The membership of the Election Committee that picks the chief executive would

rise by half, to 1,200. Pan-democrats have rejected these proposals on the

grounds they are too conservative and lack a road map to universal suffrage.

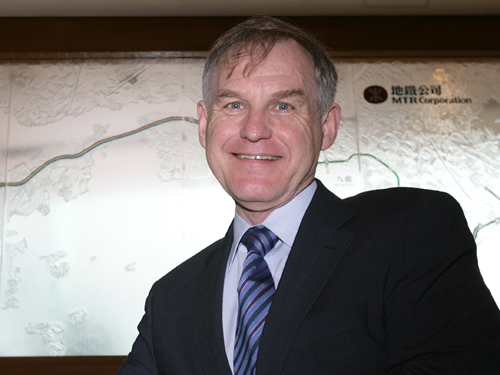

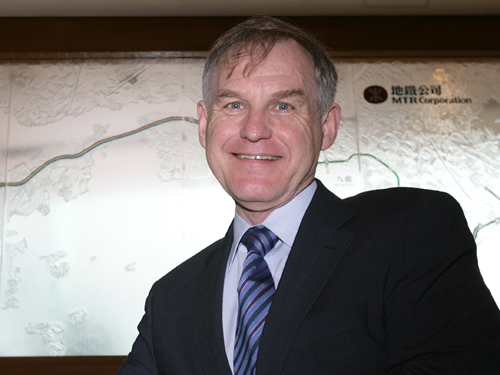

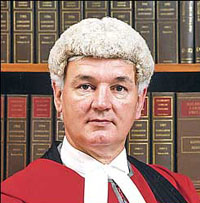

A top executive of the MTR Corporation

(SEHK: 0066) acquired his degree from a diploma mill in the United States that

was ordered to close seven years ago. According to the MTR's annual report last

year, operations director Andrew McCusker holds a degree in mechanical

engineering from the now-defunct Kensington University in California. The

school, however, was never accredited by a recognised accrediting agency or

association recognised by the United States Secretary of Education, shareholder

activist and former HKEx (SEHK: 0388, announcements, news) director David Webb

has found. "[McCusker] may well be a highly experienced and competent engineer,

certainly the MTRC seems to think so," Webb wrote in his online newsletter. "But

he might benefit from dropping his claim to a degree in engineering." The

school, according to the Los Angeles Times in 1996, had no classrooms,

laboratories or dorms; the campus was housed in a small office building, while

students earned their degrees at home without attending a class or meeting

instructors. The First Circuit Court of Hawaii, where the university was

incorporated, ordered it to be shut down in 2003 and tuition fees to be refunded

to all students since 1999, after it failed to obtain degree-awarding status.

The MTR Corp said McCusker, 65, had more than 15 years of experience when he

joined it as operations engineering manager in 1987, and the company looked not

just at education, but also at work experience, when recruiting for senior

positions. It was understood McCusker had worked for about eight years when he

began his Kensington degree in 1980. Edmund Leung Kwong-ho, former chairman of

the local branch of Britain's Institution of Mechanical Engineers - where

McCusker is a chartered member - said the institute required members to have an

accredited degree, but an engineer with ample work experience could also apply

as a mature candidate. A top executive of the MTR Corporation

(SEHK: 0066) acquired his degree from a diploma mill in the United States that

was ordered to close seven years ago. According to the MTR's annual report last

year, operations director Andrew McCusker holds a degree in mechanical

engineering from the now-defunct Kensington University in California. The

school, however, was never accredited by a recognised accrediting agency or

association recognised by the United States Secretary of Education, shareholder

activist and former HKEx (SEHK: 0388, announcements, news) director David Webb

has found. "[McCusker] may well be a highly experienced and competent engineer,

certainly the MTRC seems to think so," Webb wrote in his online newsletter. "But

he might benefit from dropping his claim to a degree in engineering." The

school, according to the Los Angeles Times in 1996, had no classrooms,

laboratories or dorms; the campus was housed in a small office building, while

students earned their degrees at home without attending a class or meeting

instructors. The First Circuit Court of Hawaii, where the university was

incorporated, ordered it to be shut down in 2003 and tuition fees to be refunded

to all students since 1999, after it failed to obtain degree-awarding status.

The MTR Corp said McCusker, 65, had more than 15 years of experience when he

joined it as operations engineering manager in 1987, and the company looked not

just at education, but also at work experience, when recruiting for senior

positions. It was understood McCusker had worked for about eight years when he

began his Kensington degree in 1980. Edmund Leung Kwong-ho, former chairman of

the local branch of Britain's Institution of Mechanical Engineers - where

McCusker is a chartered member - said the institute required members to have an

accredited degree, but an engineer with ample work experience could also apply

as a mature candidate.

Swire Properties, which aims to

raise up to US$2.7 billion from a Hong Kong IPO, has tapped Bank of China Group

Investment for US$100 million worth of shares, sources said.

Automated Systems Holdings, the leading

information-technology services provider to the Hong Kong government, plans to

accelerate expansion on the mainland and across Southeast Asia after recording

virtually flat sales in its last fiscal year. "We are working closely with

Beijing Teamsun Technology, the group's controlling shareholder, to capture more

business opportunities throughout the mainland," Automated chief executive Lai

Yam-ting said yesterday. Lai said potential mergers and acquisitions were being

considered for growth in Southeast Asia, where Automated already had operations

in Thailand. The company posted a HK$115.8 million net profit in the year to

March, up 171.4 per cent from HK$42.7 million a year earlier, boosted by a

one-off gain from the disposal of its global managed services business in August

last year. Revenue fell 2.3 per cent to HK$1.33 billion, due to a slowdown in

information-technology hardware and services sales. Lai, however, noted that the

improving economy helped the company grow in the January-March period, when it

generated HK$28.8 million in profit before taxation that was higher than those

of the previous three quarters combined. He said Automated would focus more on

growing its technology solutions business - which includes professional,

maintenance and outsourcing services - as it further develops operations on the

mainland and across Southeast Asia. About 61.2 per cent of the firm's revenue

for the year to March still came from its traditional infrastructure business,

which is based on sales of hardware such as computer servers and storage

systems. Market research firm International Data Corp forecast the mainland

information-technology services market this year to reach 82 billion yuan from

73.09 billion yuan last year. Lai said Teamsun, which bought the 68.4 per cent

holding of US-based consulting and outsourcing specialist Computer Sciences Corp

for HK$262.4 million in September, provides Automated with strategic support on

the mainland through its 30 branches nationwide. Automated Systems Holdings, the leading

information-technology services provider to the Hong Kong government, plans to

accelerate expansion on the mainland and across Southeast Asia after recording

virtually flat sales in its last fiscal year. "We are working closely with

Beijing Teamsun Technology, the group's controlling shareholder, to capture more

business opportunities throughout the mainland," Automated chief executive Lai

Yam-ting said yesterday. Lai said potential mergers and acquisitions were being

considered for growth in Southeast Asia, where Automated already had operations

in Thailand. The company posted a HK$115.8 million net profit in the year to

March, up 171.4 per cent from HK$42.7 million a year earlier, boosted by a

one-off gain from the disposal of its global managed services business in August

last year. Revenue fell 2.3 per cent to HK$1.33 billion, due to a slowdown in

information-technology hardware and services sales. Lai, however, noted that the

improving economy helped the company grow in the January-March period, when it

generated HK$28.8 million in profit before taxation that was higher than those

of the previous three quarters combined. He said Automated would focus more on

growing its technology solutions business - which includes professional,

maintenance and outsourcing services - as it further develops operations on the

mainland and across Southeast Asia. About 61.2 per cent of the firm's revenue

for the year to March still came from its traditional infrastructure business,

which is based on sales of hardware such as computer servers and storage

systems. Market research firm International Data Corp forecast the mainland

information-technology services market this year to reach 82 billion yuan from

73.09 billion yuan last year. Lai said Teamsun, which bought the 68.4 per cent

holding of US-based consulting and outsourcing specialist Computer Sciences Corp

for HK$262.4 million in September, provides Automated with strategic support on

the mainland through its 30 branches nationwide.

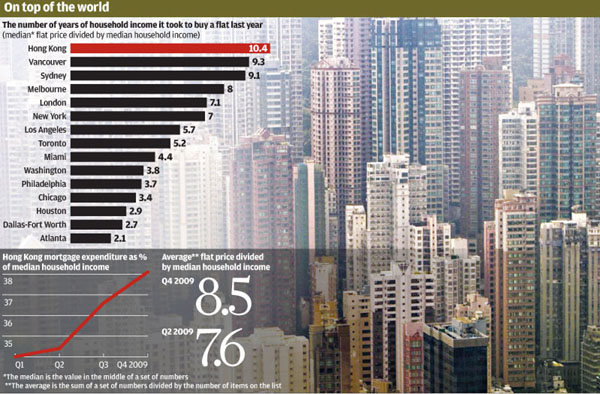

Kong Siu-kau, 63, has a tea break at the

entrance to his cage home. Cages can cost HK$1,500 a month. The redevelopment of

old buildings in Hong Kong is cutting down the supply of "cage homes" in

centrally located areas and forcing up rents for the unemployed and

underemployed who can least afford to meet higher living costs. On a per square

foot basis, those who occupy "cages" of no more than 15 sqft created by

subdividing old apartments into up to 50 separate living compartments now pay

landlords from several hundred dollars to up to HK$1,500 in rent each. That

translates into a rental charge of HK$100 per square foot, which is at least 25

per cent higher than the per square foot cost of renting a luxury house on The

Peak, where effective rents for a 3,000 sqft house range between HK$70 and HK$80

per sq ft. Kong Siu-kau, 63, has a tea break at the

entrance to his cage home. Cages can cost HK$1,500 a month. The redevelopment of

old buildings in Hong Kong is cutting down the supply of "cage homes" in

centrally located areas and forcing up rents for the unemployed and

underemployed who can least afford to meet higher living costs. On a per square

foot basis, those who occupy "cages" of no more than 15 sqft created by

subdividing old apartments into up to 50 separate living compartments now pay

landlords from several hundred dollars to up to HK$1,500 in rent each. That

translates into a rental charge of HK$100 per square foot, which is at least 25

per cent higher than the per square foot cost of renting a luxury house on The

Peak, where effective rents for a 3,000 sqft house range between HK$70 and HK$80

per sq ft.

China*:

Shanghai opens the World Expo this weekend, with 192 countries taking part in

the massive six-month showcase of ideas and technology – the latest display of

China's growing global clout. China’s most cosmopolitan city will kick things

off on Friday night with fireworks and an opening extravaganza at the riverfront

Expo site in the city centre, a day before visitors are allowed in.

China*:

Shanghai opens the World Expo this weekend, with 192 countries taking part in

the massive six-month showcase of ideas and technology – the latest display of

China's growing global clout. China’s most cosmopolitan city will kick things

off on Friday night with fireworks and an opening extravaganza at the riverfront

Expo site in the city centre, a day before visitors are allowed in.

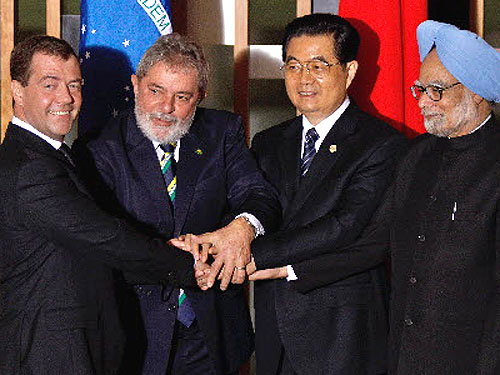

French President

Sarkozy seeks to bury the hatchet with Beijing - French President Nicolas

Sarkozy and his wife, Carla Bruni-Sarkozy, arrive at the airport in Beijing on

Wednesday. French President Nicolas Sarkozy arrived in Beijing on Wednesday for

a visit aimed at reinvigorating ties tested two years ago over Tibet and at

winning China’s support for new sanctions against Iran. The French president,

making his second state visit to China, was to head straight into a meeting with

his opposite number Hu Jintao and address the media to kick off the official

part of his three-day trip. Sarkozy – along with his wife Carla Bruni-Sarkozy

and a delegation of top ministers – began the day with an initial stop in the

ancient capital of Xian, where the couple visited the famed terracotta warriors

under tight security. The French leader will also meet Premier Wen Jiabao and

other top officials during his time in Beijing before heading to Shanghai on

Friday for the start of the World Expo. “China has become an absolutely

indispensable actor on the world stage,” Sarkozy told China’s state Xinhua news

agency in an interview published on Wednesday. “Today, there is not one major

issue that we can handle without you.” Paris hopes to win China’s support for

fresh UN sanctions against Iran over its disputed nuclear program, but first

Sarkozy has to seal France’s reconciliation with Beijing, two years after a

heated row over Tibet. In March 2008, just four months after Sarkozy’s first

state visit to China, ties soured when the French leader expressed shock at the

security crackdown in the Chinese-ruled region after protests there led to

deadly violence. A month later, the Chinese leadership was incensed when

pro-Tibetan demonstrators booed and jostled the Olympic flame as it was carried

through Paris on its way to the Beijing Games. Tensions peaked when Sarkozy met

the Dalai Lama, Tibet’s exiled spiritual leader, in December 2008, before

starting to ease when the French leader met Hu at the G20 summit on the

financial crisis last year. French Prime Minister Francois Fillon, during a

visit to China in December, said any “misunderstandings” between Paris and

Beijing were a thing of the past. In his talks with Hu, Sarkozy is expected to

seek Beijing’s backing for an overhaul of the global monetary system by the G20,

but a French official said the leaders would not directly discuss foreign

concerns over the yuan’s value. On Thursday, he will meet China’s top legislator

Wu Bangguo, the second highest-ranking figure in the Communist hierarchy, before

seeing Wen on Friday. The French president will mix politics with sightseeing

during the trip, with scheduled visits to the Great Wall, the Ming Tombs and the

Forbidden City. Sarkozy will on Friday head to Shanghai, where he will

officially open the French pavilion at the World Expo and take part in the

opening ceremony for the six-month exhibition. Cooperation agreements on

ecology, higher education and the creation of new businesses are to be signed

during Sarkozy’s visit, according to French officials. “New chapters are about

to be written in China’s relationships with France and with the European Union,”

the China Daily said Wednesday in an editorial. “French President Nicolas

Sarkozy’s three-day visit shows how each side has let bygones be bygones. It

could be seen as a formal announcement to the world that the China-France

relationship is now back to normal.” Hu is scheduled to make a state visit to

France later this year. French President

Sarkozy seeks to bury the hatchet with Beijing - French President Nicolas

Sarkozy and his wife, Carla Bruni-Sarkozy, arrive at the airport in Beijing on

Wednesday. French President Nicolas Sarkozy arrived in Beijing on Wednesday for

a visit aimed at reinvigorating ties tested two years ago over Tibet and at

winning China’s support for new sanctions against Iran. The French president,

making his second state visit to China, was to head straight into a meeting with

his opposite number Hu Jintao and address the media to kick off the official

part of his three-day trip. Sarkozy – along with his wife Carla Bruni-Sarkozy

and a delegation of top ministers – began the day with an initial stop in the

ancient capital of Xian, where the couple visited the famed terracotta warriors

under tight security. The French leader will also meet Premier Wen Jiabao and

other top officials during his time in Beijing before heading to Shanghai on

Friday for the start of the World Expo. “China has become an absolutely

indispensable actor on the world stage,” Sarkozy told China’s state Xinhua news

agency in an interview published on Wednesday. “Today, there is not one major

issue that we can handle without you.” Paris hopes to win China’s support for

fresh UN sanctions against Iran over its disputed nuclear program, but first

Sarkozy has to seal France’s reconciliation with Beijing, two years after a

heated row over Tibet. In March 2008, just four months after Sarkozy’s first

state visit to China, ties soured when the French leader expressed shock at the

security crackdown in the Chinese-ruled region after protests there led to

deadly violence. A month later, the Chinese leadership was incensed when

pro-Tibetan demonstrators booed and jostled the Olympic flame as it was carried

through Paris on its way to the Beijing Games. Tensions peaked when Sarkozy met

the Dalai Lama, Tibet’s exiled spiritual leader, in December 2008, before

starting to ease when the French leader met Hu at the G20 summit on the

financial crisis last year. French Prime Minister Francois Fillon, during a

visit to China in December, said any “misunderstandings” between Paris and

Beijing were a thing of the past. In his talks with Hu, Sarkozy is expected to

seek Beijing’s backing for an overhaul of the global monetary system by the G20,

but a French official said the leaders would not directly discuss foreign

concerns over the yuan’s value. On Thursday, he will meet China’s top legislator

Wu Bangguo, the second highest-ranking figure in the Communist hierarchy, before

seeing Wen on Friday. The French president will mix politics with sightseeing

during the trip, with scheduled visits to the Great Wall, the Ming Tombs and the

Forbidden City. Sarkozy will on Friday head to Shanghai, where he will

officially open the French pavilion at the World Expo and take part in the

opening ceremony for the six-month exhibition. Cooperation agreements on

ecology, higher education and the creation of new businesses are to be signed

during Sarkozy’s visit, according to French officials. “New chapters are about

to be written in China’s relationships with France and with the European Union,”

the China Daily said Wednesday in an editorial. “French President Nicolas

Sarkozy’s three-day visit shows how each side has let bygones be bygones. It

could be seen as a formal announcement to the world that the China-France

relationship is now back to normal.” Hu is scheduled to make a state visit to

France later this year.

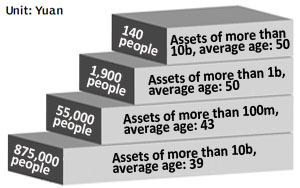

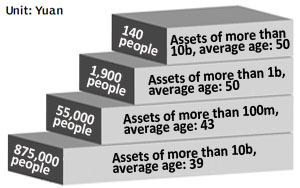

VIP guests take a look at the Aston Martin concept Rapide, a 12-cylinder,

four-door sports car at the Beijing Auto China on Sunday. Luxury auto market

zooms ahead in mainland - The businessman climbed into the Rolls Royce Phantom

with the gold-plated Spirit of Ecstasy hood ornament and sank his feet into

wine-red carpet. He says he has a Mercedes S600 sedan and a Jaguar sports car at

home but needs something for work. “I just have to consider whether it’s too

flashy. But otherwise there’s no problem. The price isn’t a big problem,” said

the 32-year-old visitor to the Beijing auto show, who would give only his

surname, Liu. Free-spending new rich who have made mainland a key growth market

for luxury goods makers are more important than ever to US, European and

Japanese creators of high-end automobiles. Sales here are surging while they sag

elsewhere and manufacturers are pulling out the stops to woo mainland buyers.

Mainland is “increasingly becoming the engine of our industry”, said Dieter

Zetsche, CEO of Daimler AG. Sales of its Mercedes-Benz cars in mainland soared

112 per cent in the first quarter of this year to 23,600 vehicles. Volkswagen

AG’s Audi unit, BMW AG’s Rolls Royce, Fiat SpA’s Ferrari and other makers of

high-priced wheels are seeing similar gains. The surge has been propelled by an

economic boom that created a new crop of millionaires and several dozen

billionaires in a country that had almost no private cars 15 years ago. Mainland

now has 825,000 people worth at least 10 million yuan (HK11.35 million),

according to Rupert Hoogewerf, a researcher of wealthy mainlanders. The new rich

“need some luxury products to validate themselves”, said Wang Honghao, editor in

chief of the automotive magazine Trends Car. “Whether it’s luxury cars or luxury

luggage, or perfume, clothes, accessories, it’s all the same.” Mainland’s auto

market, the world’s biggest since last year, defied the global downturn on the

strength of Beijing’s 4 trillion yuan, which boosted stock and real estate

prices. Luxury car sales in mainland soared 66 per cent in the first quarter

from a year earlier, well ahead of 14 per cent growth in the United States and a

6 per cent fall in Germany, homeland of Benz and BMW, according to JD Power and

Associates. BMW AG’s Rolls Royce says sales in mainland, its third-largest

market after the United States and Britain, rose 200 per cent in the first

quarter from a year earlier to more than 20 vehicles despite a base price of 6.6

million yuan. Rolls Royce’s mainland sales are so strong that it added a

production line and hired more workers partly to meet the demand. “I see China

will even overtake the UK, our home market, this year and that we will see the

Chinese market as the second-most-important market after the US,” CEO Torsten

Mueller-Oetvoes said. As mainland’s jet-setting elite gets more sophisticated,

luxury automakers are focusing on building their brand image with this niche

audience. Rolls Royce publishes a Putonghua luxury lifestyle magazine and

invites customers from mainland to visit its factory in Goodwood, England, to

see their cars being made. Mercedes-Benz hired movie stars Zhang Ziyi and Li

Bingbing to promote its cars. Luxury automakers are opening dealerships in

cities as farflung as Chengdu and holds private gatherings for buyers who want

to share their enthusiasm for cars. Mainland customers are getting more

discerning and companies need to work to reach them, said Matthew Bennett,

regional director of Aston Martin Asia Pacific. “It’s simple things like

increasing the number of people in the company who can speak Mandarin,” he said.

“The growth in China doesn’t come for free. You have to invest and it will

come.” China’s most popular luxury car is the Audi A6L, favoured by government

officials. Sales were up 14 per cent in March over a year earlier to 9,983,

though that was driven partly by stimulus spending that is winding down this

year. Aston Martin – which showcased a DBS like the one James Bond drove in

Quantum of Solace – sold about 80 cars in mainland last year. Bennett said