|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Hong Kong, China & Hawaii Biz*

Skype - FREE

Voice Over IP Skype - FREE

Voice Over IP  View Hawaii's China Connection

Video Trailer

View Hawaii's China Connection

Video Trailer

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

After

attended a China/Hong Kong Business/Trade Seminar in Hawaii...still unsure what

to do next, contact us, our Officers, Directors and Founding Members are

actively engaged in China/Hong Kong/Asia trade - we can help!

Are you ready to export your product or

service? You will find out in 3 minutes with resources to help you -

enter

to give it a try

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

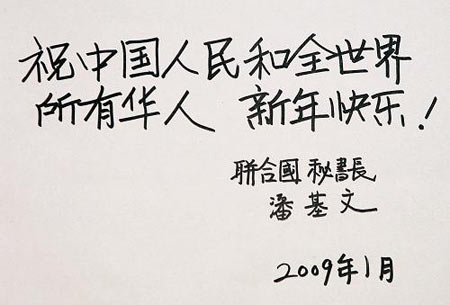

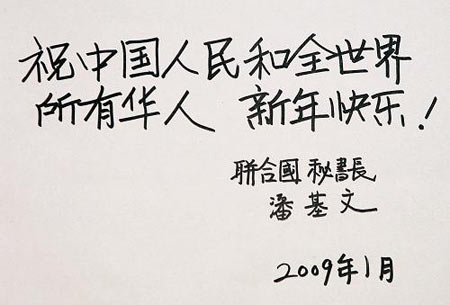

Happy Chinese New Year - Year of the Oz on

January 26 2009

(Chinese Spring Festival Jan 26th - Feb 9th)

Happy Chinese New Year - Year of the Oz on

January 26 2009

(Chinese Spring Festival Jan 26th - Feb 9th)

January 30 - Feb 1, 2009

Hong Kong:

The rights of an individual do not come before the public interest, the Court of

Appeal ruled yesterday. The decision, which involved the right of a motorist to

remain silent, means the government may now pursue some 700 cases in which car

owners have refused to identify those who violated traffic rules while driving

their vehicles. The three judges of the court unanimously quashed a magistrate's

ruling that it was unconstitutional for police to demand that an American

freelance journalist identify the driver who jumped red lights while behind the

wheel of his car. That case will be now be sent before another magistrate. High

Court Chief Judge Geoffrey Ma Tao-li said although the right to a fair trial is

absolute it is clear certain facets of this right - such as the right to silence

- are not absolute and are subject to qualification. Section 63 of the Road

Traffic Ordinance, Ma said, provides an acceptable balance struck between the

public interest and fundamental rights of the individual. He said public

interest lies very much in the effective regulation of vehicles and their use.

In Hong Kong, vehicles are prevalent, and the potential dangers posed by them

are self evident. So there has to be an effective regulatory system to govern

their use. "Extremely serious social problems would be caused if there was an

absence of such a system," Ma said. Court of Appeal vice-president Michael

Stuart- Moore said the fact a few thousand notices had been issued in 2007-2008

shows law enforcement authorities would have been unable to commence meaningful

investigations into alleged traffic violations if there was no Section 63. The

Department of Justice said the appeal ruling affirms the Secretary of Justice's

interpretation of the law. The secretary will now consider the best way to

approach similar cases. About 700 cases have been adjourned pending the appeal.

The journalist, Richard Latker, said he may seek an appeal. If he does, he must

lodge it with the Court of Final Appeal within 28 days. According to lawmaker

and solicitor Albert Ho Chun-ya, even if Latker decides to appeal police may

move on prosecutions of car owners who refused to talk. The 700 pending cases

could proceed at any time, he said, because the Court of Appeal has quashed the

magistrate's ruling. Latker, 44, was charged last May with failure to disclose

the identity of the driver who was captured by a digital camera going through a

set of red lights in Sau Mau Ping using his car. He pleaded not guilty and

claimed the ordinance breached his right to silence. In his verdict, Kowloon

City magistrate David Thomas held that Section 63 contravened the Bill of

Rights. He found Latker not guilty and dismissed the summons. Thomas had

re-affirmed his ruling after submissions from the prosecution applying for a

review. That prompted the Secretary of Justice to lodge the appeal. Hong Kong:

The rights of an individual do not come before the public interest, the Court of

Appeal ruled yesterday. The decision, which involved the right of a motorist to

remain silent, means the government may now pursue some 700 cases in which car

owners have refused to identify those who violated traffic rules while driving

their vehicles. The three judges of the court unanimously quashed a magistrate's

ruling that it was unconstitutional for police to demand that an American

freelance journalist identify the driver who jumped red lights while behind the

wheel of his car. That case will be now be sent before another magistrate. High

Court Chief Judge Geoffrey Ma Tao-li said although the right to a fair trial is

absolute it is clear certain facets of this right - such as the right to silence

- are not absolute and are subject to qualification. Section 63 of the Road

Traffic Ordinance, Ma said, provides an acceptable balance struck between the

public interest and fundamental rights of the individual. He said public

interest lies very much in the effective regulation of vehicles and their use.

In Hong Kong, vehicles are prevalent, and the potential dangers posed by them

are self evident. So there has to be an effective regulatory system to govern

their use. "Extremely serious social problems would be caused if there was an

absence of such a system," Ma said. Court of Appeal vice-president Michael

Stuart- Moore said the fact a few thousand notices had been issued in 2007-2008

shows law enforcement authorities would have been unable to commence meaningful

investigations into alleged traffic violations if there was no Section 63. The

Department of Justice said the appeal ruling affirms the Secretary of Justice's

interpretation of the law. The secretary will now consider the best way to

approach similar cases. About 700 cases have been adjourned pending the appeal.

The journalist, Richard Latker, said he may seek an appeal. If he does, he must

lodge it with the Court of Final Appeal within 28 days. According to lawmaker

and solicitor Albert Ho Chun-ya, even if Latker decides to appeal police may

move on prosecutions of car owners who refused to talk. The 700 pending cases

could proceed at any time, he said, because the Court of Appeal has quashed the

magistrate's ruling. Latker, 44, was charged last May with failure to disclose

the identity of the driver who was captured by a digital camera going through a

set of red lights in Sau Mau Ping using his car. He pleaded not guilty and

claimed the ordinance breached his right to silence. In his verdict, Kowloon

City magistrate David Thomas held that Section 63 contravened the Bill of

Rights. He found Latker not guilty and dismissed the summons. Thomas had

re-affirmed his ruling after submissions from the prosecution applying for a

review. That prompted the Secretary of Justice to lodge the appeal.

Dragon-dance performers get ready to

start the show at Harbour City in Tsim Sha Tsui, after the dragon's eyes receive

the ceremonial "dotting" that brings it to life – symbolically, of course. The

performance celebrates the Lunar New Year with prayers for good luck. Dragon-dance performers get ready to

start the show at Harbour City in Tsim Sha Tsui, after the dragon's eyes receive

the ceremonial "dotting" that brings it to life – symbolically, of course. The

performance celebrates the Lunar New Year with prayers for good luck.

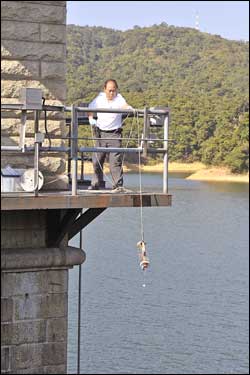

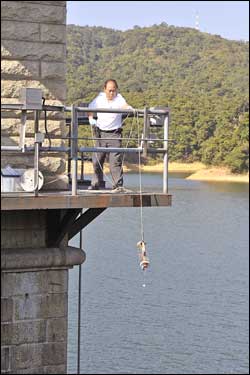

A CLP Power worker upgrades

equipment in Mai Po, one of the rural areas where facilities have been enhanced.

The power supply in rural areas has become more stable over the past eight

years, thanks to a scheme by CLP Power (SEHK: 0002) to replace overhead cables

with ones that run underground, among other upgrades. The scheme has benefited

more than 100,000 households, who mostly relied on overhead lines and

pole-mounted transformers for their electricity, the power supplier said, though

land ownership issues in the villages continue to obstruct improvement works.

Above-ground equipment is more prone to bad weather and interference by people

and animals. The company said the number of power blackouts last year dropped by

40 per cent from 2000. The time lost to an outage was also slashed from nearly

29 minutes in 2000 to about 2.7 minutes last year. It said about 350 households

in Mai Po village, where improvements were completed early last year, were not

hit by a single outage during the year, compared with two to three times a year

before. Under the scheme, overhead cables and outdoor transformers are replaced

with underground cables as far as possible. If a replacement is not feasible, a

covered substation is built to house the facilities and shield them from bad

weather. A CLP Power worker upgrades

equipment in Mai Po, one of the rural areas where facilities have been enhanced.

The power supply in rural areas has become more stable over the past eight

years, thanks to a scheme by CLP Power (SEHK: 0002) to replace overhead cables

with ones that run underground, among other upgrades. The scheme has benefited

more than 100,000 households, who mostly relied on overhead lines and

pole-mounted transformers for their electricity, the power supplier said, though

land ownership issues in the villages continue to obstruct improvement works.

Above-ground equipment is more prone to bad weather and interference by people

and animals. The company said the number of power blackouts last year dropped by

40 per cent from 2000. The time lost to an outage was also slashed from nearly

29 minutes in 2000 to about 2.7 minutes last year. It said about 350 households

in Mai Po village, where improvements were completed early last year, were not

hit by a single outage during the year, compared with two to three times a year

before. Under the scheme, overhead cables and outdoor transformers are replaced

with underground cables as far as possible. If a replacement is not feasible, a

covered substation is built to house the facilities and shield them from bad

weather.

Macau casino revenue has fallen for

the fourth month in five this month, plunging by an unprecedented 30 per cent

from January last year to 7.2 billion patacas, government-owned broadcaster TDM

reported yesterday. Preliminary figures suggest the dramatic slowdown in Macau's

once-booming gaming industry is worsening in the face of the financial crisis

and Beijing's crackdown on mainland visitation to the city. Casinos booked a

meagre 169 million patacas in revenue over the three-day Lunar New Year holiday,

down considerably from last year, TDM cited a government source as saying.

Casino revenues averaged almost 300 million patacas per day last year, according

to official figures. Still, January's revenue data excludes the final three days

of the month and is only marginally below last month's 7.65 billion patacas and

the average 7.78 billion patacas per month for September to December. The

dramatic fall-off compared with a year ago can be partly attributed to the

timing of the Lunar New Year holiday, which fell in February last year and when

play by high rollers typically slows, and the fact that January last year set a

monthly record of 10.33 billion patacas in casino revenue due to an influx of

new gaming credit to the VIP segment. Macau's VIP segment accounts for 65 to 70

per cent of all casino revenue and has slowed more dramatically than the

cash-based mass market in recent months. Analysts and industry executives said

this trend was largely the result of a bursting of the VIP credit bubble, which

has accelerated as junket agents curtail lending to high rollers. The shake-out

in the VIP segment saw the number of companies and individuals registered to act

as VIP junket agents decline at the end of last year for the first time since

junket licensing began in 2005, government data shows. The number of registered

junkets fell to 151 at the end of last month, down 19 per cent from 186 junkets

at the end of 2007, according to Macau Gaming Inspection and Co-ordination

Bureau information published yesterday in the government gazette. Beijing's

eight-month-old travel restrictions have also taken a toll. The central

government has cut the number of times mainlanders can travel to Macau under the

individual visitation scheme to once every three months, down from twice a month

before June last year. As a result, visitor arrivals to the city fell for the

first time in 5-1/2 years last month. Total arrivals slumped 2.78 per cent from

a year earlier to 2.54 million, the first decrease in 66 months since the

Sars-plagued second quarter of 2003. Mainland arrivals fell 4.03 per cent to

1.38 million, the first drop in a similar span, while non-tour-group mainland

arrivals under the scheme plummeted 30.4 per cent to 477,859.

The government's scheme of providing

tax relief for the interest paid on home loans is expected to be extended in

next month's budget. Homeowners would be able to continue to claim tax

deductions of up to HK$100,000 a year beyond 10 years under an initiative being

considered by Financial Secretary John Tsang Chun-wah, sources close to the

government have revealed. The government hopes the measure will provide relief

to taxpayers and help stimulate the city's recession-hit economy. The sources

did not indicate the likely length of the extension. However, the Democratic

Alliance for the Betterment and Progress of Hong Kong has suggested extending

the entitlement period from the existing 10 years to 15 years. The mortgage

relief measure for homebuyers was announced in the 1998-99 budget by then

financial secretary and current chief executive, Donald Tsang Yam-kuen. The

measure was initially introduced for five years but in the 2004-05 budget it was

extended to seven years. In 2006, the government extended the tax break again -

to 10 years - to reduce the pressure on homebuyers from rising interest rates.

The finance chief is scheduled to deliver his second budget speech on February

25. The government had originally estimated a deficit of HK$7.5 billion for the

2008-09 financial year, but sources have indicated that by the end of December

it had recorded a HK$30 billion surplus. A government source said the public

expected the financial secretary to come up with some tax relief measures in the

coming budget. However, handouts would not be anywhere as near as big as those

last year. In his maiden budget delivered in February last year, the financial

secretary offered tax cuts, handouts and subsidies totalling HK$75 billion. The

interest rate deduction applies only to taxpayers who live in the properties for

which they are claiming. It applies both to existing and first homebuyers, and

taxpayers can choose the years in which they claim the deduction. However, the

10-year entitlement period of taxpayers who have claimed the deduction

continuously since it was introduced is due to expire this financial year. It is

understood that many economists suggested extending the entitlement period

during their prebudget meetings with the finance chief. "The extension of

entitlement period for the deduction is worth consideration as it would not

result in a huge amount of forgone tax revenue," a government source said. The

government had estimated that extending the entitlement period would cost HK$1.2

billion in the 2006-07 financial year. In 2006, the administration said that

extending the seven-year entitlement period would benefit about 80,000 taxpaying

homeowners. Francis Lui Ting-ming, professor of economics at the University of

Science and Technology, said he would not be surprised if the government took

the "political gesture" to extend the entitlement period for tax deductions for

home loan interest, although the actual benefit to qualifying taxpayers would

not be that great.

A leading Beijing loyalist has

described Taiwanese billionaire Tsai Eng-meng as a smart investor for taking a

stake in cash-strapped Asia Television. Chan Wing-kee, a local delegate to the

Chinese People's Political Consultative Conference and an ATV shareholder,

yesterday confirmed Mr Tsai had agreed to shore up the TV station's finances

with a cash injection. Mr Chan declined to discuss the terms of the deal, but

said Mr Tsai would buy the shares held by ABN Amro in a joint venture company

called Alnery, which holds 47.58 per cent of ATV shares. Asked about the funds

from Taiwan, Mr Chan said: "It is absolutely good news. For ATV, we should have

a toast ... Mr Tsai is a smart investor." Speaking on Cable TV, Mr Chan

suggested that ABN Amro was no longer a preferred business partner. "First, the

Dutch bank was acquired by the Royal Bank of Scotland. Second, the Royal Bank of

Scotland is under the control of the [British] government," Mr Chan said. He was

referring to a series of acquisitions and bank rescues which have occurred

during the global financial turmoil that followed the US subprime crisis last

year. Mr Chan said in an ATV interview Taiwanese investors would not control the

station. "ATV will still be a Hongkonger's TV station, with the Cha family

remaining the dominant shareholder." The South China Morning Post (SEHK: 0583,

announcements, news) reported yesterday that Mr Tsai, whose net worth has been

estimated by Forbes at US$2.6 billion, signed a preliminary agreement last week

to become a shareholder of Alnery. Alnery is jointly owned by the Cha family,

ABN Amro and former ATV chief executive Louis Page. According to an exchange

filing, Mr Tsai, chairman of Taiwan-based Want Want China Holdings, entered a

deal in November to buy Taiwan's China Times Group. Want Want, the largest maker

of rice crackers and flavoured drinks on the mainland, is not involved in the

deal. ATV senior vice-president Kwong Hoi-ying said the TV station was not

prepared to comment. A spokesman for the Commerce and Economic Development

Bureau said the Broadcasting Authority had not yet received an application from

ATV in relation to the deal. "As a licensee, ATV needs to apply for formal

approval to the Broadcasting Authority in case there are any changes in the

shareholders," the spokesman said. The Cha family also owns a 10.75 per cent

stake of ATV through Panfair. Phoenix TV chairman Liu Changle and businessman

and former ATV chief executive Chan Wing-kee jointly own a 26.85 per cent stake

and Citic Group owns 14.81 per cent. Partly because of a lack of funding, ATV

has long been the underdog to TVB (SEHK: 0511). ATV's new executive chairman,

Linus Cheung Wing-lam, has admitted that the station was facing a difficult

financial situation. At a Legislative Council panel meeting last month, Mr

Cheung said the station would need about HK$1 billion to keep going for the next

three years. There have been reports the broadcaster is losing up to HK$2

million a day.

A close female friend of Asia

Television's executive chairman Linus Cheung Wing-lam has helped line up a deal

in which Taiwan billionaire businessman Tsai Eng-meng has agreed to acquire a

stake in the financially beleaguered station, a source familiar with the

situation said. Cheung's friend Rebecca Huang, 42, is presently a member of the

management of Taipei-based Eastern Broadcasting Company. Huang was a presenter

at Taiwan network TVBS before joining Eastern Broadcasting. Huang has known

Cheung since she worked for Eastern Broadcasting as a presenter in Hong Kong.

When Cheung became single in 2001, he and Huang were frequently seen going out

together but Huang later returned to Taiwan to head the Asian channel at Eastern

Broadcasting. Tsai has agreed to inject HK$1 billion - in the form of

convertible bonds - to help keep ATV afloat. Want Want China Holdings (0151)

chairman Tsai will inject the funds in his personal capacity and the Cha family

will remain the dominant shareholder, according to ATV non-executive director

Chan Wing- kee. It is believed the broadcaster will issue convertible bonds to

Tsai who will pump in HK$1 billion in several stages. The amount will be

sufficient to cover the broadcaster's operations for the next three years. The

station is said to be losing HK$1 million a day. Chan said Tsai will buy the ATV

stake of Dutch Bank ABN Amro. Huang has an MBA from Harvard University. During

her time there, she came to know former Taiwan premier Tang Fei who went to the

university to study after stepping down from office. A close female friend of Asia

Television's executive chairman Linus Cheung Wing-lam has helped line up a deal

in which Taiwan billionaire businessman Tsai Eng-meng has agreed to acquire a

stake in the financially beleaguered station, a source familiar with the

situation said. Cheung's friend Rebecca Huang, 42, is presently a member of the

management of Taipei-based Eastern Broadcasting Company. Huang was a presenter

at Taiwan network TVBS before joining Eastern Broadcasting. Huang has known

Cheung since she worked for Eastern Broadcasting as a presenter in Hong Kong.

When Cheung became single in 2001, he and Huang were frequently seen going out

together but Huang later returned to Taiwan to head the Asian channel at Eastern

Broadcasting. Tsai has agreed to inject HK$1 billion - in the form of

convertible bonds - to help keep ATV afloat. Want Want China Holdings (0151)

chairman Tsai will inject the funds in his personal capacity and the Cha family

will remain the dominant shareholder, according to ATV non-executive director

Chan Wing- kee. It is believed the broadcaster will issue convertible bonds to

Tsai who will pump in HK$1 billion in several stages. The amount will be

sufficient to cover the broadcaster's operations for the next three years. The

station is said to be losing HK$1 million a day. Chan said Tsai will buy the ATV

stake of Dutch Bank ABN Amro. Huang has an MBA from Harvard University. During

her time there, she came to know former Taiwan premier Tang Fei who went to the

university to study after stepping down from office.

The minimum wage should be pegged above

dole payments to provide an incentive for people to work, newly appointed

Executive Council member and Chinese University of Hong Kong vice chancellor

Lawrence Lau Juen-yee said yesterday. Asked whether he agreed with a comment by

a fellow academic that the new Exco was weak in political power, Lau agreed,

partly from a personal point of view because he has just gained Chinese

citizenship. "I support setting up a minimum wage level as long as it is tied to

the Comprehensive Social Security Assistance. It should be set at a rate which

people will not choose not to work because they want to receive CSSA," Lau said.

"It's purely my personal opinion and I have not discussed this with the chief

executive," Lau said. He said he was not part of any political party or group:

"I joined Exco to offer my expertise in the economics field at a time when Hong

Kong is facing adversity," Lau, a member of the Chinese People's Political

Consultative Conference, said during a Lunar New Year gathering. "I just became

a Chinese citizen anyway, so there's not much political power I could have," Lau

said. He gave up his American citizenship to take his seat in Exco. He also

suggested that a flexible salary level and the taking of no pay leave to ensure

workers are not not sacked. Last October Lau was appointed to the Chief

Executive's Task Force on Economic Challenges to help deal with the fall-out

from the financial meltdown. Legislator Lee Cheuk-yan, of the Hong Kong

Confederation of Trade Unions, said he welcomed Lau's suggestion with regard to

a minimum wage. "We've been fighting for a minimum wage to be set at HK$33 per

hour, which will give people an inventive to work instead of receiving the CSSA,"

Lee said. However, Lee said Lau was unwise to suggest no-pay leave as a way to

minimize costs without the need to sack staff. "Not all companies need to cut

salaries. Lau is now an Exco member and he should be cautious when making such

comments. The best way to deal with economic adversity is to have a mechanism

that will allow employers and employees to discuss the costs issue on an equal

footing," Lee said. The minimum wage should be pegged above

dole payments to provide an incentive for people to work, newly appointed

Executive Council member and Chinese University of Hong Kong vice chancellor

Lawrence Lau Juen-yee said yesterday. Asked whether he agreed with a comment by

a fellow academic that the new Exco was weak in political power, Lau agreed,

partly from a personal point of view because he has just gained Chinese

citizenship. "I support setting up a minimum wage level as long as it is tied to

the Comprehensive Social Security Assistance. It should be set at a rate which

people will not choose not to work because they want to receive CSSA," Lau said.

"It's purely my personal opinion and I have not discussed this with the chief

executive," Lau said. He said he was not part of any political party or group:

"I joined Exco to offer my expertise in the economics field at a time when Hong

Kong is facing adversity," Lau, a member of the Chinese People's Political

Consultative Conference, said during a Lunar New Year gathering. "I just became

a Chinese citizen anyway, so there's not much political power I could have," Lau

said. He gave up his American citizenship to take his seat in Exco. He also

suggested that a flexible salary level and the taking of no pay leave to ensure

workers are not not sacked. Last October Lau was appointed to the Chief

Executive's Task Force on Economic Challenges to help deal with the fall-out

from the financial meltdown. Legislator Lee Cheuk-yan, of the Hong Kong

Confederation of Trade Unions, said he welcomed Lau's suggestion with regard to

a minimum wage. "We've been fighting for a minimum wage to be set at HK$33 per

hour, which will give people an inventive to work instead of receiving the CSSA,"

Lee said. However, Lee said Lau was unwise to suggest no-pay leave as a way to

minimize costs without the need to sack staff. "Not all companies need to cut

salaries. Lau is now an Exco member and he should be cautious when making such

comments. The best way to deal with economic adversity is to have a mechanism

that will allow employers and employees to discuss the costs issue on an equal

footing," Lee said.

Hong Kong exports continued to weaken in December, with the total value of

exports plunging 11.4 percent from a year earlier. Economists warned Hong Kong's

trade sector will see even gloomier times in coming quarters. "Weak trade

performance will likely be a dragging factor for Hong Kong GDP growth this

year," Citi economist Cheng Cheng-mount said. December's fall in exports was

worse than market expectations and showed the second straight month of declines,

after a 5.3 percent fall year on year in November. Re-exports, which are mostly

to and from the mainland and constitute the lion's share of Hong Kong exports,

fell 10.3 percent year on year in December. Re-exports were down 10.7 percent

from November. The value of domestic exports plunged 39 percent year on year in

December. "Exports will probably suffer more in coming months on the worsening

global economic outlook, as well as the controversial issue of Chinese yuan

appreciation," Cheng said. Imports plunged 16.2 percent in December when

compared with a year earlier, showing the effects of weakened domestic

consumption in Hong Kong. The SAR's trade deficit widened to HK$11.76 billion,

from HK$8.15 billion in November. Sherman Chan, an economist at Moody's

Economy.com, said imports of consumer goods will continue to weaken in coming

months amid rising unemployment. Imports of capital goods will also slow as

businesses take a cautious stance on investment, Chan said. Hong Kong's

full-year export growth was just 5.1 percent, the worst performance since 2001,

when global trade was dampened after the World Trade Center attacks. Imports for

the full year of 2008 rose 5.5 percent. "The outlook for Hong Kong's external

trade in coming months remains subject to considerable uncertainties and

downdrag from the rapidly deteriorating external environment," a government

spokesman said. Chan said negative export figures reported by China in recent

months have further clouded Hong Kong's export outlook. "As global economic

conditions will remain dire for much of 2009, Hong Kong is set to book an annual

decline in exports," Chan said.

Hong Kong exports continued to weaken in December, with the total value of

exports plunging 11.4 percent from a year earlier. Economists warned Hong Kong's

trade sector will see even gloomier times in coming quarters. "Weak trade

performance will likely be a dragging factor for Hong Kong GDP growth this

year," Citi economist Cheng Cheng-mount said. December's fall in exports was

worse than market expectations and showed the second straight month of declines,

after a 5.3 percent fall year on year in November. Re-exports, which are mostly

to and from the mainland and constitute the lion's share of Hong Kong exports,

fell 10.3 percent year on year in December. Re-exports were down 10.7 percent

from November. The value of domestic exports plunged 39 percent year on year in

December. "Exports will probably suffer more in coming months on the worsening

global economic outlook, as well as the controversial issue of Chinese yuan

appreciation," Cheng said. Imports plunged 16.2 percent in December when

compared with a year earlier, showing the effects of weakened domestic

consumption in Hong Kong. The SAR's trade deficit widened to HK$11.76 billion,

from HK$8.15 billion in November. Sherman Chan, an economist at Moody's

Economy.com, said imports of consumer goods will continue to weaken in coming

months amid rising unemployment. Imports of capital goods will also slow as

businesses take a cautious stance on investment, Chan said. Hong Kong's

full-year export growth was just 5.1 percent, the worst performance since 2001,

when global trade was dampened after the World Trade Center attacks. Imports for

the full year of 2008 rose 5.5 percent. "The outlook for Hong Kong's external

trade in coming months remains subject to considerable uncertainties and

downdrag from the rapidly deteriorating external environment," a government

spokesman said. Chan said negative export figures reported by China in recent

months have further clouded Hong Kong's export outlook. "As global economic

conditions will remain dire for much of 2009, Hong Kong is set to book an annual

decline in exports," Chan said.

China:

China is determined to keep its currency at a sensible and balanced level and is

not to blame for sharp fluctuations in exchange rates, Premier Wen Jiabao said

during a trip to Berlin yesterday. Meanwhile, German Chancellor Angela Merkel

told Mr Wen she wanted Beijing to hold talks with Tibet's spiritual leader, the

Dalai Lama. Click here to find out more! "Given the current economic situation

we think the exchange rate ... should be kept at a reasonable and balanced

level," Mr Wen told reporters at a joint news conference with Dr Merkel. The new

US Treasury secretary, Timothy Geithner, surprised China last week by branding

it a currency manipulator for depressing the value of the yuan to support its

exports. The International Monetary Fund has said the yuan is undervalued.

"There are strong fluctuations in exchange rates between different currencies in

the world ... but China is not to blame for this," Mr Wen added. He said China's

foreign exchange rate policy stuck "to the principle that it is oriented towards

market needs and the exchange rate is flexible or bound to a currency basket".

Tibet is one of the most sensitive subjects for western leaders to broach with

China, which views the Dalai Lama as a separatist. It took months for China to

forgive Dr Merkel for meeting him in 2007. "We talked about the situation in

Tibet, and from the German side, I emphasised that we have a common interest

that talks with the Dalai Lama get under way," Dr Merkel said at the news

conference. "If there is anything Germany can do in this regard, we would like

to help." Mr Wen was in Berlin as part of a European tour to discuss

co-operation in solving the global financial crisis. Germany and China said in a

joint statement that they wanted to reform the international financial system

and ensure concrete results at a meeting of leaders from the Group of 20 nations

in April. Dr Merkel and Mr Wen promised to strengthen ties between their two

countries, the world's two biggest exporters of goods. Dr Merkel said she saw

good possibilities for further co-operation on infrastructure projects, such as

trains. During Mr Wen's Berlin visit, China's Shanghai Maglev Transportation

Development Co signed a memorandum of understanding with Germany's ThyssenKrupp

on the Transrapid magnetic high-speed rail project. In another deal, Chinese

truck-maker Beiqi Foton and Germany's Daimler signed a previously agreed truck

venture. Trade between China and Germany grew significantly last year, with

German exports to China rising by an annual 14.3 per cent to €31.3 billion

(HK$321.6 billion) through November. Germany imported goods worth €54.3 billion

from China during the same period, an increase of 5.6 per cent, official data

shows. Mr Wen said he aimed this year to maintain trade with Germany at a

similar level to last year. Germany and China are competing for the position of

the world's top goods exporter.

China:

China is determined to keep its currency at a sensible and balanced level and is

not to blame for sharp fluctuations in exchange rates, Premier Wen Jiabao said

during a trip to Berlin yesterday. Meanwhile, German Chancellor Angela Merkel

told Mr Wen she wanted Beijing to hold talks with Tibet's spiritual leader, the

Dalai Lama. Click here to find out more! "Given the current economic situation

we think the exchange rate ... should be kept at a reasonable and balanced

level," Mr Wen told reporters at a joint news conference with Dr Merkel. The new

US Treasury secretary, Timothy Geithner, surprised China last week by branding

it a currency manipulator for depressing the value of the yuan to support its

exports. The International Monetary Fund has said the yuan is undervalued.

"There are strong fluctuations in exchange rates between different currencies in

the world ... but China is not to blame for this," Mr Wen added. He said China's

foreign exchange rate policy stuck "to the principle that it is oriented towards

market needs and the exchange rate is flexible or bound to a currency basket".

Tibet is one of the most sensitive subjects for western leaders to broach with

China, which views the Dalai Lama as a separatist. It took months for China to

forgive Dr Merkel for meeting him in 2007. "We talked about the situation in

Tibet, and from the German side, I emphasised that we have a common interest

that talks with the Dalai Lama get under way," Dr Merkel said at the news

conference. "If there is anything Germany can do in this regard, we would like

to help." Mr Wen was in Berlin as part of a European tour to discuss

co-operation in solving the global financial crisis. Germany and China said in a

joint statement that they wanted to reform the international financial system

and ensure concrete results at a meeting of leaders from the Group of 20 nations

in April. Dr Merkel and Mr Wen promised to strengthen ties between their two

countries, the world's two biggest exporters of goods. Dr Merkel said she saw

good possibilities for further co-operation on infrastructure projects, such as

trains. During Mr Wen's Berlin visit, China's Shanghai Maglev Transportation

Development Co signed a memorandum of understanding with Germany's ThyssenKrupp

on the Transrapid magnetic high-speed rail project. In another deal, Chinese

truck-maker Beiqi Foton and Germany's Daimler signed a previously agreed truck

venture. Trade between China and Germany grew significantly last year, with

German exports to China rising by an annual 14.3 per cent to €31.3 billion

(HK$321.6 billion) through November. Germany imported goods worth €54.3 billion

from China during the same period, an increase of 5.6 per cent, official data

shows. Mr Wen said he aimed this year to maintain trade with Germany at a

similar level to last year. Germany and China are competing for the position of

the world's top goods exporter.

Lu Caixia, a 60-year-old retired

camera factory worker from Suzhou in Jiangsu province, queues in the foyer of a

branch of the Beijing Quanjude restaurant company, the mainland's leading roast

duck chain, waiting for the waiter to call her number. Her daughter booked a

table for the family's Lunar New Year's Eve dinner at the chain's Tiananmen

Square flagship outlet, ensuring that eight members of the family, from Ms Lu's

81-year-old mother-in-law to her 10-month-old grandson, could usher in the new

year with a feast together. Despite these recessionary times, distance from home

and the devastation of natural disasters, many people still found ways to

observe the traditional holiday - some with joy, others with tears. "Our family

got what we prayed for last year - a baby, health and jobs - so my daughter

suggested we celebrate the new year with a family gathering here to relish the

authentic flavour of Beijing roast duck," Ms Lu said, estimating that the meal

would cost more than 1,000 yuan (HK$1,136). "This looks a bit expensive to me,

but considering that today is Lunar New Year's Eve and the dinner is a

once-a-year event, we feel it's worth it," she said on Sunday. "My daughter and

her husband work for foreign-funded companies here in Beijing, and the waves of

staff cuts amid the global financial crisis did not affect them, which is the

biggest thing we want to celebrate." In suburban Tongzhou, far from the bright

lights of the capital's inner city, Zhang Lianyou , 41, and his wife prepared

their Lunar New Year's Eve meal in a 12-square-metre vegetable market hut. The

hut, piled to the rafters with vegetables, is their shop, bedroom and kitchen.

The couple cooked five dishes of pork, bean curd and various vegetables and set

the feast on their "dining table"- a block of wood on top of a basket of

potatoes. "This is the first Lunar New Year's Eve meal we have ever had away

from home, and also the first one without our daughter and son around," Mr Zhang

said as his wife wept. The couple repeatedly delayed their trip home to see

their 13-year-old daughter and nine-year-old son in the central province of

Henan as their vegetables sold faster and for higher prices in the weeks leading

up to the holiday. When they eventually decided they had earned enough, it was

too late - all the train tickets to their hometown were sold out. "My wife

argued with me, blaming me for being too late to buy the tickets home," Mr Zhang

said, sipping on a glass of erguotou, a popular Beijing liquor. "She misses the

children and doesn't want to prepare more dishes for the dinner. "But we need

more money for [the children's] education, and our crops did not bring in much.

So, by sacrificing our reunion with our children and relatives, we are able to

save more for the children's schooling." Hundreds of kilometres from the capital

in Wenchuan county, epicentre of the May 12 Sichuan earthquake, truck driver

Wang Pingbing , 30, ate Lunar New Year's Eve dinner with nine relatives in a

small, one-room, temporary home. Mr Wang said: "Although many of my

acquaintances had family members who lost property or were injured in the quake,

no one in my family was hurt in the disaster. So, I really have boundless thanks

for heaven's blessings." The Wangs managed to cook all the major courses they

would normally have prepared for the traditional dinner. The groundwork for a

new 105-square-metre house to be built on the site of the family's old home was

completed in the days leading up to the lunar new year, and Mr Wang is waiting

for spring so he can start building the rest of the house. "My family is hoping

to move into our new house in three or four months' time," Mr Wang said. "As for

further down the road, I really don't know." Lu Caixia, a 60-year-old retired

camera factory worker from Suzhou in Jiangsu province, queues in the foyer of a

branch of the Beijing Quanjude restaurant company, the mainland's leading roast

duck chain, waiting for the waiter to call her number. Her daughter booked a

table for the family's Lunar New Year's Eve dinner at the chain's Tiananmen

Square flagship outlet, ensuring that eight members of the family, from Ms Lu's

81-year-old mother-in-law to her 10-month-old grandson, could usher in the new

year with a feast together. Despite these recessionary times, distance from home

and the devastation of natural disasters, many people still found ways to

observe the traditional holiday - some with joy, others with tears. "Our family

got what we prayed for last year - a baby, health and jobs - so my daughter

suggested we celebrate the new year with a family gathering here to relish the

authentic flavour of Beijing roast duck," Ms Lu said, estimating that the meal

would cost more than 1,000 yuan (HK$1,136). "This looks a bit expensive to me,

but considering that today is Lunar New Year's Eve and the dinner is a

once-a-year event, we feel it's worth it," she said on Sunday. "My daughter and

her husband work for foreign-funded companies here in Beijing, and the waves of

staff cuts amid the global financial crisis did not affect them, which is the

biggest thing we want to celebrate." In suburban Tongzhou, far from the bright

lights of the capital's inner city, Zhang Lianyou , 41, and his wife prepared

their Lunar New Year's Eve meal in a 12-square-metre vegetable market hut. The

hut, piled to the rafters with vegetables, is their shop, bedroom and kitchen.

The couple cooked five dishes of pork, bean curd and various vegetables and set

the feast on their "dining table"- a block of wood on top of a basket of

potatoes. "This is the first Lunar New Year's Eve meal we have ever had away

from home, and also the first one without our daughter and son around," Mr Zhang

said as his wife wept. The couple repeatedly delayed their trip home to see

their 13-year-old daughter and nine-year-old son in the central province of

Henan as their vegetables sold faster and for higher prices in the weeks leading

up to the holiday. When they eventually decided they had earned enough, it was

too late - all the train tickets to their hometown were sold out. "My wife

argued with me, blaming me for being too late to buy the tickets home," Mr Zhang

said, sipping on a glass of erguotou, a popular Beijing liquor. "She misses the

children and doesn't want to prepare more dishes for the dinner. "But we need

more money for [the children's] education, and our crops did not bring in much.

So, by sacrificing our reunion with our children and relatives, we are able to

save more for the children's schooling." Hundreds of kilometres from the capital

in Wenchuan county, epicentre of the May 12 Sichuan earthquake, truck driver

Wang Pingbing , 30, ate Lunar New Year's Eve dinner with nine relatives in a

small, one-room, temporary home. Mr Wang said: "Although many of my

acquaintances had family members who lost property or were injured in the quake,

no one in my family was hurt in the disaster. So, I really have boundless thanks

for heaven's blessings." The Wangs managed to cook all the major courses they

would normally have prepared for the traditional dinner. The groundwork for a

new 105-square-metre house to be built on the site of the family's old home was

completed in the days leading up to the lunar new year, and Mr Wang is waiting

for spring so he can start building the rest of the house. "My family is hoping

to move into our new house in three or four months' time," Mr Wang said. "As for

further down the road, I really don't know."

The International Monetary Fund's

chief economist said it was not the right time to push China on its

foreign-exchange policy, a rebuke to the Obama administration, which said last

week the mainland was "manipulating" its currency. "It is probably not the right

time to focus on the Chinese exchange rate, given that it is not a central

element of the world crisis," Olivier Blanchard told reporters on Wednesday.

Calls for China to loosen restrictions on its currency were criticised more

forcefully by economists and policymakers at the World Economic Forum in Davos,

Switzerland. Allowing the yuan to strengthen would be "economic suicide" amid an

economic slump, Stephen Roach, Morgan Stanley's Asia chairman, told a panel.

"I've never seen an economy in recession voluntarily raise their currency. It's

horrible advice." South Africa's Finance Minister Trevor Manuel said on the same

panel: "Shouting from Washington to Beijing is not going to make a difference."

United States Treasury Secretary Timothy Geithner said last week President

Barack Obama considered China to be "manipulating" its currency. Mr Geithner

said the US would "aggressively" push Beijing to move faster on currency policy

reform to let market forces play a larger role in setting the yuan's value.

Renewed clashes over the yuan threaten to stoke tension between two of the

world's biggest economies and undermine co-operation to counter the global

recession. The mainland limited the yuan's gains against the US dollar in July

last year. It had risen 21 per cent after the removal of a peg three years

earlier. In Berlin, Premier Wen Jiabao said yesterday the yuan was at a

"reasonable and balanced" exchange rate. "In light of the current economic

situation, we are of the opinion that the exchange rate of the [yuan] is being

maintained at a reasonable and balanced level," he said after talks with

Chancellor Angela Merkel. In Davos, Mr Wen had expressed interest in having

"early contacts" with the Obama administration. "A peaceful and harmonious

bilateral relationship between these two countries will make both winners," he

said. "A confrontational one will make both losers." Mr Blanchard said: "I don't

think we should obsess about an exchange rate." He said it was more important to

consider whether Beijing was pursuing macroeconomic policies that would help it

and other economies around the world. The International Monetary Fund's

chief economist said it was not the right time to push China on its

foreign-exchange policy, a rebuke to the Obama administration, which said last

week the mainland was "manipulating" its currency. "It is probably not the right

time to focus on the Chinese exchange rate, given that it is not a central

element of the world crisis," Olivier Blanchard told reporters on Wednesday.

Calls for China to loosen restrictions on its currency were criticised more

forcefully by economists and policymakers at the World Economic Forum in Davos,

Switzerland. Allowing the yuan to strengthen would be "economic suicide" amid an

economic slump, Stephen Roach, Morgan Stanley's Asia chairman, told a panel.

"I've never seen an economy in recession voluntarily raise their currency. It's

horrible advice." South Africa's Finance Minister Trevor Manuel said on the same

panel: "Shouting from Washington to Beijing is not going to make a difference."

United States Treasury Secretary Timothy Geithner said last week President

Barack Obama considered China to be "manipulating" its currency. Mr Geithner

said the US would "aggressively" push Beijing to move faster on currency policy

reform to let market forces play a larger role in setting the yuan's value.

Renewed clashes over the yuan threaten to stoke tension between two of the

world's biggest economies and undermine co-operation to counter the global

recession. The mainland limited the yuan's gains against the US dollar in July

last year. It had risen 21 per cent after the removal of a peg three years

earlier. In Berlin, Premier Wen Jiabao said yesterday the yuan was at a

"reasonable and balanced" exchange rate. "In light of the current economic

situation, we are of the opinion that the exchange rate of the [yuan] is being

maintained at a reasonable and balanced level," he said after talks with

Chancellor Angela Merkel. In Davos, Mr Wen had expressed interest in having

"early contacts" with the Obama administration. "A peaceful and harmonious

bilateral relationship between these two countries will make both winners," he

said. "A confrontational one will make both losers." Mr Blanchard said: "I don't

think we should obsess about an exchange rate." He said it was more important to

consider whether Beijing was pursuing macroeconomic policies that would help it

and other economies around the world.

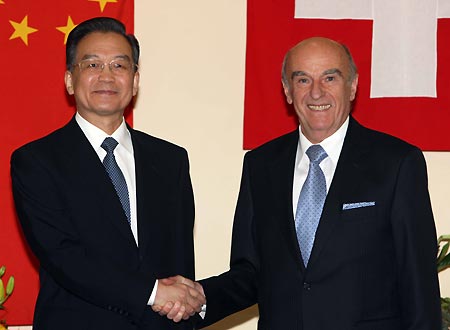

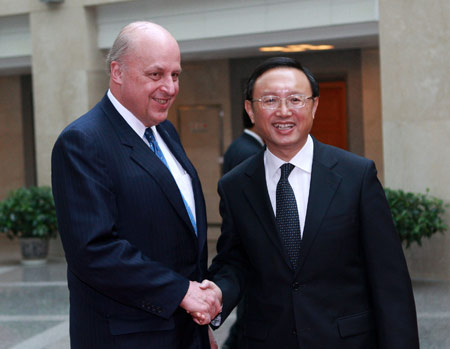

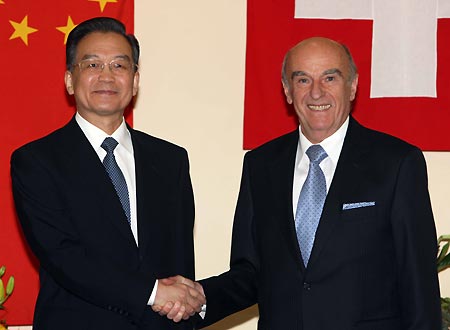

Chinese Premier Wen Jiabao (L)

speaks while German Chancellor Angela Merkel looks on during a news conference

in Berlin Jan. 29, 2009. China and Germany have vowed to make joint efforts to

stabilize the global economy amid the ongoing financial and economic crisis,

said a joint statement issued Thursday. The cooperation between China and

Germany, the world's two major export-driven economies, is of special

significance for the world's efforts to tackle the financial downturn, said the

statement released after visiting Chinese Premier Wen Jiabao's meeting with

German Chancellor Angela Merkel. The two sides agreed to strengthen dialogue on

economic and trade, currency and fiscal policies and pledged to support each

other on their economic stimulus plans based on their own situations, it said.

China and Germany have agreed to enhance their comprehensive strategic

partnership and cooperation in jointly dealing with the global economic crisis,

Wen told a press conference following his meeting with Merkel. The strengthened

Sino-German cooperation is of special significance in the context of the current

world economic downturn, said Wen. Chinese Premier Wen Jiabao (L)

speaks while German Chancellor Angela Merkel looks on during a news conference

in Berlin Jan. 29, 2009. China and Germany have vowed to make joint efforts to

stabilize the global economy amid the ongoing financial and economic crisis,

said a joint statement issued Thursday. The cooperation between China and

Germany, the world's two major export-driven economies, is of special

significance for the world's efforts to tackle the financial downturn, said the

statement released after visiting Chinese Premier Wen Jiabao's meeting with

German Chancellor Angela Merkel. The two sides agreed to strengthen dialogue on

economic and trade, currency and fiscal policies and pledged to support each

other on their economic stimulus plans based on their own situations, it said.

China and Germany have agreed to enhance their comprehensive strategic

partnership and cooperation in jointly dealing with the global economic crisis,

Wen told a press conference following his meeting with Merkel. The strengthened

Sino-German cooperation is of special significance in the context of the current

world economic downturn, said Wen.

Tourists take photos in front of red

lanterns that pile up as the head of an ox at the National Stadium, or Bird's

Nest, on Thursday, January 29, 2009. According to the office in charge of

ministry-level coordination on tourism during national holidays, five days into

the Spring Festival holiday, the number of tourists are still rising in many

cities and travel spots across the country. Statistics show that, as of

Thursday, travel agencies in the Guangzhou city of south China's economic

powerhouse in Guangdong province had organized 123,900 city residents for

travel, up 39.45 percent year on year. Sanya of south China's Hainan Province

remains a hot spot for travelers as an average of 96.18 percent of hotel rooms

in the city were booked. The hotel reservation in Haikou, capital of Hainan,

also reached 81.83 percent. The office calls on related organizations at all

levels to strengthen the security services and regulate market order to ensure

the smooth run of golden-week travel. Besides domestic boom, more Chinese choose

to travel abroad. Earlier reports said a total of 39,377 people in Shanghai, the

country's economic hub, would travel abroad between Jan. 21 to Feb. 1, up 5.26

percent year on year, as predicted by the municipal holiday travel office. The

number of people heading for Europe and Australia soared by 30 percent to 40

percent year on year during the holiday, according to the Shanghai Spring

International Travel Agency. Shopping overseas has become more attractive with

the appreciation of the Chinese currency yuan and the drop of commodity price

overseas, it said. Tourists take photos in front of red

lanterns that pile up as the head of an ox at the National Stadium, or Bird's

Nest, on Thursday, January 29, 2009. According to the office in charge of

ministry-level coordination on tourism during national holidays, five days into

the Spring Festival holiday, the number of tourists are still rising in many

cities and travel spots across the country. Statistics show that, as of

Thursday, travel agencies in the Guangzhou city of south China's economic

powerhouse in Guangdong province had organized 123,900 city residents for

travel, up 39.45 percent year on year. Sanya of south China's Hainan Province

remains a hot spot for travelers as an average of 96.18 percent of hotel rooms

in the city were booked. The hotel reservation in Haikou, capital of Hainan,

also reached 81.83 percent. The office calls on related organizations at all

levels to strengthen the security services and regulate market order to ensure

the smooth run of golden-week travel. Besides domestic boom, more Chinese choose

to travel abroad. Earlier reports said a total of 39,377 people in Shanghai, the

country's economic hub, would travel abroad between Jan. 21 to Feb. 1, up 5.26

percent year on year, as predicted by the municipal holiday travel office. The

number of people heading for Europe and Australia soared by 30 percent to 40

percent year on year during the holiday, according to the Shanghai Spring

International Travel Agency. Shopping overseas has become more attractive with

the appreciation of the Chinese currency yuan and the drop of commodity price

overseas, it said.

January 30, 2009

Hong Kong:

Tens of thousands of religious followers sought good fortune at Che Kung and

Wong Tai Sin temples yesterday, but pinwheel sellers and fortune- tellers said

crowds did not equal sales. The third day of the Lunar New Year is traditionally

regarded as unlucky to visit other people's homes. So people turned up in droves

at the Che Kung temple in Sha Tin to spin the wheels and bang the drums in the

hopes of gaining good luck in the Year of the Ox. Police estimated 74,000 people

had visited the Sha Tin temple by 5.30pm. Among the wishes were those for

financial security. "I only hope that I can keep my job. That would be enough,"

said one worshipper. Some said they donated less to the temple and spent less on

buying pinwheels this year because of the financial crisis. Others said the cost

of making donations and wishes was small so it did not matter. A pinwheel seller

said he was afraid to raise the price despite costs increasing by 20 percent and

a fortune-teller said smaller crowds this year meant 40 percent less business. A

follower said he came to the temple to make a wish for Hong Kong, since Heung

Yee Kuk chairman Lau Wong-fat drew a fortune stick indicating "worst luck" for

the city on Tuesday - the second "worst luck" stick since 2003. Wong Tai Sin

temple has been swamped by people since Lunar New Year's Eve. More than 120,000

visited yesterday, with visitors waiting up to one hour and 20 minutes to get

in. Some mainland tourists gave up, saying they did not want to waste their

holiday time lining up. Many went to Lantau to take the Ngong Ping 360 cable car

and see the Tian Tan Buddha. At one point, a queue of an estimated 1,000 people

waited for a ride on the cable car. Hong Kong:

Tens of thousands of religious followers sought good fortune at Che Kung and

Wong Tai Sin temples yesterday, but pinwheel sellers and fortune- tellers said

crowds did not equal sales. The third day of the Lunar New Year is traditionally

regarded as unlucky to visit other people's homes. So people turned up in droves

at the Che Kung temple in Sha Tin to spin the wheels and bang the drums in the

hopes of gaining good luck in the Year of the Ox. Police estimated 74,000 people

had visited the Sha Tin temple by 5.30pm. Among the wishes were those for

financial security. "I only hope that I can keep my job. That would be enough,"

said one worshipper. Some said they donated less to the temple and spent less on

buying pinwheels this year because of the financial crisis. Others said the cost

of making donations and wishes was small so it did not matter. A pinwheel seller

said he was afraid to raise the price despite costs increasing by 20 percent and

a fortune-teller said smaller crowds this year meant 40 percent less business. A

follower said he came to the temple to make a wish for Hong Kong, since Heung

Yee Kuk chairman Lau Wong-fat drew a fortune stick indicating "worst luck" for

the city on Tuesday - the second "worst luck" stick since 2003. Wong Tai Sin

temple has been swamped by people since Lunar New Year's Eve. More than 120,000

visited yesterday, with visitors waiting up to one hour and 20 minutes to get

in. Some mainland tourists gave up, saying they did not want to waste their

holiday time lining up. Many went to Lantau to take the Ngong Ping 360 cable car

and see the Tian Tan Buddha. At one point, a queue of an estimated 1,000 people

waited for a ride on the cable car.

Taiwanese billionaire Tsai Eng-meng has

agreed to inject funds to shore up the finances of loss-making Asia Television,

triggering changes in the broadcaster's shareholding structure, according to

informed sources. Mr Tsai, whose net worth is estimated by Forbes at US$2.6

billion, signed a preliminary agreement last week to become a substantial

shareholder of Alnery, a company that controls 47.58 per cent of ATV. Alnery is

jointly owned by Payson Cha Mou-sing's family, ATV's dominant stakeholder, ABN

Amro and former ATV chief executive Louis Page. Mr Tsai and his family are

believed to have bought ABN Amro's stake in Alnery, and the deal is believed to

be worth several hundred million Hong Kong dollars, according to the sources. In

2007, the Cha family and ABN Amro injected HK$800 million into ATV and became

its dominant shareholders. The Cha family also owns another 10.75 per cent stake

in ATV through Panfair, with the remaining shares held by Phoenix TV chairman

Liu Changle, businessman and former ATV chief executive Chan Wing-kee, and

mainland conglomerate Citic Group. Multiple sources have confirmed that fresh

capital is being brought in to sustain ATV through changing the shareholding

structure of Alnery, in particular the ABN Amro stake. Sources said Alnery had

two kinds of shares, voting and non-voting, to ensure the Cha family held more

than 51 per cent of voting control over the company, even though the other

shareholders may have contributed more capital. As the changes in Alnery's

shareholdings brought about by Mr Tsai's investment would not change the Cha

family's overall controlling stake in ATV, they would need only simple

administrative approval by the Broadcasting Authority. No approval by the

Executive Council would be required as the changes would not involve non-local

parties taking a controlling stake or breaches to cross-media ownership rules,

sources said. Mr Tsai, dubbed the "king of rice crackers", is chairman of Hong

Kong-listed Want Want China Holdings, the largest maker of rice crackers and

flavoured drinks on the mainland. However, he is believed to have made the ATV

investment through a holding company wholly owned by his family. Mr Tsai's

investment would provide critical funding to sustain the operations of ATV as

the local broadcaster needs about HK$1 billion to keep going for the next three

years. Taiwanese billionaire Tsai Eng-meng has

agreed to inject funds to shore up the finances of loss-making Asia Television,

triggering changes in the broadcaster's shareholding structure, according to

informed sources. Mr Tsai, whose net worth is estimated by Forbes at US$2.6

billion, signed a preliminary agreement last week to become a substantial

shareholder of Alnery, a company that controls 47.58 per cent of ATV. Alnery is

jointly owned by Payson Cha Mou-sing's family, ATV's dominant stakeholder, ABN

Amro and former ATV chief executive Louis Page. Mr Tsai and his family are

believed to have bought ABN Amro's stake in Alnery, and the deal is believed to

be worth several hundred million Hong Kong dollars, according to the sources. In

2007, the Cha family and ABN Amro injected HK$800 million into ATV and became

its dominant shareholders. The Cha family also owns another 10.75 per cent stake

in ATV through Panfair, with the remaining shares held by Phoenix TV chairman

Liu Changle, businessman and former ATV chief executive Chan Wing-kee, and

mainland conglomerate Citic Group. Multiple sources have confirmed that fresh

capital is being brought in to sustain ATV through changing the shareholding

structure of Alnery, in particular the ABN Amro stake. Sources said Alnery had

two kinds of shares, voting and non-voting, to ensure the Cha family held more

than 51 per cent of voting control over the company, even though the other

shareholders may have contributed more capital. As the changes in Alnery's

shareholdings brought about by Mr Tsai's investment would not change the Cha

family's overall controlling stake in ATV, they would need only simple

administrative approval by the Broadcasting Authority. No approval by the

Executive Council would be required as the changes would not involve non-local

parties taking a controlling stake or breaches to cross-media ownership rules,

sources said. Mr Tsai, dubbed the "king of rice crackers", is chairman of Hong

Kong-listed Want Want China Holdings, the largest maker of rice crackers and

flavoured drinks on the mainland. However, he is believed to have made the ATV

investment through a holding company wholly owned by his family. Mr Tsai's

investment would provide critical funding to sustain the operations of ATV as

the local broadcaster needs about HK$1 billion to keep going for the next three

years.

Before-and-after pictures of old

buildings along Tai Kok Tsui Road show how well subsidies from the government

have worked in the area. The Urban Renewal Authority is to spend HK$64 million

on helping owners of old buildings to refurbish their buildings and make them

more environmentally friendly. The move follows a recent government announcement

that it would create more construction work to combat rising unemployment as the

economy contracts in response to the global financial crisis. "Starting in

April, more buildings will become eligible for our maintenance loans and free

repair materials," authority director of works and contracts Stephen Lam Wai-nam

said last week. Two authority schemes, one providing interest-free loans and the

other free materials, have aided 518 residential buildings which are more than

20 years old since the schemes' introduction in 2003. The loan scheme, with an

upper limit of HK$100,000 per building, is open not just to resident owners, but

also to non-profit organisations. "Trade unions and religious bodies often take

up a large proportion of old buildings," Mr Lam said. "Without their

participation, owners' corporations often cannot afford the costs." But he said

the free materials scheme would be extended to include about 150 commercial

buildings with at least 75 per cent resident occupiers. "In Central and Western

district, many old commercial properties are actually flats instead of offices,

but residents were unable to seek aid because of the zoning." While paint,

drains and re-roofing materials have been on offer, the authority will also

include energy-saving bulbs, waste recycling facilities, potted plants and fire

safety doors. Solar energy units and roof gardens might be added to the list, Mr

Lam said. Previously, owners received materials by way of subsidy to the value

of up to 20 per cent of the total renovation costs, or HK$150,000, whichever was

lower. The authority would raise that limit to 30 per cent for small-sized

buildings. In Tai Kok Tsui, where most residential building owners have received

refurbishment help, the authority would repave streets, replace old street lamps

and drains, and put in plants to enhance streetscapes. However, Yau Tsim Mong

district councillor Henry Chan Man-yu said Tai Kok Tsui was hard to transform

because half of the area north of Tai Kok Tsui Road was occupied by old

factories which were vacant or had been converted into offices and flats. "It is

difficult to revitalise unless the urban renewal policy covers not just

residential, but industrial zones," he said. Before-and-after pictures of old

buildings along Tai Kok Tsui Road show how well subsidies from the government

have worked in the area. The Urban Renewal Authority is to spend HK$64 million

on helping owners of old buildings to refurbish their buildings and make them

more environmentally friendly. The move follows a recent government announcement

that it would create more construction work to combat rising unemployment as the

economy contracts in response to the global financial crisis. "Starting in

April, more buildings will become eligible for our maintenance loans and free

repair materials," authority director of works and contracts Stephen Lam Wai-nam

said last week. Two authority schemes, one providing interest-free loans and the

other free materials, have aided 518 residential buildings which are more than

20 years old since the schemes' introduction in 2003. The loan scheme, with an

upper limit of HK$100,000 per building, is open not just to resident owners, but

also to non-profit organisations. "Trade unions and religious bodies often take

up a large proportion of old buildings," Mr Lam said. "Without their

participation, owners' corporations often cannot afford the costs." But he said

the free materials scheme would be extended to include about 150 commercial

buildings with at least 75 per cent resident occupiers. "In Central and Western

district, many old commercial properties are actually flats instead of offices,

but residents were unable to seek aid because of the zoning." While paint,

drains and re-roofing materials have been on offer, the authority will also

include energy-saving bulbs, waste recycling facilities, potted plants and fire

safety doors. Solar energy units and roof gardens might be added to the list, Mr

Lam said. Previously, owners received materials by way of subsidy to the value

of up to 20 per cent of the total renovation costs, or HK$150,000, whichever was

lower. The authority would raise that limit to 30 per cent for small-sized

buildings. In Tai Kok Tsui, where most residential building owners have received

refurbishment help, the authority would repave streets, replace old street lamps

and drains, and put in plants to enhance streetscapes. However, Yau Tsim Mong

district councillor Henry Chan Man-yu said Tai Kok Tsui was hard to transform

because half of the area north of Tai Kok Tsui Road was occupied by old

factories which were vacant or had been converted into offices and flats. "It is

difficult to revitalise unless the urban renewal policy covers not just

residential, but industrial zones," he said.

Visitors to Sha Tin racecourse are

attracted by the HK$1.5 million gold horseshoe. Betting at yesterday's meeting

fell this year as people felt the economic pinch. But these prizes and a

giveaway of phone straps were not enough to stop a fall in attendance or betting

turnover at Sha Tin yesterday. While betting turnover passed HK$1 billion, it

was down 7.46 per cent on last year. Just over 83,000 people passed through the

turnstiles, a drop of 3.64 per cent. Punters at the track said they intended to

cut spending on horse racing because of the poor economy. Peter Chu, who visited

the racecourse, said he planned to spend only HK$200 to HK$300 on betting. "I

just want to try my luck during this festive season to see if I have the

blessing from the god of wealth," he said. Fellow punter Chan Hoi said he would

spend about HK$300 betting on the programme of 11 races. "I don't come to the

racecourse during the year and only came with my friends today to celebrate the

new year," he said. All those who passed through the turnstiles were given a set

of phone straps of the four champions of last year's Cathay Pacific (SEHK: 0293)

Hong Kong International Races and asked to turn wheel of fortunes near the

entrance for their chance to win prizes. An exhibition featuring a giant

handmade gold horseshoe, the largest of its kind in Hong Kong, with gold display

items by a jewellery chain store - worth more than HK$5 million - attracted many

visitors to the track's concourse. The gold horseshoe was valued at HK$1.5

million and weighed 60 taels (2.26kg). Chief Secretary Henry Tang Ying-yen and

Jockey Club chairman John Chan Cho-chak opened the race day. Liza Wang and

Raymond Lam performed festive songs, and there was a grand carnival parade down

the home straight after the final race. The action on the track was headlined by

a treble for jockey Weichong Marwing, while the Chinese New Year Cup was won by

5-1 chance Regency Dragon, ridden by Christophe Soumillon for trainer David

Ferraris. Jockey Club chief executive Winfried Engelbrecht-Bresges said the day

was a "great success in the current circumstances". He said from next week, the

Jockey Club would report the gross margin on each race rather than the turnover.

"The turnover figure is too misleading for many people and makes them think the

Jockey Club is making all this money for itself," he said. More than 80 per cent

of turnover was returned to the punters as dividends and the balance was the

"gross margin", he said. The gross margin yesterday was HK$176.8 million, of

which the government took HK$128.2 million. The remainder was used to pay for

the show, he said. Visitors to Sha Tin racecourse are

attracted by the HK$1.5 million gold horseshoe. Betting at yesterday's meeting

fell this year as people felt the economic pinch. But these prizes and a

giveaway of phone straps were not enough to stop a fall in attendance or betting

turnover at Sha Tin yesterday. While betting turnover passed HK$1 billion, it

was down 7.46 per cent on last year. Just over 83,000 people passed through the

turnstiles, a drop of 3.64 per cent. Punters at the track said they intended to

cut spending on horse racing because of the poor economy. Peter Chu, who visited

the racecourse, said he planned to spend only HK$200 to HK$300 on betting. "I

just want to try my luck during this festive season to see if I have the

blessing from the god of wealth," he said. Fellow punter Chan Hoi said he would

spend about HK$300 betting on the programme of 11 races. "I don't come to the

racecourse during the year and only came with my friends today to celebrate the

new year," he said. All those who passed through the turnstiles were given a set

of phone straps of the four champions of last year's Cathay Pacific (SEHK: 0293)

Hong Kong International Races and asked to turn wheel of fortunes near the

entrance for their chance to win prizes. An exhibition featuring a giant

handmade gold horseshoe, the largest of its kind in Hong Kong, with gold display

items by a jewellery chain store - worth more than HK$5 million - attracted many

visitors to the track's concourse. The gold horseshoe was valued at HK$1.5

million and weighed 60 taels (2.26kg). Chief Secretary Henry Tang Ying-yen and

Jockey Club chairman John Chan Cho-chak opened the race day. Liza Wang and

Raymond Lam performed festive songs, and there was a grand carnival parade down

the home straight after the final race. The action on the track was headlined by

a treble for jockey Weichong Marwing, while the Chinese New Year Cup was won by

5-1 chance Regency Dragon, ridden by Christophe Soumillon for trainer David

Ferraris. Jockey Club chief executive Winfried Engelbrecht-Bresges said the day

was a "great success in the current circumstances". He said from next week, the

Jockey Club would report the gross margin on each race rather than the turnover.

"The turnover figure is too misleading for many people and makes them think the

Jockey Club is making all this money for itself," he said. More than 80 per cent

of turnover was returned to the punters as dividends and the balance was the

"gross margin", he said. The gross margin yesterday was HK$176.8 million, of

which the government took HK$128.2 million. The remainder was used to pay for

the show, he said.

Masked raiders broke into the Lok Ma Chau

mansion of millionaire author and art collector Yu Lai-sa early yesterday and

gagged and bound her before fleeing with HK$5 million worth of cash and

valuables. Yu, who is also known as Yu Hui- yin, told police of her ordeal at

the hands of two armed men in dark clothing. The colorful 55-year-old, who hit

the headlines recently following complaints about the design of the mansion